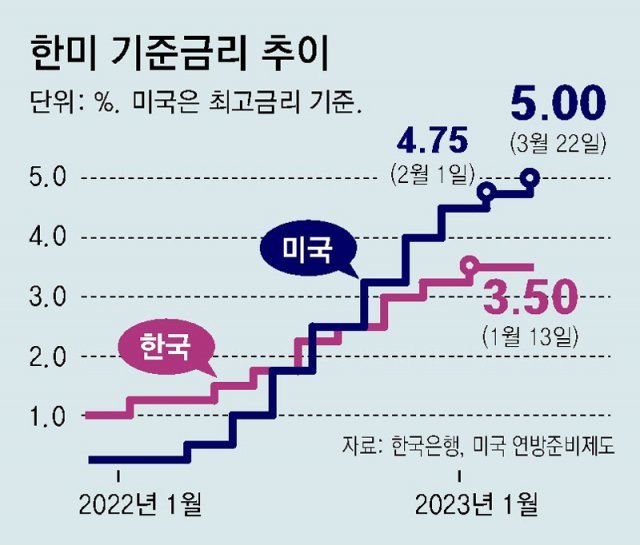

1.5%p difference from Korean interest rate widens

Amid the aftermath of the banking crisis, the US central bank, the Federal Reserve, took the baby step of raising the base interest rate by 0.25 percentage point on the 22nd (local time). With nine consecutive hikes since March last year, the US interest rate jumped from 4.50-4.75% to 4.75-5.0%, entering the upper 5% range. The gap with Korea’s interest rate has reached 1.5 percentage points, the largest in 22 years since 2000.

Fed Chairman Jerome Powell (pictured) said at a press conference after the Federal Open Market Committee (FOMC) meeting that day, “We considered interest rate freezes, but I thought it was important to maintain trust by demonstrating through actions that we are doing our best to stabilize prices.” revealed the background.

Chairman Powell said at a US Congressional hearing two weeks ago that he would “raise the final interest rate forecast (for this year),” but the median rate forecast for the end of this year in the dot plot released by the FOMC that day is 5.1% (5.0-5.25%). It maintained the forecast for last December. Analysts say the move actually signaled the end of interest rate hikes out of concern over a credit crunch amidst the banking crisis. However, Chairman Powell said, “There will be no interest rate cut this year,” and he was wary of the optimism of’pivot (policy transition)’.

The Bank of Korea took a breather thanks to the Fed’s speed control. However, if the Fed takes another baby step at the FOMC in May, the interest rate gap between Korea and the US will widen to 1.75%, which is expected to increase the burden on monetary policy. On this day, the won-dollar exchange rate closed at 1278.3 won, down 29.4 won from the previous trading day (1307.7 won), amid expectations of the end of the Fed’s tightening.

Korea’s dilemma with the 5% base rate in the US

Powell: “I’ll upload more if I need to”

The market line “the end of the rate hike”… exchange rate↓

Korea Bank to freeze interest rates again next month

The U.S. Federal Reserve (Fed) slowed down the pace of tightening in consideration of uncertainty in the financial market, while leaving room for further rate hikes. The ‘Big Step’ (a 0.5 percentage point increase), which was feared, was avoided. However, it is burdensome that the US interest rate hike is still alive and that the gap between Korea and the US benchmark interest rate has widened to 1.5 percentage points, the largest in 22 years. As the base rate is raised to narrow the interest rate gap, we are faced with a ‘higher order equation’ where we cannot ignore the emergency signals of an economic recession and cannot watch the largest interest rate reversal in history.

The Fed, struggling between inflation control and financial stability, chose the ‘baby step’ (a 0.25 percentage point increase), making it clear that it would focus on evolving the banking crisis in the future while controlling prices. The signal to keep an eye on the spread of economic instability, such as unrelenting inflation and the crisis of small and medium-sized banks, was also reflected in the dot plot released on the day.

In a dot plot in which FOMC members plotted the path of future interest rate hikes, the median forecast for the final interest rate at the end of this year was 5.1% (5.0-5.25%), the same as last December. Instead of the phrase “ongoing increase,” which was included in the statement every time interest rates were raised, the phrase “additional policy firming” was used for the first time to blur the future policy path. It is read as meaning that only one baby step remains at the current base rate (4.75-5%).

Fed Chairman Jerome Powell said, “We have not raised our rate forecasts given the banking crisis,” but “we are not looking at a rate cut this year. If there is a need to raise interest rates further, we will raise them further,” he said. However, despite Powell’s bluff, the market believes that the rate hike is nearing its end. According to the Chicago Mercantile Exchange’s FedWatch, investors predicted a 60.3% chance of a rate freeze in May and a 76.4% chance of a rate cut in July as of 00:00 on the 23rd. Amid concerns about a credit crunch and economic recession following the banking crisis, the Fed appears to have put more emphasis on accelerating its pivot (policy transition).

As a result, the Bank of Korea, which froze the benchmark interest rate at 3.5 percent last month, bought some time. In the market right now, observations are gaining momentum that the Bank of Korea will freeze interest rates once more at the Monetary Policy Committee meeting on the 11th of next month and monitor prices and economic conditions.

The current account balance, which recorded the largest deficit in history (-4.52 billion dollars) in January, the slump in the real estate market, and the burden of household debt are also factors that increase the possibility of a base rate freeze. In addition, as the consumer price inflation rate (4.8%) in February fell to the 4% level for the first time in 10 months, the pressure on inflation was slightly relieved.

However, the ever-widening base rate gap between Korea and the US is a burden. If the Fed takes an additional baby step in May, the interest rate differential will widen to an all-time high of 1.75 percentage points. The outflow of foreign funds may accelerate and pressure on the won-dollar exchange rate to rise (the won’s value to fall) may increase. According to the Korea Exchange, foreign investors net sold about 1.3 trillion won worth of stocks in the KOSPI and KOSDAQ markets from the 10th to the 20th, when Silicon Valley Bank (SVB) went bankrupt. Ahn Dong-hyun, a professor of economics at Seoul National University, said, “The only reason Korea raised interest rates is the exchange rate.

On the 23rd, the won-dollar exchange rate plummeted (the value of the won soared) despite the largest interest rate gap between Korea and the United States. On this day, the won-dollar exchange rate in the Seoul foreign exchange market closed at 1278.3 won, down 29.4 won from the previous trading day. Ha Joon-kyung, a professor of economics at Hanyang University, analyzed, “This is a phenomenon that occurred when the value of the US dollar fell as the market’s expectation that the Fed’s interest rate hike was over was reflected.”

New York =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.