Analysis of China’s foreign trade statistics, including the General Administration of Customs

China’s imports from South Korea decreased by US$13.4 billion

‘Pro-China’ solidarity is strengthened and total income increases

Russia/Saudi Energy, Malaysia Semiconductor

“We need to lower our dependence on China and take advantage of diversification opportunities”

Last year, it was found that the reorganization of the supply chain not only in the United States but also in China accelerated due to the deepening conflict between the United States and China. While China’s total imports increased, imports from Korea, the US, Japan, and Taiwan, which account for the largest portion of the Chinese economy, decreased by 60 trillion won.

Solidarity with countries that claim to be ‘pro-China’, such as Russia and Saudi Arabia, has become tighter. In addition, China is actively promoting self-reliance in the semiconductor and oil refining sectors, which are Korea’s first and second export items, raising concerns that the future trade balance prospects between Korea and China are not bright.

On the 7th, the Dong-A Ilbo commissioned the Federation of Korean Industries to analyze China’s General Administration of Customs and Trade Statistics, and found that China imported 200.163 billion dollars (about 251 trillion won) from Korea last year. This is a 6.27% decrease from the previous year ($213.555 billion). During the same period, Japan (10.34%), Taiwan (4.46%), and the United States (1.01%) also decreased.

Korea, the US, Japan, and Taiwan are China’s four largest importers. Although the total amount of imports from these four countries decreased by 5.61% from 850.634 billion dollars in 2021 to 802.885 billion dollars last year, China’s total imports increased from 2.6788836 trillion dollars to 2.715537 billion dollars, a decrease of 1.37%. % increased

In particular, South Korea, which was the largest importer in China until 2019, is gradually losing ground. South Korea’s share of China’s total imports declined from 10% in 2015 to 2016 to 7.37% last year.

Russia is a representative country that has offset the decrease in existing major trading partners. Last year, China imported $112.225 billion from Russia, up 43.23 percent from the previous year. Russia has been the 10th largest importer from China since 2019, but rose to sixth last year. Malaysia (import of $109.892 billion), Saudi Arabia ($77.88 billion), and Indonesia ($77.95 billion) also increased by 11.95%, 37.26%, and 22.43%, respectively.

In 2019, the sum of imports from BRICs (Brazil, Russia, India, China, and South Africa) recorded $183.362 billion, reversing Korea ($173.551 billion), and then increased to $270.966 billion last year, widening the gap. The value of the six ASEAN countries (Malaysia, Vietnam, Thailand, Indonesia, Singapore, and the Philippines) also increased from $183.362 billion to $389.339 billion during the same period.

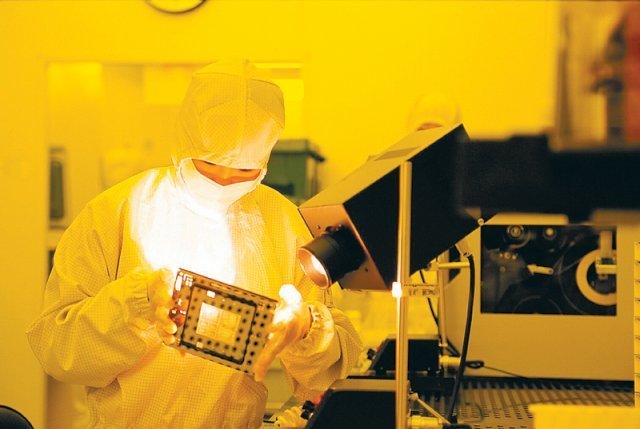

The decrease in Chinese imports from South Korea is largely attributable to the sluggishness of key items such as semiconductors and petroleum products. In the semiconductor industry, falling memory chip prices and sluggish demand are the biggest causes, but China itself is aggressively pursuing policies to reduce its dependence on foreign countries such as South Korea. China’s chip self-sufficiency rate, which was 5% in 2018, increased to 10% in 2020 and 17% last year.

As for oil refining, ‘de-Korea’ has already begun in earnest to the level of self-resolving. According to the Korea Petroleum Association, the largest exporter of domestic petroleum products such as diesel, gasoline and naphtha was China for six consecutive years from 2016 to 2021, but it plummeted to fourth place last year. China’s share of total exports shrank from 19.9% to 7.9%.

On the contrary, the representative sector in which China forms a new relationship is energy. Since the outbreak of the Russian-Ukrainian war in February last year, it has shown a drastic change. China imported $98.4 billion from Russia between March and December last year in relation to the four major energy resources: crude oil, petroleum, coal and gas. It increased by 43.6% compared to the same period last year. Currently, China imports Russian crude oil through Siberia-Pacific pipelines, Far Eastern ports, and European ports close to Russia. Saudi Arabia also began speeding up energy trade by agreeing to strengthen cooperation with China in the energy supply chain amid conflicts with the United States in October of last year.

Malaysia is drawing attention as a beneficiary of the US-China semiconductor fight. It is expected that China will expand its distribution network through Malaysia, which specializes in post-processing such as testing and packaging, amid US export restrictions. It is not yet large, but all major countries such as Korea, Taiwan, and Japan decreased in memory semiconductor imports from China last year, while Malaysia alone increased 34.54% from $915 million to $1.231 billion. Semiconductor equipment items also increased by 27.72% from $3.711 billion to $4.74 billion.

Heo Yun, professor at Sogang University Graduate School of International Studies, said, “China is actively pushing for import substitution of intermediate goods and capital goods imported from Korea, and value chain restructuring is expected to deepen in the future.” We should take this as an opportunity to diversify our supply chain and widen the gap with China.”

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.