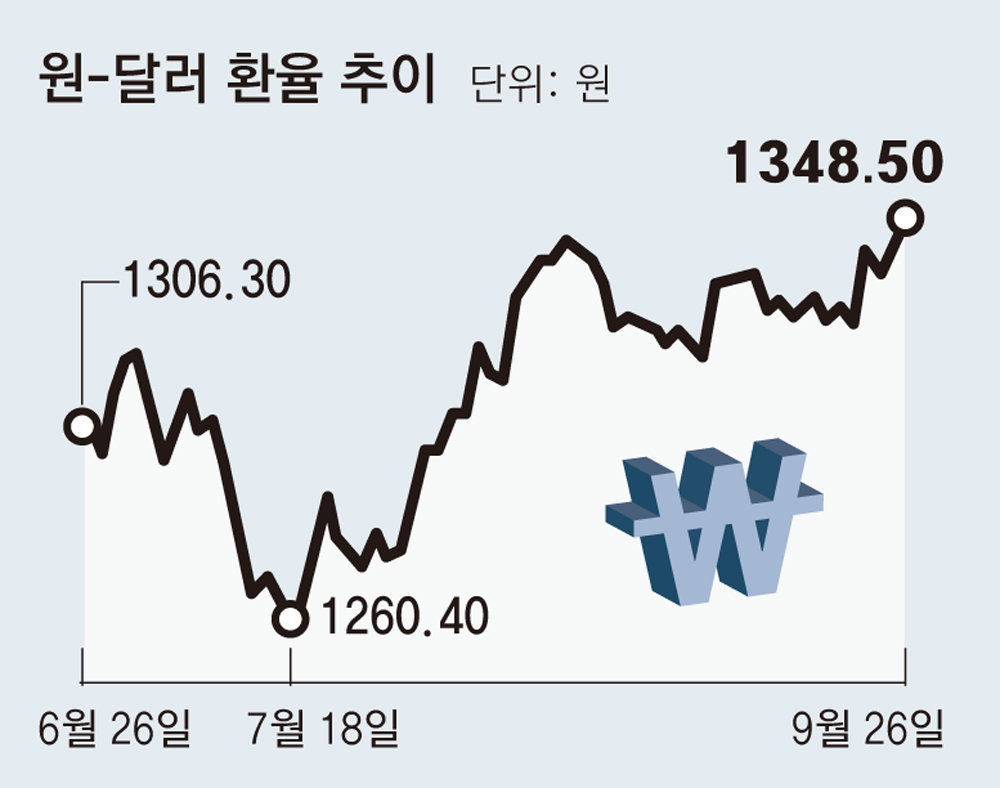

The won-dollar exchange rate rose by 12 won to 1,348 won.

U.S. Treasury yields rise after Powell’s remarks

Institutions net sold KRW 473 billion – foreigners net sold KRW 45.5 billion

China’s crisis again, fueling market instability

The domestic financial market was turbulent on the 26th, with the won-dollar exchange rate soaring and stock prices plummeting in the aftermath of the prolonged tightening in the United States. This is due to the recent deepening of the strong dollar phenomenon due to the prolonged tightening policy of the U.S. Federal Reserve System (Fed) and concerns about a shutdown (temporary business suspension) of the U.S. federal government. The re-ignition of China’s real estate crisis also had an impact on worsening investment sentiment.

On this day, the won-dollar exchange rate closed at 1348.5 won, up 12.0 won from the previous day, breaking the highest level of the year. This is the highest level in 10 months since November 23 last year (1,351.80 won). During the day, it rose to 1349.3 won. This year, the exchange rate peaked at 1,343 won on the 17th of last month and has fluctuated repeatedly before rising again this month. KOSPI ended trading at 2,462.97, down 32.79 points (1.31%) from the previous day due to selling by institutions and foreigners, falling for four consecutive days. Institutions and foreigners net sold 473 billion won and 45.5 billion won, respectively, pulling down the index. Individuals made net purchases of 497.6 billion won.

The decline in the value of the won and stock prices on this day was largely due to the Federal Reserve’s recent tightening policy. Earlier, on the 20th, Federal Reserve Chairman Jerome Powell held a press conference immediately after freezing the benchmark interest rate, saying, “There is a long way to go before the inflation rate returns to the Fed’s target of 2%. “We are prepared to raise interest rates further if we deem it appropriate,” he said, freezing global investment sentiment.

The prolonged tightening policy in the United States and the resulting strong dollar encourage foreign investors to leave. The deterioration of global investment sentiment due to high interest rates is due to the inevitable lowering of preference for risky assets such as stocks in emerging countries. In fact, on this day, foreign investors net sold 45.5 billion won in the KOSPI and 98.6 billion won in the KOSDAQ market. In the KOSPI 200 futures market, 1.3079 trillion won was sold.

After Chairman Powell’s remarks, the interest rate on 10-year maturity U.S. Treasury bonds, which serves as a reference point for bond interest rates in each country, exceeded 4.5% per annum as of the 25th (local time). It is the highest in 16 years since October 2007, just before the global financial crisis. The 30-year U.S. Treasury bond interest rate also closed at 4.65%, the highest since 2011.

The re-emergence of Chinese real estate development company Hengda Group also contributed to the financial market instability. Bad news broke out all at once, including the arrest of former CEO Xia Haijun and former Chief Financial Officer (CFO) Panda Rong and the suspension of new bond issuance. On the 25th, Hengda announced that it had failed to pay the principal and interest on 4 billion yuan (about 733.8 billion won) of bonds issued in China. On this day, Hengda’s stock price plunged more than 25% on the Hong Kong stock market, raising concerns that the final bankruptcy may be counting down. Experts believe that the won-dollar exchange rate could rise to the 1,360 won range depending on future U.S. economic indicators. Ha Geon-hyeong, a researcher at Shinhan Investment & Securities, said, “If the U.S. economic indicators released in the next few weeks are sluggish, the exchange rate could soar to the 1,360 won range.”

Beijing =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.