Bloomberg News reported on the 16th (local time) that despite the Fed’s aggressive rate hike last year, the possibility of the Fed returning to a rate hike of 0.5 percentage point is rising as the US inflation indicators all exceeded market expectations. did.

Bloomberg News analyzed that, despite the Fed’s aggressive interest rate hike, inflation has not been controlled.

Bloomberg introduced that some are predicting that the US interest rate will rise to 6%.

◇ Inflation indicators rise all at once as the Fed eases tightening

: The Fed, which raised interest rates four times in a row last year by 0.75 percentage points, raised interest rates by 0.5 percentage points at the Open Market Committee (FOMC) in December last year, followed by a 0.25 percentage point increase at the FOMC in February this year. and lowered the intensity of the tightening.

Then, all the inflation indicators in the United States are coming out one after another higher than expected by the market. Both the producer price index (PPI) and the consumer price index (CPI) far exceeded market expectations.

The U.S. Department of Labor announced on the same day that the PPI rose 0.7% from the previous month and 6.0% from the previous year. This far exceeds Bloomberg’s expectations of 0.4% MoM and 5.4% YoY.

Excluding energy and food prices, which are highly volatile, the core PPI rose 0.5% month-on-month and 5.4% year-on-year, respectively. The monthly rate of increase is the highest in the last 10 months.

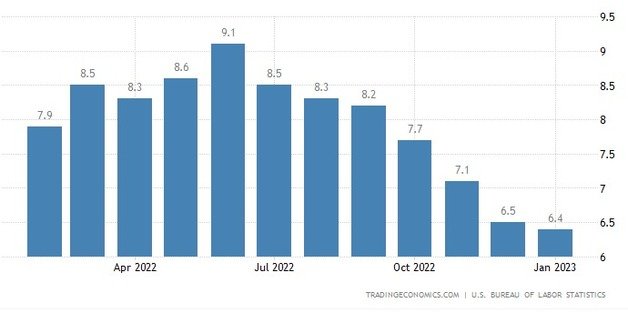

The consumer price index (CPI) released earlier also exceeded market expectations.

The U.S. Department of Labor announced on the 14th that the CPI rose 0.5% month-over-month and 6.4% year-over-year. This is above Dow Jones’ expectations. Dow Jones expected a 0.4% MoM and 6.2% YoY.

Core CPI, excluding highly volatile energy and food prices, rose 0.4% MoM and 5.6% YoY. This also exceeded the Dow Jones’ expectations. The Dow Jones had expected a rise of 0.3% and 5.5%, respectively.

Despite the Fed’s rate hike, inflationary pressures remain high. As a result, voices are emerging that the Fed should tighten again.

CPI Monthly Trends for the Past Year – Captured by the Bureau of Labor Statistics

CPI Monthly Trends for the Past Year – Captured by the Bureau of Labor Statistics◇ Governor Mester “The possibility of a 0.5%p rate hike is open.

: Loretta Mester, president of the Cleveland Fed, said, “The possibility of a 0.5 percentage point rate hike at the next FOMC is open.”

He said at a forum hosted by the Center for Global Interdependence that day, “We saw convincing indicators that a rate hike of 0.5 percentage point should be carried out at the next FOMC, and if inflation persists stubbornly, the central bank should be prepared to raise interest rates further.” ”he said.

In a Q&A with reporters, he added, “The range of interest rate hikes does not always have to be 0.25 percentage points. As we have already shown, we must be able to move faster when needed.”

He also pointed out that the risk factors for rising inflation are everywhere. Inflation risks remain high as a result of the war between Russia and Ukraine, which could lead to higher food and energy prices, while China’s reopening could boost demand for raw materials, it said.

Not only that, but other experts are arguing that the Fed should step up tightening.

Blerina Urucci, chief U.S. economist at Lowe Price, said the possibility of the Fed raising rates at its June and July meetings has increased. “Assuming the Fed also raises in March and May, as is widely known, the target range for the benchmark rate would be 5.5% to 5.75%,” he added.

◇ “I wouldn’t be surprised if the base rate goes up to 6%”

: Ken Rogoff, former chief economist at the International Monetary Fund (IMF), said in an interview with Bloomberg TV, “I wouldn’t be surprised if interest rates ended at 6% to keep inflation down.”

Bloomberg forecast that the US interest rate is likely to be much higher than the Fed and the market expect.

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.