The US government has announced that it will take additional deposit protection measures to prevent the crisis of deposit withdrawals by small and medium-sized banks. As the U.S. banking crisis raised the possibility of a blow to commercial real estate, which has become vulnerable due to high interest rates, the U.S. government and Wall Street are engaged in an all-out war to restore trust in banks.

U.S. Treasury Secretary Janet Yellen referred to the case where the financial authorities fully guaranteed deposits at Silicon Valley Bank (SVB) and Signature Bank, which were closed on the 21st (local time), and said, “If small and medium-sized banks are faced with a deposit withdrawal crisis with a high risk of proliferation ( “Similar measures could be taken against the two banks.” It is interpreted as suggesting the possibility of full deposit guarantee only for small and medium-sized banks. Earlier, Bloomberg News reported on the 20th that the U.S. Treasury is considering a plan to guarantee deposits exceeding the protection limit of 250,000 dollars (approximately 330 million won) without congressional approval.

The U.S. government is wary of a bank run (large-scale deposit withdrawal) ‘fire’ spreading to the real economy. The balance of commercial real estate loans by small and medium-sized U.S. banks totals 2.3 trillion dollars (approximately 3,009 trillion won).

U.S. tensions over ‘spreading crisis’

High interest rates and banking crisis hit real estate

1 Concern about sharp drop in MBS price

Yellen actively intervenes in “bank run is contagious”

“This (the current banking crisis) is different from 2008. If 2008 was a solvency crisis (for financial institutions), the problem now is a contagious bank run.”

On the 21st (local time), U.S. Treasury Secretary Janet Yellen said in an interview with Rob Nicholls, CEO of the Federation of Banks, that “the U.S. banking system is still sound.” The degree of stress, which means whether banks can maintain an adequate level of capital in a crisis situation, is still a ‘red light’, but it is emphasized that the risk of the banking system collapsing is not as it was during the 2008 financial crisis.

The US Treasury is focusing on calming the market by strengthening deposit protection measures for small and medium-sized banks. In particular, tensions are rising that the real economy could deteriorate as a result of a chain shock in the local commercial real estate market, which is closely connected to small and medium-sized banks. Commercial real estate, such as rental apartments and office buildings, is already cooling down even before the closure of the Silicon Valley Bank (SVB) due to the high-intensity austerity of the US Federal Reserve (Fed).

Major investment banks (IB) such as JP Morgan and Goldman Sachs are also warning of the possibility of a crisis in the commercial real estate market. There are concerns that high interest rates and banking crises may lead to rapid funding shortages, affecting the real estate economy, and that bad real estate loans may transfer risks to banks, resulting in a “perfect storm” (extra-large complex crisis).

According to the Financial Times (FT), JPMorgan Wealth Management CEO George Gatch said at the European Media Summit that day, “When the Fed puts on the brakes (to the economy), something gets in the windshield.” Examples include massive losses, the closure of SVB, and UBS’ acquisition of Credit Suisse. “The next epicenter will be commercial real estate,” Gatchi warned.

Commercial real estate was in a state of shock from high interest rates and market changes even before the banking crisis. It is vulnerable to high interest rates due to the high proportion of loans compared to the residential real estate market, such as detached houses, and has suffered from a sharp drop in office demand due to the spread of telecommuting and job cuts by large companies.

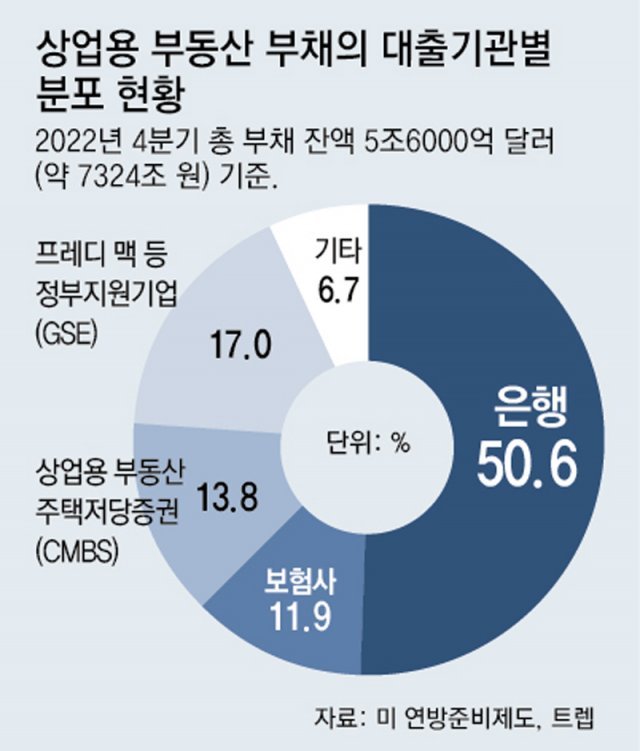

Banks are the main source of funding for this sector, handling half of commercial real estate loans worth 5.6 trillion dollars (approximately 7,324 trillion won). In particular, 80% of commercial real estate debt originating from banks is concentrated in small and medium-sized banks. A total of 270 billion dollars (353 trillion won) in loans maturing this year could further aggravate the banking crisis if commercial real estate companies fail to repay the money on time.

Uncertainty is also high in the mortgage-backed securities (MBS) market, which banks hold intensively along with government bonds. The MBS market is worth 8 trillion dollars (approximately 1 trillion won). The Wall Street Journal (WSJ) predicted, “If banks throw out MBS to secure liquidity, MBS prices could plummet.”

After Yellen’s remarks suggesting active intervention on this day, First Republic’s stock price rose 29.5%, but after the New York Stock Exchange closed, it fell again by 10% in after-hours trading, showing an unstable trend. Bloomberg News, citing an official, said that Wall Street CEOs and Treasury Department officials are looking for a solution by putting their heads together and looking for potential buyers.

The high-intensity tightening by central banks over the past year and the recent banking crisis are making it difficult for central banks to make decisions. Following the European Central Bank (ECB), which took the big step of raising the base rate by 0.5 percentage point last week, the Federal Reserve on the 22nd and the British Central Bank on the 23rd are in a situation where they have to choose between financial stability and inflation evolution.

ECB President Christine Lagarde took a big step and said, “Inflation and financial stability are not trade-offs.” The UK also saw consumer price inflation rise 10.4% in February, up from the previous month, putting emergency lights on on both inflation and financial stability.

New York =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.