Even in the shock of the Adani Group accounting fraud

Stock market boom thanks to global investment

Production base relocation boom amid US-China conflict

“This year’s No. 1 population” market is also attractive

While the effect of China’s reopening (resumption of economic activity) has not been good, a ‘warm wind’ is blowing in the Indian stock market, which has been temporarily slowed by the scandal over accounting fraud by the Adani Group, India’s largest conglomerate in February. As India emerges as a global manufacturing base to replace China due to the reorganization of the global supply chain, global investment funds are pouring in. Among foreign investors, expectations are growing that ‘Made in India’ will become a new trend in the near future after passing the ‘Made in China’ era.

According to the Indian Stock Exchange on the 1st, the Nifty 50, the representative index of the Indian stock market, closed at 18,534.40 on the 31st of last month, up 2.6% from 18,065.00 on April 28th (18,065.00), about a month ago. Compared to March 28 (16,951.70), which recorded the lowest level of the year, it soared more than 9.3%.

Experts analyze that the strong performance of the Indian stock market is largely attributable to the intensifying conflict between the US and China, which has led many global companies to move their production bases to India, which is safer than China. In fact, according to KOTRA, more than 63% of global companies have moved more than 40% of their production bases in China to India and Vietnam over the past two years. Among Korean companies, Samsung Electronics withdrew its factory in China early and is operating the world’s largest smartphone factory in Noida, near New Delhi, the capital of India. Apple, which is accelerating de-China, is also planning to increase its production in India from 5% to 25% by 2025. It was decided to increase it to 70,000. Nissan, a Japanese automaker, and Renault of France have decided to invest 79 billion yen (approximately 750 billion won) in a plant in India to jointly develop new vehicles such as electric vehicles.

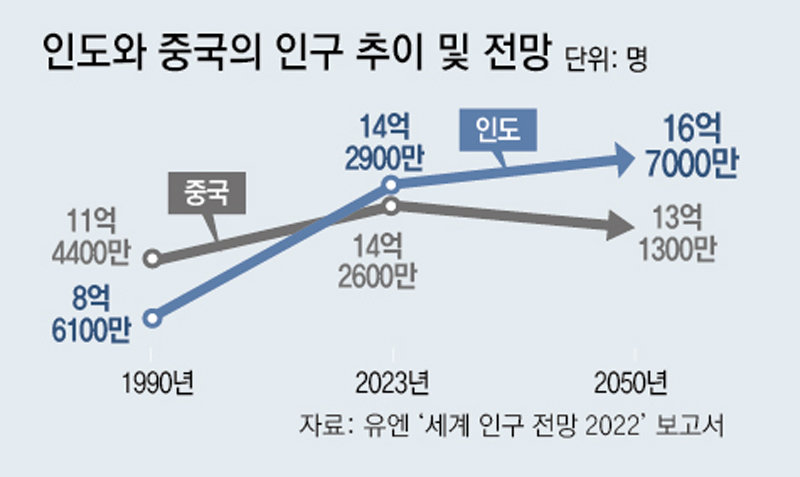

In addition, the fact that India is expected to overtake China this year to become the most populous country in the world is also a factor that enhances India’s investment attractiveness. This is because it means that it can become a huge ‘production base’ and ‘consumer market’ at the same time as China. The UN predicts that India’s population will surpass China’s by the end of this year, exceeding 1.429 billion. Currently, China’s population is about 1.426 billion. CNN analyzed, “India’s huge technical manpower and cheap labor force are a great attraction for manufacturers.”

India’s economic prospects are also evaluated as bright, thanks to the benefit of the restructuring of the global supply chain. According to the National Statistical Office (NSO) of India on the 31st of last month, India recorded an economic growth rate of 6.1% in the first quarter (January-March) of this year, higher than the previous growth forecast (5.5%). The growth rate for the 2022-2023 fiscal year (April 2022 to March 2023) was also revised up to 7.2%, 0.2 percentage point higher than the estimate. The International Monetary Fund (IMF) predicted that India’s average annual growth rate from 2022 to 2027 would be 6.8%, and predicted that India would surpass Germany and Japan in 2027 to become the world’s third largest gross domestic product (GDP).

Even among domestic investors, Indian stock products, which were usually low in awareness, are starting to attract attention. According to the Korea Exchange, ‘TIGER Indonesia 50’, an exchange-traded fund (ETF) that follows the Nifty 50 Index, listed by Mirae Asset Global Investments on April 14, recorded a return of 17.9%, ranking first among all ETF products in monthly return. did. CNBC, a US economic media outlet, said, “In order to realize India’s dream of becoming the world’s ‘new factory’, there are challenges to overcome, such as aging infrastructure and bureaucracy, but India’s potential is still undeniable.”

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.