6 Central Banks Block the Financial Crisis

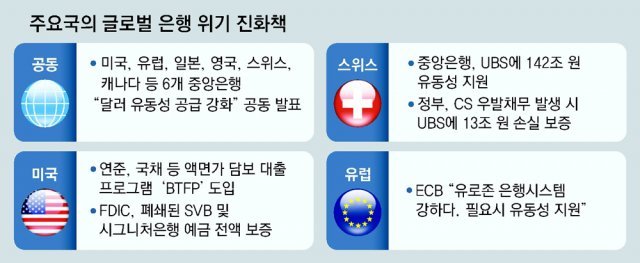

Credit Suisse (CS), a world-renowned investment bank that gave birth to concerns about the ‘second Lehman crisis’, was acquired by Switzerland’s No. 1 bank UBS, and the urgent fire of the global banking crisis was barely extinguished. Six major central banks, including the U.S. Federal Reserve System (Fed), have also started ‘support fire’, saying, “We will strengthen the supply of dollar liquidity.”

The Swiss government and the Swiss National Bank (SNB) held a press conference on the 19th (local time) and said, “Thanks to the support of the Swiss Federal Government, the Financial Supervisory Authority (FINMA) and the SNB, UBS today announced the acquisition of CS.” The total amount of the acquisition was 3 billion Swiss francs (approximately 4.23 trillion won), and SNB supported the acquisition by providing liquidity of up to 100 billion Swiss francs (approximately 141.7 trillion won) to UBS.

Immediately after this announcement, six central banks, including the United States, Europe, the United Kingdom, Switzerland, Japan and Canada, issued a statement at the same time and said, “We decided to change the operation frequency of the dollar swap from ‘week’ to ‘day’,” a joint measure to strengthen dollar liquidity. announced about This measure was taken in consideration of the situation in which eurozone banks had difficulty obtaining US dollars during the 2008 global financial crisis, which aggravated the crisis.

But market anxiety is not abating. The KOSPI, which exceeded 2,400 points in the early market on the 20th, closed at 2,379.20, down 0.69% from the previous trading day, as caution spread ahead of the US base rate decision. Hong Kong’s Hang Seng Index fell 3.01 percent, and Japan’s Nikkei Average fell 1.42 percent.

[글로벌 은행 위기]

Major stock markets in Asia, including the KOSPI, fell… Aftershock continues, such as loss on write-off of CS bond

“Fast response compared to the 2008 financial crisis”… The 22nd Fed’s interest rate decision

Six central banks around the world, including the US Federal Reserve System (Fed) and the European Central Bank (ECB), have begun evolving simultaneous crises by agreeing to strengthen liquidity supply. The purpose is to prevent a recurrence of the 2008 global financial crisis by supplying US dollars easily and quickly when certain financial companies face the risk of bankruptcy, such as Credit Suisse (CS) acquired by UBS.

Despite such efforts by central banks of each country, distrust in the overall financial system grew, leading Asian stock markets to fall sharply on the 14th. In the Hong Kong stock market, market anxiety has not subsided, such as a sell-off of financial stocks. On the 15th, the stock markets of major European countries, including the UK, Germany and France, are also showing a decline led by financial stocks in the early stages.

The central banks of Switzerland, Japan, Britain, and Canada, including the Federal Reserve and ECB, issued a joint statement on Sunday (local time) and said, “We decided to take measures to strengthen liquidity supply through the (existing) ‘Dollar Liquidity Swap Line’ agreement. Agreed. From the 20th, we will increase the existing 7-day maturity-based operation from weekly to daily.” It is intended to act as a ‘liquidity barrier’ to alleviate the funding crunch in the global financial market, enabling households and corporations to raise funds smoothly.

A swap agreement refers to the exchange and deposit of a certain amount of their own currency between the central banks of the countries that signed the agreement to stabilize the exchange rate. It is used as a safeguard when dollar liquidity is insufficient in countries with dollar-denominated debt. Reuters analyzed that the crisis of small and medium-sized US banks, which originated from the collapse of Silicon Valley Bank (SVB), shows the depth of concern of central banks around the world about the spread of the global financial industry as a whole.

On the same day, the US Federal Deposit Insurance Corporation (FDIC) announced on the 10th that it would sell the bankrupt Signature Bank to Flagstar Bank. It is known that various normalization measures such as division and sale of SVB are also considered. The ECB has also committed to lending to eurozone banks in the event of a crisis.

The quick response of each country is being evaluated as much more active than during the 2008 financial crisis. Bob Michelle, chief investment officer (CIO) of JP Morgan Wealth Management, told Bloomberg TV, “We are responding at a speed we have never seen before. Each country cut off ‘layers of bureaucracy’.”

The market’s attention is focused on the Federal Reserve’s decision to hold the Federal Open Market Committee (FOMC) meeting on the 21st and 22nd to determine the US base rate. It remains to be seen whether the Fed will adjust its high-intensity tightening path to achieve financial stability, a key policy challenge for central banks. There are many observations that the Fed will raise interest rates by 0.25 percentage points, but some are predicting the possibility of interest rates being frozen.

Central banks of major countries have stepped up in fear of a ‘global banking crisis’, but there is considerable concern that the aftershocks are not over. According to CNBC, CS and UBS shares fell 60% and 10%, respectively, from the previous trading day in the pan-European STOXX 600 on the 20th. The enormous loss of CS bond holders is also considered a ‘primer’. Reuters predicted that CS’ ‘Amortable Contingent Capital Securities (AT1)’ worth 16 billion Swiss francs (approximately 22.7 trillion won) would be written off to ‘0’ according to the acquisition, resulting in huge losses for creditors.

The decline in the value of the euro and pound against the dollar due to the preference for safe assets, the risk of additional bankruptcies of small and medium-sized US banks, and the decline in Switzerland’s status as a global financial powerhouse are also contributing to market uncertainty.

Reuters reported that small and medium-sized U.S. banks such as First Republic and Pac West Bancorp have tried to raise capital privately, but have yet to succeed. Octavio Marenzi, CEO of Opimas Consulting, said that Switzerland’s status as a financial center had suffered a major blow and was concerned that “Switzerland will be evaluated as the ‘banana republic’ of the financial industry.” It is a derogatory expression referring to third world countries that are politically and economically unstable and dependent on international capital.

Paris =

New York =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.