The US economy determines the world economy, but among them, the direction of US consumption is the most important. US consumption accounts for 68.5% of US GDP (as of 2021), so it is not an exaggeration to say that the US is a country that returns to consumption. Also, in terms of global GDP, the US accounts for 16.6%, second only to China (17.8%). As such, the growth momentum of not only the US but also the world economy changes according to changes in US consumption as it plays a large role in the world economy. It is natural for numerous economic players and financial market participants to keep an eye on the direction of the US economy.

“What will the US economy look like in the future?” Questions like this are expected to be a major topic throughout this year in all asset markets, including the stock market and bond market. Recalling the atmosphere of the financial market in January and February, the US economy showed a solid performance centered on employment and service industries. The prevailing opinion was that a state in which stability coexisted) was possible.

However, after the Silicon Valley Bank (SVB) bankruptcy in mid-March, this outlook has completely receded. Now, a landing is inevitable, and the prospect that that landing will also be a hard landing, not a soft landing, is emerging. Looking at the ‘Probability Indicators of a US Recession One Year Later’ compiled by the Federal Reserve Bank of New York, the probability of a recession has recently risen sharply, exceeding the probability of recessions in 2000, 2008, and 2020 (see Graph 1). Then, should the U.S. economy now accept a recession as a fait accompli?

Of course, the US first quarter economic growth rate announced at the end of April recorded a positive growth of 1.1%. Private investment (4.5→12.5%) declined sharply, but consumption expenditure (1.0% in 4Q→3.7% in 1Q) showed a favorable trend, driving positive growth. However, now that is also the past, and we may have to prepare for negative growth in the future. Real economic agents may not feel it yet, but the capital market is already preparing to some extent.

Global investment bank Bank of America surveyed fund managers around the world in April about ‘large potential risk factors in the current financial market’, and found that ‘bank credit crunch and recession’ (35%), ‘high inflation and central banks’ Austerity’ (34%) was selected. In addition, despite the fact that the prospect of a mild recession appeared in the minutes of the regular meeting of the US Federal Open Market Committee (FOMC) in March, and that the Fed’s economic trend report ‘Beige Book’ mentioned a decrease in loans and demand, and a slowdown in employment after the SVB crisis. Need to pay attention.

Furthermore, it is also true that the US banking crisis is currently ongoing, following the SVB and Signature Bank (SBNY) and the recent First Republic Bank (FRC) bankruptcy. The fact that the total assets of these three banks (approximately 532 billion dollars, approximately 703 trillion won) exceeds the assets of the 25 banks that went bankrupt during the 2008 financial crisis (approximately 526 billion dollars, reflecting inflation) reduces anxiety about the current banking sector crisis. It looks more stimulating.

However, just like the bankruptcies of SVB (acquired by First Citizens) and SBNY (acquired by New York Community Bank), FRC was acquired by JP Morgan Chase, and the government and private sector are taking joint responses to suppress the aftermath such as depositor anxiety and additional deposit withdrawals. It is appropriate to evaluate positively that there is. In addition, it should be taken into account that the government prepared crisis response plans in the banking sector in advance during past financial crises, and that the response speed is improving as time goes by. SVB took 17 days from bankruptcy to acquisition, but SBNY took 3 days from bankruptcy to acquisition.

In the end, the implications of the FRC bankruptcy for the market are as follows. First of all, the side effects of the Fed’s high-intensity tightening will not end in one to two months, so there is room for another small- and medium-sized bank crisis to emerge in the future. In addition, as the lending screening of not only small and medium-sized banks but also large banks has been further strengthened for risk management, a US economic recession is inevitable, and uncertainty surrounding the severity of the US economic slowdown will remain at the center of the global economy for the time being. Lastly, the Fed, which provided a clue to the crisis in the banking sector, is expected to end the interest rate hike cycle with the FOMC meeting held on May 4 (local time) and decide whether or not to cut the interest rate while monitoring the impact thereafter.

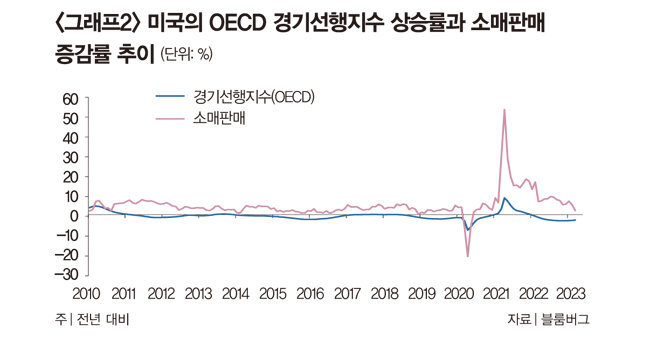

Looking at the growth rate of the OECD (Organization for Economic Co-operation and Development) leading economic index and the rate of change in retail sales, it can be seen that the leading economic index is rebounding after bottoming out, but the sluggishness of the consumption economy has deepened since the banking sector crisis (Graph 2). reference). In this situation, as negative sensitivity to major economic indicators such as employment indicators, consumption indicators, and the manufacturing economy increases, it should be noted that the results of the indicators scheduled for the future may cause changes in market sentiment surrounding a recession.

*If you search for and follow ‘Magazine Donga’ and ‘Two Venters’ on YouTube and Portal respectively, you can find various investment information such as videos as well as articles.

Jiyoung Han, Analyst, Investment Strategy Team, Kiwoom Securities

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.