[실리콘밸리은행 파산 후폭풍] Started bank run after SVB funding plan announcement

U.S. shuts down super-fast banks in 48 hours… Tech companies “It will be Monday the 13th”

Appeal for government support amid concerns over bankruptcy… Korean financial authorities, feel the impact on the domestic market

Silicon Valley Bank (SVB), the main bank for US tech companies, was closed 48 hours after a massive deposit withdrawal (bank run). A bank with 277 trillion won in assets collapsed in an instant while trying to respond to situations such as a sharp drop in government bonds due to a steep interest rate hike. The global startup industry is appealing to the government for emergency support amid fears of bankruptcy.

On the morning of the 10th (local time), the California Department of Financial Protection and Innovation shut down SVB, which was in an insolvent situation, and designated the Federal Deposit Insurance Corporation (FDIC) as the bankruptcy trustee. Established in 1983, SVB is a bank whose main customers are venture capital (VC) and startups in the western United States. It has served as a ‘funding line’ for the tech industry in the US, UK, India and China by attracting deposits from tech companies and providing loans to early startups.

However, as the price of government bonds held by SVB plummeted due to the recent interest rate hike by the US Federal Reserve System (Fed) and the interest burden on deposits increased, the announcement of a large-scale financing plan caused fear in the market. On the afternoon of the 8th, when SVB Financial Group, the parent company of SVB, announced plans to procure new shares worth 2.25 billion dollars (about 3 trillion won), the ‘bank run’ began. US tech companies, which suffered from a funding crunch due to high interest rates, scrambled to withdraw their deposits.

On the 9th, 42 billion dollars (approximately 56 trillion won) was withdrawn in one day, and the stock price plummeted by more than 60%. Eventually, on the morning of the 10th, after 48 hours, the bank was closed. It is pointed out that “it is the second largest bank failure in U.S. history after the collapse of Washington Mutual Bank in 2008.”

Silicon Valley companies are concerned about ‘Monday the 13th’, comparing ‘Friday the 13th’, which is regarded as ominous in the West, saying that a series of bankruptcies could happen from the 13th. Venture capitalist David Sacks tweeted: “If we don’t announce ‘all deposits are safe’ before Monday, the crisis will spread.”

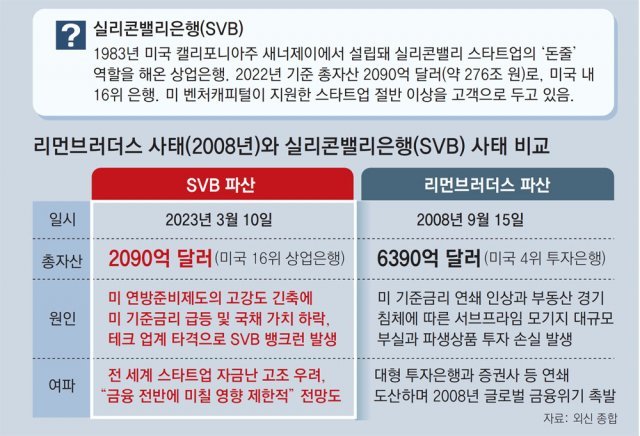

Considering that this situation is affected by the pandemic bubble and high interest rates, there are also observations that real estate loan banks and others could become the epicenter of the next crisis. However, there are many prospects that SVB’s customers are limited to the tech industry and will not lead to a ‘second Lehman moment’ as the global financial crisis broke out when the entire financial system collapsed with the bankruptcy of Lehman Brothers in 2008.

Our financial authorities are also keenly aware of the impact it will have on the domestic financial market. Deputy Prime Minister and Minister of Strategy and Finance Chu Kyung-ho held a regular meeting on the 12th with Financial Services Commission Chairman Kim Joo-hyun, Financial Supervisory Service Governor Lee Bok-hyun, Bank of Korea Vice Governor Lee Seung-heon, and Presidential Secretary for Economic Affairs Choi Sang-mok to examine the SVB crisis. The financial authorities said, “We cannot rule out the possibility that financial market volatility and uncertainty will expand as the SVB’s liquidity crisis spreads to bank closures.”

It is known that the National Pension Service owns about 100,000 shares of SVB. As of the end of last year, the stock value was about 30.4 billion won, but on the 9th, the stock price plummeted and was cut in half.

Bankruptcy of Silicon Valley

16th largest bank in the US with 277 trillion won in assets

Investment losses rise due to steep interest rate hikes

“It will not spread to the overall US financial risk”

Opinions are divided on “risks such as real estate loans and banks”

Cars are parked in front of a Silicon Valley Bank (SVB) branch in Wellesley, Massachusetts, USA on Saturday, the 11th (local time). On the 10th, the U.S. financial authorities shut down SVB, where large-scale deposit withdrawals took place. Wellesley = AP Newsis

Cars are parked in front of a Silicon Valley Bank (SVB) branch in Wellesley, Massachusetts, USA on Saturday, the 11th (local time). On the 10th, the U.S. financial authorities shut down SVB, where large-scale deposit withdrawals took place. Wellesley = AP Newsis It is analyzed that the sudden collapse of Silicon Valley Bank (SVB), the ‘financial line’ of the US tech industry, was caused by the pandemic bubble and steep interest rate hikes. If the global financial crisis of 2008 originated from ‘bad loans’, this crisis was caused by a sudden shift in liquidity to a market that was overflowing with liquidity. Governments around the world are paying keen attention to the repercussions that a large-scale bank failure that has occurred after a year of high-intensity tightening from the US Federal Reserve (Fed) will have on the global market.

Silicon Valley was shocked by the collapse of SVB on the 10th (local time). This is because large banks with assets of 209 billion dollars (approximately 277 trillion won) and total deposits of 175.4 billion dollars (approximately 232 trillion won) disappeared in an instant.

SVB has experienced a surge in deposits during the recent pandemic. Total deposits increased from $60 billion in the first quarter of 2020 (January to March) to about $200 billion in the first quarter of 2022. This is because the profits of tech companies have soared due to the spread of the non-face-to-face industry. 44% of US venture capital (VC)-backed tech and health companies listed last year were customers of SVB, so deposits increased more than other banks.

SVB, like other general banks, did not make much profit through ‘deposit margin’, which is a method of lending at higher interest rates than deposit rates. This is because tech companies with overflowing investment funds had no reason to borrow money from SVB. Accordingly, SVB invested mainly in long-term U.S. Treasury bonds, which are safe assets. However, the price of government bonds has plummeted amid the Fed’s intense tightening since March last year. Losses increased, and interest rates on deposits increased due to interest rate hikes.

On the 8th, SVB announced a large-scale financing plan of 2.25 billion dollars (about 3 trillion won) to secure liquidity. However, this action turned out to be a fatal blow. Startups, their main customers, started large-scale withdrawals in response to signs of difficulties in their ability to pay bank deposits. The tech industry was in a state of dryness due to the recent high interest rates, so the fear was greater. As a result, 42 billion dollars (approximately 56 trillion won) withdrew in one day on the 9th.

The financial crisis of 2008 was triggered by the bankruptcy of Lehman Brothers, an investment bank, while derivative products based on non-performing loans were spreading across financial companies. Washington Mutual Bank, which was recorded as the largest bank failure in the United States at the time, was eventually closed due to its high proportion of housing-related loans.

Former U.S. Treasury Secretary Larry Summers said in an interview with Bloomberg TV, “Unlike the Lehman crisis, SVB (the risk of insolvency of deposits) is concentrated in the tech industry, so the risk will not spread throughout the U.S. finance industry.” In addition, major U.S. banks have a high percentage of consumers and diversified businesses such as credit cards, so risks are more dispersed than SVB. The U.S. government also quickly took bankruptcy measures when rumors of the SVB bank run began to circulate in order to block concerns about a series of bank failures.

However, as the virtual currency industry has already suffered a series of bankruptcies due to the pandemic bubble, the sense of crisis that Daum’s real estate lending banks may be at risk is also rising. Rick Heitzman, the founder of First Mark Capital, a VC, told the Wall Street Journal (WSJ), “If SVB, which has been an axis of the startup ecosystem for 40 years, can disappear in an instant, what else might crash?”

US President Joe Biden started discussing responses with California Governor Gavin Newsom, and US Treasury Secretary Janet Yellen also said, “We will keep an eye on the situation.” The UK branch of SVB is also about to declare bankruptcy. In response, 180 startups in the UK have submitted an appeal to UK Treasury Secretary Jeremy Hunt asking for intervention. The Washington Post (WP) said, “There are voices calling for measures such as bailing out the US federal government, and controversy over concerns about moral hazard.”

New York =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.