Industry “Korean Semiconductor – Grab and Shake the Battery”

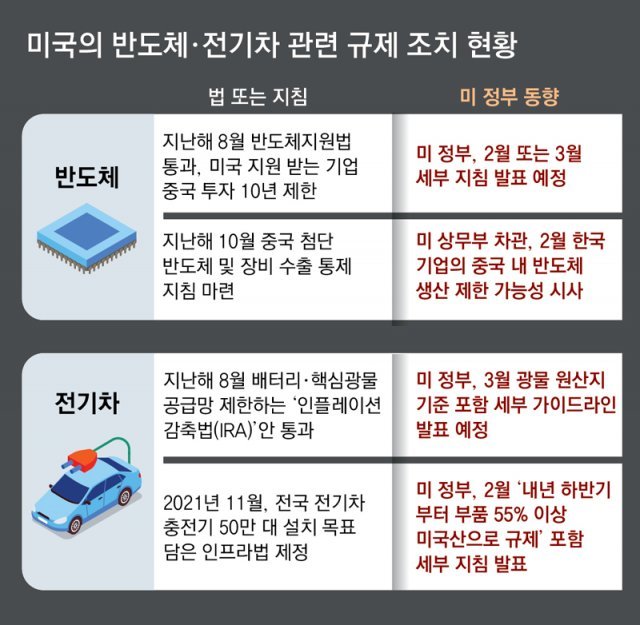

The strategy of ‘America First’, which means America’s nationalism, is tightening the Korean industry more and more. Uncertainties in the semiconductor industry grew even greater when a U.S. government official said that Korean semiconductor companies could restrict production in China. In the battery industry, even a month before the announcement of the detailed guidelines for the Inflation Reduction Act (IRA), an “electric vehicle charger version of the IRA” appeared. Among companies, there is a saying that “the United States is shaking Korea’s main growth industries, semiconductors and batteries, with both hands.”

According to related industries on the 26th, the detailed regulations of the’Buy America’ bill announced by the Joe Biden administration on the 15th of this month (local time) have thrown domestic companies into confusion. The bill, in which the government decided to invest about 10 trillion won to build 500,000 electric vehicle charging stations across the United States, was passed in 2021. However, in the detailed regulations, in order to receive subsidies for chargers, a proviso was attached that US steel should be used and final assembly in the US. In particular, from July next year, more than 55% of parts must be manufactured in the United States. In other words, not only production in the United States, but also local procurement of materials and parts was forced. An official from company A, a charger company, said, “American materials are often of poor quality, and if we urgently want to find a supplier, we have no choice but to sign a contract at a relatively higher price than local companies.”

.

US puts pressure on EV chargers

Recently announced ‘Buy America’ detailed rules

Potential adverse effects on Korean companies

Exporters contemplate establishing local factories

Securing US-made materials is also a fire in the foot

The strengthening of the US government’s ‘America First’ policy is doubling the burden on Korean companies that have been heavily dependent on the North American market and have maintained close supply chain partnerships with China. The US government has expressed its position that it will “continue dialogue in a way that does not harm our allies.” However, it is analyzed that the detailed guidelines that have recently emerged are highly likely to adversely affect South Korea.

In the case of this detailed charger-related regulation, it is not that there was no process of collecting opinions from the industry. However, it is said in the industry that most of them were not reflected in the final draft, and rather, confusion only expanded. Initially, the standard for the percentage of US-made parts was ‘25% until this year and 55% from January next year’. The final plan was ‘55% from July next year’, which delayed the application by only six months, but ‘American steel’, which was not there originally, suddenly intervened. An official from charger company B said, “As a result, the position to have a factory in the United States has not changed either.”

The comments of Alan Esteves, the U.S. Undersecretary of Commerce for Industrial Security, which stirred up the domestic semiconductor industry, seem to be the same. When asked what would happen if the one-year grace period on export control of semiconductors to China, which was provided to domestic companies such as Samsung Electronics and SK Hynix, expires in October this year, he only mentioned, “There is a high possibility of setting a limit at the semiconductor level.” He said he would discuss the direction with companies. From the standpoint of Samsung and SK, after the second half of this year (July to December), a big variable has arisen in their global production strategy as well as public investment. An official from the semiconductor industry said, “We will not harm our allied companies, but in the end, our companies have to devote time and energy to behind-the-scenes negotiations.”

The domestic automobile and battery industries are only staring at the mouth of the US government with about a month left before the announcement of detailed IRA regulations scheduled for the end of March. The Korean industry, which is highly dependent on Chinese battery materials such as lithium and cobalt, is keenly aware of the definition of ‘Foreign Entity of Concern’. Even in the US government’s most recent guideline, the IRA White Paper of December last year, this was not clearly stipulated.

The IRA only states that “if parts or core minerals are procured from a group of concerns in the United States, tax credits are excluded.” Even in the December white paper, there was no specific definition for this. Although China is mentioned as a representative of the concern group, in reality, it is impossible in the near future to exclude China from the supply chain and produce batteries and electric vehicles. Hwang Kyung-in, an associate researcher at the Korea Institute for Industrial Economics and Trade, said, “Considering that the US Treasury Department hinted at the possibility of mitigating the scope of core mineral recognition through the IRA white paper, it is necessary to make a comprehensive judgment by observing detailed regulations regarding the requirements related to groups of concern.” As ‘may’ is expressed in the major clauses in ‘, we have to keep various possibilities open.”

About six months after the announcement of the IRA draft, domestic battery and materials companies are continuing their efforts to diversify their battery material supply chains to the United States and Chile, Australia, and Canada, which have signed free trade agreements (FTAs) with the United States. However, it is expected that most factories will take at least two to three years to start construction and start mass production. There is a high possibility that the domestic industry will be directly hit this year and next year. In the meantime, companies have appealed for a ‘three-year deferment’ from the time of application of battery material-related regulations, but it is expected that it is unlikely to be accepted.

Frustration and confusion in the domestic battery industry has increased with the announcement of plans to establish a battery production line in Michigan, the United States of CATL and Ford, a Chinese battery company, on the 13th of this month. This is because they have virtually turned a blind eye to the entry of Chinese battery makers into the US ‘home’ market. CATL was criticized for circumventing the IRA by only licensing the technology and producing it locally in the US. An official from the battery industry said, “The United States has chosen to attract jobs and production facilities in its own country even while undermining the fundamental direction of the IRA to exclude China from the battery supply chain.” “This means that it becomes more difficult to predict the direction of many policies.”

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.