[전기차 글로벌 전쟁 현장을 가다]

〈Above〉 Chinese electric car powerhouse ‘Quantum Jump’

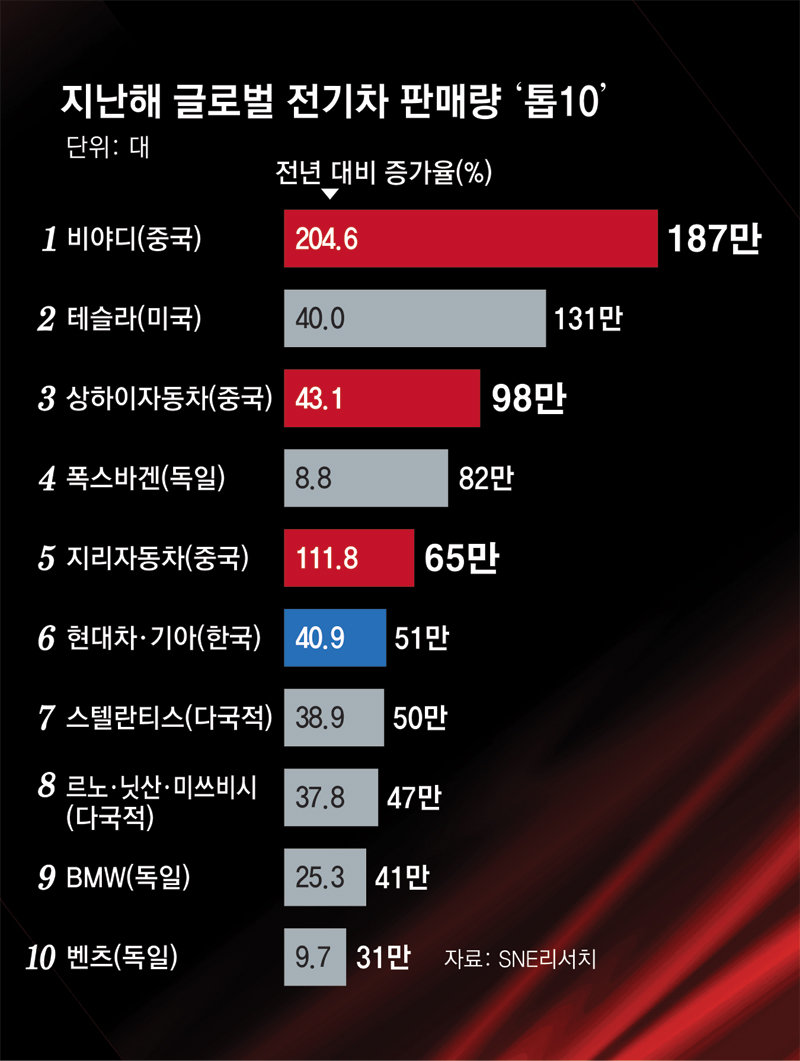

Competition between 100 local brands and 200 models, rapid growth in technology… 120% increase in exports last year

China’s total automobile exports ranked second after Japan

‘Four minutes.’

On the morning of the 19th of last month, the Nio Battery Exchange in Minhang District, Shanghai, China. It was the time it took for the reporter to visit the exchange in a Nio vehicle, a Chinese electric car brand, and replace the 75 kWh (kilowatt hour) battery with a new one. All procedures were performed with an unmanned system. It usually takes about an hour to charge a battery of this capacity with a 50kW fast charger.

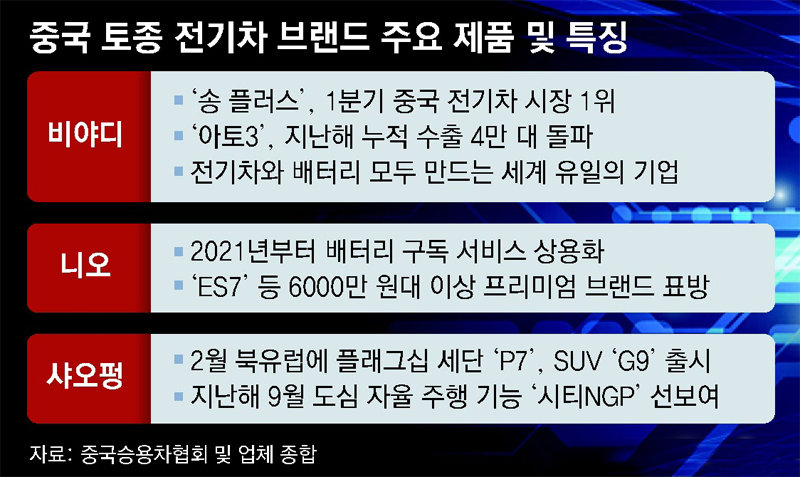

Payments and reservations are completed with a few taps on the application (app) on the in-vehicle display. Nio vehicle owners can use it for free four times a month, and after that, they can use it for 100 yuan (about 19,300 won) at a time. Nio commercialized such a battery subscription service (BaaS) for the first time in the world in April 2021.

A Nio exchange in Minhang District, Shanghai, China, visited on the 19th of last month. If you park in line with the yellow line inside the door, the car body lifts slightly, and the exchange device below automatically replaces the battery with a fully charged battery. The replacement time was about 4 minutes.

A Nio exchange in Minhang District, Shanghai, China, visited on the 19th of last month. If you park in line with the yellow line inside the door, the car body lifts slightly, and the exchange device below automatically replaces the battery with a fully charged battery. The replacement time was about 4 minutes.Nio currently operates 108 exchanges in Shanghai and 1,000 exchanges across China. It plans to install 1,000 more by the end of this year. An official from Nio explained, “It is not a service to replace a battery that has reached the end of its life, but a service innovation that dramatically shortens the charging time of customers.” Thanks to this service, Nio sold about 31,000 electric vehicles in China in the first quarter of this year (January to March) alone.

China, the world’s largest electric vehicle market, is becoming the world’s best electric vehicle powerhouse both in name and reality in terms of industry. It is evaluated that Chinese electric vehicle companies, which have been focusing only on quantitative growth with the home market on their back, now have global competitiveness in terms of technology and product quality.

According to the Korea Automobile Research Institute on the 2nd, the sales of electric vehicles in China last year were 5,075,286 units, accounting for more than 60% of the total global market. The Chinese market is twice as large as Europe (1,622,895 units) and the United States (802,653 units) combined. Excluding imported cars, about 100 Chinese brands are selling around 200 types of vehicles. As they compete fiercely for products and services, the Chinese electric vehicle industry is growing rapidly both quantitatively and qualitatively.

As Chinese electric vehicles are accelerating their entry into the global market, competition for supremacy in electric vehicles between the US and China is heating up. China’s exports of new energy vehicles (electric vehicles, hydrogen vehicles, etc.) reached 680,000 units last year, up 120% from the previous year. Thanks to this, China’s automobile exports have surpassed Germany and Korea and rose to the world’s second place after Japan. China’s competitiveness, which had been lagging behind in internal combustion locomotives, began to work in the global market as it faced a new paradigm of electric cars.

World’s first commercialization of battery subscription service… Threat to the luxury car market ‘Tesla Stronghold’

Plans to build a production plant in Europe-Thailand… Accelerating global expansion beyond the threshold of domestic demand

Chinese electric car brands, with their three leaders, such as BYD, Nio, and Xpeng, are fiercely competing with each other by asserting their competitiveness. In particular, Tesla, which entered China in April 2014, is aiming at the mid-size and high-end electric vehicle market, which has been dominated for nearly 10 years.

Chinese BYD ‘Song Plus’.

Chinese BYD ‘Song Plus’.At a BYD sales agency in Shanghai’s Minhang District, a sports utility vehicle (SUV) ‘Song Plus’ released in April 2021 was displayed at a basic price of 203,800 yuan (approximately 39.37 million won). Song Plus sold 102,826 units in the Chinese electric vehicle market, where about 200 models compete in the first quarter of this year (January to March), surpassing Tesla’s Model Y (94,647 units) and rising to the top spot.

An industry insider in China said, “The fact that BYD’s mid-sized model overtook Tesla Model Y in China has become a hot topic in China as well.” This proves that it has risen that much,” he said.

The Song Plus, equipped with a 71.7kWh battery, has a mileage of 505km per charge based on the China Range Measurement Standard (CLTC). The Model Y with a mileage of 545 km starts at 260,000 yuan (approximately 50 million won). Song Plus is cheaper than 10 million won.

This is the part where evaluations say that the strength of BYD, which has vertically integrated batteries and electric vehicles, is well revealed. Batteries account for about 40% of EV manufacturing costs. Collaboration with battery makers is also necessary to develop new electric vehicles. This is the background for BYD to secure price competitiveness.

In addition to the battery exchange station, Nio is equipped with an artificial intelligence (AI) assistant, ‘Nomi’, which can control the vehicle with voice. There is also an automatic parking function. It is evaluated that it is worthy of competing with foreign premium brands in terms of product quality. Xiaopeng unveiled the mid-size SUV ‘G6’ aimed at the Tesla Model Y at the Shanghai International Motor Show last month. Nio and Xiaopeng sold 31,041 and 18,230 units in China, respectively, in the first quarter, making them among the top 10 brands in electric vehicle sales in China along with BYD.

Chinese electric vehicle companies that have grown based on the domestic market are targeting the Chinese high-end electric vehicle market and at the same time exploring overseas markets such as Europe, Japan, Southeast Asia, and South America. Brands that have survived the fierce competition for survival in recent years are leading the way. It is known that the number of Chinese electric vehicle brands, which reached 300 in 2021, decreased by less than half last year. This is the end of the so-called ‘covering the jade’. Analysts say that the surviving companies have strengthened their competitiveness while surviving in the fiercest battlefield.

BYD sold 10,305 units of the SUV electric vehicle ‘ATTO 3’, which was launched in Thailand on November 1 last year, in 42 days. A significant portion of Chinese electric car exports belonged to Tesla’s Chinese factories, but BYD is taking the lead in pioneering non-Tesla-affiliated export routes. Ato 3 is also sold in Europe, Australia and Singapore, and exported 40,014 units last year. In January of this year, it was also released in Japan, which is called the ‘graveyard of foreign cars’. BYD aims to open 100 stores in Japan by 2025.

It is also active in establishing overseas production bases. In September of last year, BYD announced plans to build a 150,000-unit electric vehicle assembly plant in Thailand. The British Guardian recently reported that “BYD is preparing to establish a European production plant by selecting Germany, Spain, Poland, France and Hungary as candidates for plant establishment.”

Nio opened a battery exchange facility manufacturing plant in Hungary in September of this year and set a target of installing 120 battery exchange facilities across Europe. Expansion of the Chinese electric vehicle ecosystem, such as batteries, automobile parts, exchanges, and electric vehicle manufacturing, is taking place in all directions.

An official from the domestic automobile industry said, “China’s strategy to skip it and compete in the electric vehicle market rather than trying to catch up with the ‘super gap’ in the era of internal combustion locomotives is gradually ripening.” “Global competitors are bound to be nervous about the success of Chinese brands.”

Shanghai =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.