Last year, 93.3% of global electric car sales were in the United States, China, and Europe… Korea does not have regulations on internal combustion engine vehicles at the national level.

“By 2030, we will increase the domestic electric vehicle production capacity to 5 times the current level and make it one of the top 3 global future cars. The government will also work as one team so that Hyundai Motor Group can lead the global mobility innovation.”

President Yoon Seok-yeol attended the groundbreaking ceremony for Kia’s EV-only plant held in Hwaseong, Gyeonggi Province on April 11 and expressed his aspirations as such. It is intended to provide institutional support so that it can take a firm position in the electric vehicle market along with the US and China. The place where President Yoon gave a speech that day was a finished car factory built by the Hyundai Motor Group in Korea for the first time in 29 years. Hyundai Motor Group plans to increase domestic electric vehicle production to 1.51 million units by investing 24 trillion won by 2030. It is nearly five times larger than last year (330,000 units).

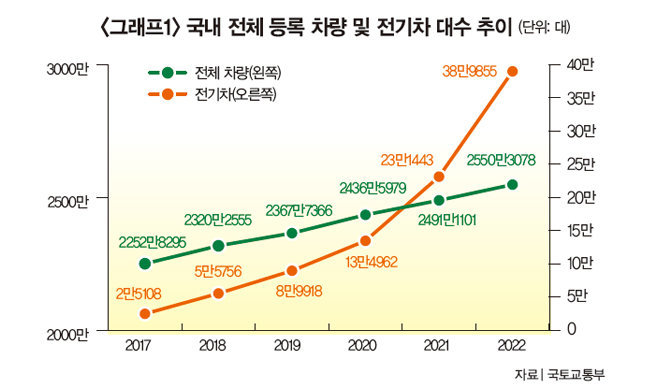

The Korean electric vehicle market continues to grow rapidly. According to the Ministry of Land, Infrastructure and Transport, the number of newly registered electric vehicles in Korea last year was 164,000, an increase of 63.8% from the previous year. As a result, the number of electric vehicles registered in Korea increased to 389,855 (see Graph 1). The share of the total number of registered cars (25,503,078) is only 1.53%, but the number of electric vehicles, which was 25,108 in 2017, increased more than 15 times in five years. It was possible thanks to the active performance of Hyundai Motor Group, which has an unrivaled share of 73.9% in the Korean electric vehicle market. Tesla, the global No. 1 electric vehicle company, saw its sales in Korea drop 18.3% last year compared to the previous year due to the reduction of subsidy benefits.

The spread of electric vehicles is a global trend. On April 12 (local time), the U.S. Environmental Protection Agency (EPA) announced regulations to reduce carbon emissions, including the introduction of a battery minimum performance function and reduction of pollutant emissions. According to the new regulations, from cars produced in 2027, if the average emission of carbon dioxide, nitrogen oxides and fine dust per mile (about 1.6 km) driven cannot be reduced by an average of 13% per year by 2032, a huge penalty will be imposed. There are many views that the regulation is forcing the sale of electric vehicles because it is virtually impossible to meet the strengthened standards by improving the technology of internal combustion locomotive vehicles. The EPA also predicts that 67% of passenger cars sold in 2032 will be electric. As of last year, electric vehicles accounted for 5.8% of all new passenger cars sold in the US.

The European Union (EU) announced last year that it would virtually remove internal combustion locomotives from the market by 2035. On October 27, 2018 (local time), the EU delegation and the European Parliament agreed on the carbon emission regulation bill, which requires automobile manufacturers in member states to reduce carbon emissions to zero by 2035. Thomas Schaeffer, CEO of Volkswagen, Europe’s largest automaker, also announced that it plans to produce only electric vehicles in its European factories from 2033.

China, which has emerged as the world’s largest electric vehicle market, is no exception. The State Council of China announced the ‘New Energy Vehicle Technology Roadmap 2.0’ in 2021, converting half of new cars sold in China to electric vehicles from 2035, and reducing the proportion of internal combustion engine vehicles in the remaining portion while increasing hybrid vehicles. knitted

On the other hand, Korea’s electric vehicle policy has focused on expanding its supply. President Yoon made a promise to ban new registrations of internal combustion locomotives by 2035 during the presidential election campaign, but since his election, he has not taken concrete steps in this regard. There is no roadmap for regulating internal combustion engine vehicles at the national level, only the Seoul Metropolitan Government announced that it plans to block the registration of new vehicles with internal combustion engines from 2035. Even this requires the cooperation of the Ministry of Land, Infrastructure and Transport and the Ministry of Environment for the relevant regulations to become a reality.

Experts analyzed that there would be difficulties in announcing regulatory policies right away. Lee Ho-geun, a professor at the Department of Automotive Engineering at Daeduk University, said, “In order to increase sales of electric vehicles, we need to check the electricity supply and demand network, but it would have been difficult to regulate internal combustion locomotives right away in the existing situation where energy policies were rapidly changing.” This is why it is considered that providing tangible and intangible incentives to electric vehicle users is a priority rather than regulating internal combustion locomotives. Professor Lee emphasized, “It is necessary to provide intangible benefits to consumers, such as giving parking benefits to electric vehicles or allowing operation of bus-only cars during certain sections of commuting time, rather than just providing financial incentives.”

The fact that the Korean electric vehicle industry is focused on exports is also considered to be different from the US, China, and Europe. Last year, 93.3% of global electric car sales occurred in the three regions of the United States, China and Europe. Hyundai Motor Group also plans to increase domestic electric vehicle production to 1.51 million units by 2030, of which 920,000 units are set for export.

The problem is that each country is carrying out protectionist trade against the electric vehicle industry. The U.S. Treasury Department announced on April 17 (local time) 22 eco-friendly vehicles that will receive subsidies of up to $7,500 (about 9.93 million won) under the Inflation Reduction Act (IRA). ·Tesla (5 types) vehicles, Stellantis (3 types) and Ford (3 types) vehicles were included as hybrid companies. Nearly half of the 13 brands (41 brands) that received subsidies until last year were eliminated from the subsidies. In particular, as Korean, European, and Japanese automakers were all eliminated, only American companies survived, igniting the controversy over trade protectionism. The US White House is in the position that “it is part of the ‘Invest America’ measures to strengthen the competitiveness of the United States through the revival of the manufacturing industry.”

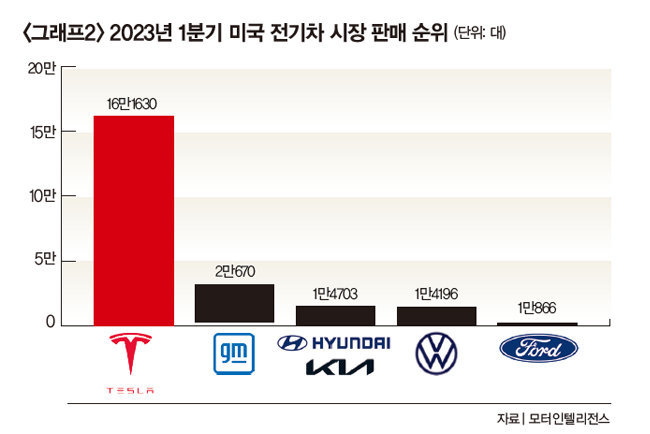

In the first quarter, Ford, an American automobile company, suffered a loss in the domestic electric vehicle market. The sales volume of electric vehicles fell from second place last year to fifth place this year. According to Motor Intelligence, a market research company, Ford only sold 10,866 electric vehicles in the first quarter, falling behind Hyundai Motor Group and Volkswagen (see Graph 2). It is analyzed that the suspension of operation of the Mexican plant for facility expansion and the recall of electric pickup trucks affected Ford’s poor performance.

However, the difference in electric car sales between companies other than Tesla is not large, so the ranking can change at any time. This is why the industry is nervous because foreign companies such as Hyundai Motor Group and Volkswagen are excluded from subsidy benefits in the US, while only domestic companies such as Tesla, General Motors, and Ford are included.

As the U.S. policy goal is unrealistic, there are voices that it will be revised later. “There is no question about where we are going,” said John Bocella, president of the Alliance for Automotive Innovation (AAI), which represents the US auto industry. It should be reviewed continuously as the enactment proceeds,” he added. According to J.D. Power, a US market research company, the average transaction price of an electric vehicle in the US in March was $61,800 (about 82 million won), 35.53% higher than the average price of an internal combustion engine vehicle ($45,600). U.S. Senator John Barrasso (Republican Party) also said, “’Electrification of everything’ is not a solution. It’s the way to higher prices and fewer choices,” he said, expressing skepticism about the current policy.

Kim Pil-soo, chairman of the Korea Electric Vehicle Association, said, “Considering that the share of electric vehicles among new cars sold in the US last year was 5.8%, it is virtually impossible to increase it to 67% by 2032.” As much as this can be modified, Korean companies and the government should prepare for it,” he said.

*If you search for and follow ‘Magazine Donga’ and ‘Two Venters’ on YouTube and Portal respectively, you can find various investment information such as videos as well as articles.

<This article

Weekly Donga

Published in issue 1386>

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.