US announces detailed regulations on semiconductor support law

Facility maintenance and expansion possible even with subsidies

Relief for the time being that the industry “does not evacuate factories”

Cannot maximize production… profitability concerns

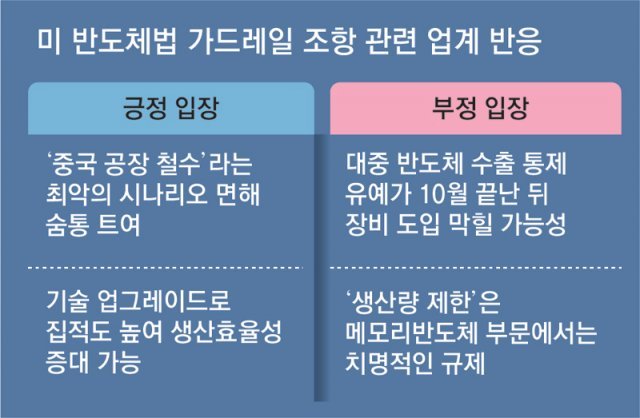

Samsung Electronics and SK Hynix reacted by saying, “The worst has been avoided” to the announcement of the US Commerce Department that if they receive US investment subsidies, they will not be able to expand their high-tech semiconductor production by more than 5% in China for 10 years. Contrary to concerns that Chinese factory operations may be completely blocked, partial upgrades of factory facilities are expected to be possible.

On the one hand, demand for memory semiconductors can increase explosively depending on the economic cycle, but there are also opinions that ‘limiting production in China’ will continue to be a burden. The fact that the suspension of control of semiconductor export equipment to China ends in October is also a factor that increases uncertainty.

On the 22nd, Samsung Electronics announced its official position regarding the US Department of Commerce’s guardrail provisions, saying, “We plan to closely review today’s announcement and establish future response directions.” A Samsung Electronics official explained, “Since the subsidy application starts on the 31st of this month, we will decide whether to apply after going through various discussions during the remaining period.”

The core of the detailed regulations of the Semiconductor Act, ‘Guardrail (Safety Device)’, released by the US Department of Commerce on the 21st (local time), is the limitation of semiconductor production capacity. If domestic semiconductor companies such as Samsung Electronics and SK Hynix receive investment subsidies under the US Semiconductor Act, they will not be able to expand their production capacity, measured by wafer (semiconductor substrate) capacity, by more than 5% in China over the next 10 years.

Samsung Electronics and SK Hynix, which have local factories in China, are in a position to “turn off the big fire right now.” This is because concerns that the operation of factories in China could be completely blocked if subsidies are received have been resolved. An official from the semiconductor industry said, “I was relieved because I did not have to consider withdrawing the factory right away.

Minister of Trade, Industry and Energy Lee Chang-yang said at a press conference on the 22nd, “Uncertainties have been resolved and companies have secured considerable flexibility in their investment strategies.”

On the other hand, there is also a warning that restrictions on ‘production capacity’ will have a fatal effect on the semiconductor industry. In particular, memory semiconductors are an industry that maximizes profits by mass-producing one product. Regarding this, Minister Lee explained, “If technology is improved, chips can be miniaturized and more chips can be produced on the same wafer.” However, chair professor Hwang Chul-seong of the Department of Materials Science and Engineering at Seoul National University emphasized, “DRAM and NAND flash have increased by 5% and 10% each year for the past five years, but increasing production by only 5% for 10 years is the same as not doing the memory business.”

Apart from the guardrail provisions, once the one-year suspended export control measures are over, Samsung Electronics and SK Hynix may be restricted from upgrading their factories in China. The U.S. Department of Commerce is reviewing a plan to place a ‘cap’ on the import of semiconductor equipment from domestic semiconductor companies’ factories in China. It is a structure that will inevitably disappear the driving force for Korean companies to invest in Chinese factories.

The US government finalizes the relevant regulations after collecting opinions for 60 days on the draft detailed regulations announced this time. The government is looking at the final confirmation of detailed provisions related to the Semiconductor Act in the second half of this year (July-December). Senior Secretary to the President for Economic Affairs Choi Sang-mok said, “According to President Yoon Seok-yeol’s strong instructions, we had close consultations with the US government through the NSC channel at the White House. I will be more special and meticulous to take care of it so that it can be.”

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.