U.S. Treasury yield 4.8%, highest in 16 years

Fear index soars to highest level in 5 months

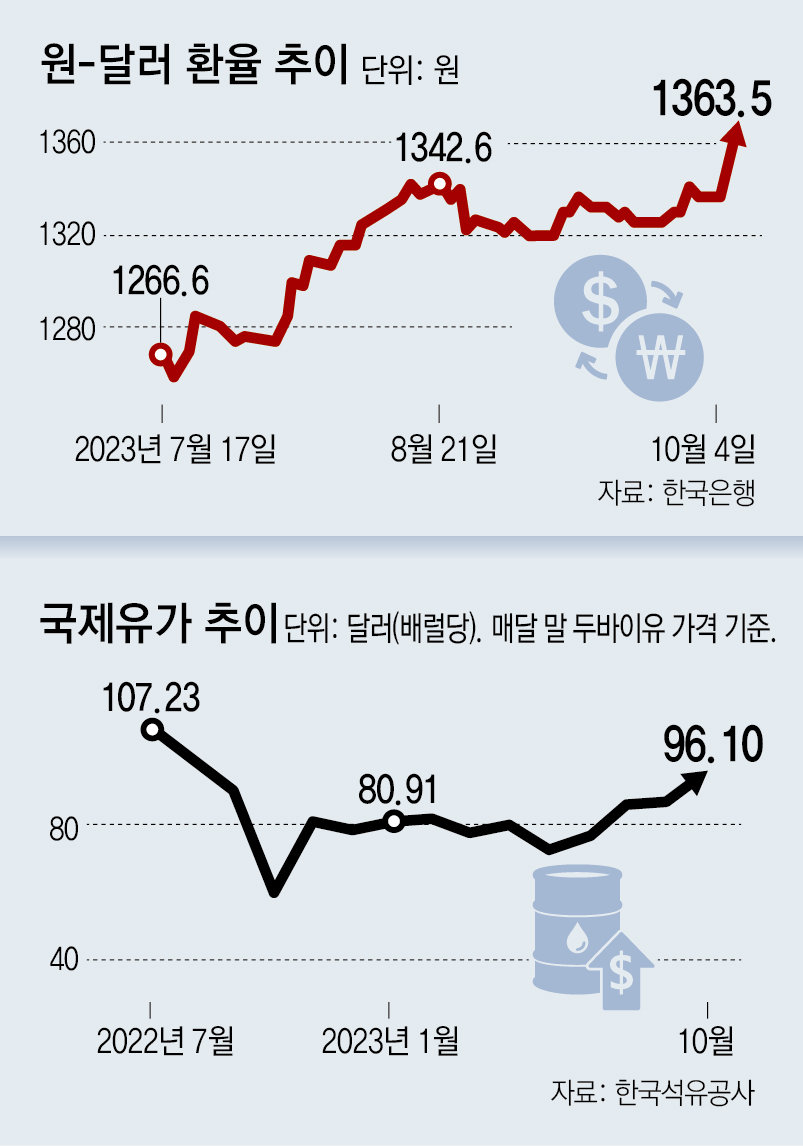

The exchange rate rose by 14.2 won to 1,363 won, the highest of the year.

KOSPI 2.4%↓, major stock market decline

Due to concerns about prolonged high interest rates, the interest rate on 10-year U.S. government bonds exceeded 4.8%, breaking a 16-year high. As a result, the domestic financial market was turbulent, with the value of the won and stock prices plummeting on the 4th. Coupled with the recent upward trend in international oil prices, there are concerns that the three highs of high interest rates, high exchange rates, and high oil prices could hit the Korean economy again as they did last year.

On the 3rd (local time), the interest rate on 10-year U.S. Treasury bonds, which serves as a reference point for global bond interest rates, rose 0.12 percentage points from the previous day to 4.81%, breaking the highest since August 2007. The interest rate on 30-year U.S. Treasury bonds also rose to 4.95%, approaching the 5% level. In the aftermath of this, the interest rate on Korean government bonds also rose on the 4th. The 3-year maturity rose 0.22% points from the previous trading day, and the 10-year maturity rose 0.32% points.

As concerns about high interest rates spread, the Chicago Board Options Exchange (CBOE) Volatility Index (VIX), known as the ‘fear index’, rose 2.17 points (12.32%) from the previous day to 19.78, breaking the highest in five months.

The domestic financial market, which opened on the 4th after the long Chuseok holiday, was greatly shaken as it absorbed the shock of the fear of high interest rates from the United States at once. On this day, the won-dollar exchange rate closed at 1363.5 won, a sharp increase of 14.2 won from the previous trading day (the value of the won plummeted). Since the 27th of last month (1,356 won), the ointment point has been broken again. KOSPI closed at 2,405.69, plummeting 59.38 points (2.41%). It has been about six months since March 27th of this year that KOSPI dropped to the 2,410 level. The KOSDAQ index also plunged 33.62 points (4.00%). Not only Korean but also Asian stock markets fell all at once. On this day, Japan’s Nikkei 225 average stock price plummeted 2.28%, falling to the lowest level in five months. Hong Kong H Index (-1.12%) and Taiwan’s Jiquan Index (-1.10%) were both in decline. It suffered the full effects of the plunge in the US and European stock markets the previous day.

Experts are concerned that worsening corporate performance and decreased consumption due to the third crisis could drag down the economic growth rate. Recently, major global investment banks (IBs) such as JP Morgan predicted that Korea’s economic growth rate next year will remain in the 1% range, continuing this year. Seo Sang-young, a researcher at Mirae Asset Securities, said, “High interest rates are likely to increase companies’ financial costs and lead to worsening performance.”

Wall Street bond king: U.S. government bond interest rate will go to 5%

Korean treasury bonds are also at their highest since November last year

Price-growth-interest rate ‘three rabbits’ dilemma

KOSPI plunges 2.4%… The exchange rate exceeded 1,363 won The domestic financial market was shaken on the 4th as fears of a prolonged period of high interest rates arose, with U.S. Treasury yields hitting the highest level in 16 years. On this day, the closing price of the KOSPI and exchange rate is displayed on the electronic board of the KB Kookmin Bank dealing room in Yeongdeungpo-gu, Seoul.

KOSPI plunges 2.4%… The exchange rate exceeded 1,363 won The domestic financial market was shaken on the 4th as fears of a prolonged period of high interest rates arose, with U.S. Treasury yields hitting the highest level in 16 years. On this day, the closing price of the KOSPI and exchange rate is displayed on the electronic board of the KB Kookmin Bank dealing room in Yeongdeungpo-gu, Seoul. The three highs (high interest rates, high exchange rates, and high oil prices) caused by the prolonged high interest rates originating from the United States are squeezing the domestic economy. This is because it can reduce economic growth by causing worsening corporate performance and a decline in consumption. The government is caught in a dilemma as it has to tackle three birds with one stone: prices, growth, and financial stability.

The reason the interest rate on 10-year U.S. Treasury bonds soared to 4.81% on the 3rd (local time) is because the market expects the Federal Reserve System (Fed) to maintain high interest rates for a long time. Cleveland Federal Reserve President Loretta Mester, who is classified as a representative hawk of the Federal Reserve (who favors monetary tightening), announced that she supports raising the benchmark interest rate next month. Even Atlanta Fed President Rapial Bostic, who is dovish (prefers monetary easing), said, “It is appropriate to maintain the current interest rate for a long time.”

Wall Street giants are also betting on high interest rates. Bill Gross, a famous investor known as the ‘Bond King’ on Wall Street, appeared on a broadcast and predicted, “The yield on 10-year U.S. Treasury bonds is likely to reach 5%.” Ray Dalio, founder of Bridgewater Associates, known as the ‘godfather of hedge funds,’ also made a similar prediction, saying, “High inflation will continue for longer.”

Prolonged high interest rates from the United States are increasing anxiety in the domestic financial market. In the aftermath of the U.S. Treasury interest rate hike, the 10-year Korean Treasury bond interest rate rose to 4.35% per annum on the 4th, the highest since November last year. The 5-year bank bond interest rate, which is the standard for calculating bank loan interest rates, was also the highest this year at 4.517%. As the strong dollar phenomenon became more noticeable due to preference for global safe assets, the won-dollar exchange rate on this day ended trading at 1363.5 won, up 14.2 won from the previous trading day. In addition, rising international oil prices are fueling economic instability. On the 3rd (local time) at the New York Mercantile Exchange, the West Texas Intermediate (WTI) futures price closed at $89.23, up $0.41 from the previous day.

Experts say that the third high school phenomenon can increase the burden on households and businesses, reduce consumption and investment, and lead to low growth. In fact, as the debt burden grew, household consumption expenditures in the second quarter of this year (April to June) only increased by 2.7% compared to the previous year. This is the lowest increase since the first quarter of 2021 (January to March). Last month’s Consumer Sentiment Index (CCSI) was 99.7, down 3.4 points from the previous month. Ha Jun-kyung, professor of economics at Hanyang University, said, “As household debt continues to increase, financial soundness is worsening. “This is a situation where the government needs to step in and reduce the rate at which household debt is growing,” she said.

High interest rates can also weaken the competitiveness of companies. This is because if financing becomes difficult, the number of marginal companies that cannot repay their debt may increase. As of the end of last year, marginal companies unable to repay interest with money earned over three years accounted for 15.5% of all non-financial corporations subject to external audit. This is an increase of 0.6 percentage points compared to a year ago (14.9%).

The problem is that the authorities’ monetary and fiscal policies are tied up even in times of crisis such as massive household debt and economic recession. Interest rates must be lowered to stimulate the economy, but it is burdensome that the benchmark interest rate gap between Korea and the United States is at a record high of 2 percentage points. Conversely, interest rates must be raised to cope with rising exchange rates and high inflation, but this raises concerns about household debt and economic recession. Even in the recent high interest rate situation, the balance of household loans from the five major banks at the end of last month was KRW 682.3294 trillion, an increase of KRW 1.5174 trillion from the previous month.

Expanding government finances to stimulate the economy is not feasible due to declining tax revenues. With the national debt reaching 1,097 trillion won as of July this year, a tax revenue deficit of about 59 trillion won is expected this year. The managed fiscal balance, which shows the actual running of the country, is in deficit by 68 trillion won as of July of this year. Kang Hyeon-joo, a researcher at the Capital Market Research Institute, said, “The government’s response is not easy because the third crisis originated from external factors, but there is a need to take measures to stabilize the market through appropriate intervention in the foreign exchange market.”

New York =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.