High interest rates coupled with deepening global economic instability… Concerns about domestic price stimulus

International oil prices have emerged as another detonator for the Korean economy. The direct cause is that Saudi Arabia and Russia, major oil producing countries, began to cut crude oil production on a large scale starting in July and August. The high oil price phenomenon, coupled with the possibility of a prolonged high interest rate on U.S. Treasury bonds, is increasing uncertainty in the global economy. Experts predict that international oil prices will remain around $80 to $90 per barrel for some time amidst the rising factors caused by production cuts by major oil producing countries and the downward factors caused by the global economic downturn.

International oil prices showed a high rise in the third quarter of this year. The price of Brent crude oil, the international oil price standard, was around $70 (about 94,460 won) per barrel in the second quarter, but exceeded $94 (about 126,870 won) at the end of September (see Graph 1). Dubai oil, which is the standard for the price of Middle Eastern crude oil that Korea mainly imports, and West Texas Intermediate (WTI), which is listed on the New York Mercantile Exchange, also showed a similar trend and soared. Accordingly, even JP Morgan Chase, the largest bank in the United States, predicted that international oil prices could soar to $150 (about 202,450 won) in the future. In a report released in September, JP Morgan analyst Christian Malek said, “Brent crude oil will trade at $90 to $110 per barrel next year, and will rise to $100 to $120 by 2025 and $150 by 2026.” He added, “The global energy market is producing “We are expected to enter a ‘super cycle’ due to a shock to our capabilities,” he said. While major oil producing countries have recently reduced production, demand for crude oil continues to increase, while investment by fossil fuel producers continues to decrease in line with the carbon neutral policy, which is said to be ‘adding insult to injury.’

The recent surge in oil prices is a situation that is not easy to resolve immediately, given that it is the result of a combination of price defense by oil-producing countries and political ‘mongni’. In March, international oil prices fell below $70 per barrel due to concerns about a global financial crisis following bank failures in the U.S. and Europe. Accordingly, Saudi Arabia and Russia agreed to control crude oil production, and in April OPEC (Organization of the Petroleum Exporting Countries) and OPEC Plus announced plans to reduce crude oil production on a large scale. As demand for crude oil plummeted due to the COVID-19 pandemic, major oil producing countries significantly reduced production and recovered to previous levels in August of last year. However, as oil prices continued to fall, production was cut again. On October 4 (local time), Saudi Arabia and Russia announced that they would continue to reduce crude oil production and supply for the time being. This is also a ‘collaboration’ that combines the political interests of Russia, which is trying to counter the international community’s economic sanctions after the invasion of Ukraine, and Saudi Arabia, which is at odds with the United States after the inauguration of the Joe Biden administration.

Saudi Arabia and Russia have no choice but to cut crude oil production and control exports due to their respective domestic economic conditions. In the case of Saudi Arabia, enormous financial resources are needed for large-scale infrastructure construction projects such as the construction of ‘Neom City’ led by powerful figure, Crown Prince and Prime Minister Mohammed bin Salman. Russia faces two challenges: securing foreign capital through crude oil exports and meeting domestic oil demand. Recently, the Russian military has been making repeated retreats in the face of the Ukrainian army’s massive offensive. To operate large-scale armored forces and air power, a huge amount of fuel is inevitably needed. Some analysts say that Russia’s domestic energy shortage is serious due to the demand for fuel for agricultural machinery needed for the fall harvest and heating oil in the winter.

Meanwhile, there were also predictions that international oil prices would weaken in the future in October. Citibank, one of the top three U.S. banks, predicted in its fourth quarter outlook report, “Brent crude oil prices will weaken to an average of $82 in the fourth quarter of this year and $74 on average next year.” This is in accordance with the forecast that crude oil production in the United States, Brazil, Canada, and Guyana will increase. In fact, contrary to initial concerns, international oil prices

It is showing a downward trend in early October.

Regarding international oil price trends, Seong Tae-yoon, a professor of economics at Yonsei University, said, “The recent high oil price situation is more related to Saudi Arabia and Russia’s production cut measures rather than a super cycle.” He added, “It is unlikely that it will surge to $150 as predicted by some, including JP Morgan.” said. However, Professor Seong said, “In a situation where the technical efficiency of new and renewable energy has not been secured, the strengthening of climate-related regulations is also raising energy prices.” “It can cause an impression,” he analyzed. Park Joo-heon, professor of economics at Dongduk Women’s University and former director of the Korea Energy Economics Institute, predicted, “With the winter season approaching when energy consumption increases, it is difficult for Russia and Saudi Arabia to change their production cuts anytime soon.” He added, “Oil prices will remain strong until next spring.”

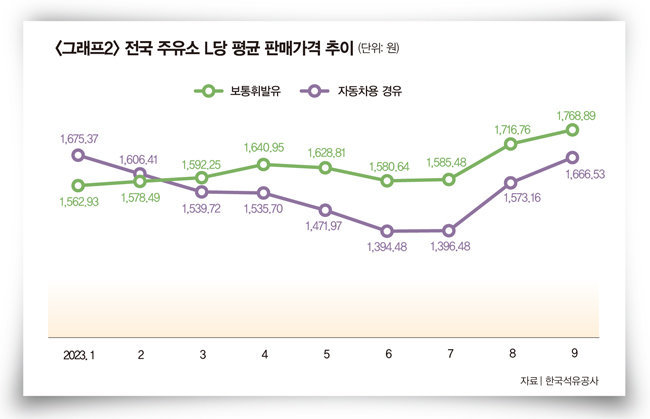

The Korean economy was hit hard by high oil prices. The increase in gasoline prices at gas stations that consumers feel right now is unusual. According to Korea National Oil Corporation, the average selling price of regular gasoline at gas stations nationwide, which was about 1,580 won per liter in June, rose to about 1,768 won in September (see Graph 2). During the same period, the average selling price of diesel also rose sharply from about 1,394 won to 1,666 won. Oil prices stimulated overall shopping cart prices. According to the ‘Consumer Price Trends’ compiled by Statistics Korea, the consumer price index in September was 112.99, up 3.7% from the previous year, recording the largest increase in five months since April.

If international oil prices continue to soar, it is inevitable that Korea, an energy importing country, will suffer a severe blow to its overall economy and industry. Although there is an assumption that energy prices are not controlled, some argue that this, combined with the high interest rate trend, could cause a ‘butterfly effect’ in the domestic economy. Professor Park Joo-heon pointed out, “The surge in crude oil prices could worsen Korea Electric Power Corporation (KEPCO)’s deficit problem and have a significant negative impact on the overall Korean economy.” The surge in oil prices also stimulates the price of natural gas, which is linked to the price of crude oil. The analysis is that if the price of natural gas, a major power generation raw material, rises, not only the household economy but also KEPCO’s deficit problem may become more serious. Professor Park’s explanation follows.

“There is a high possibility that the financial problems of KEPCO, which has almost reached its bond issuance limit due to the rise in international energy prices, will become more serious. Even if the urgent fire is extinguished by revising the KEPCO Act and raising the issuance limit again, if KEPCO issues large-scale corporate bonds, confusion in the domestic bond market may increase. There is already a possibility that the United States will raise interest rates again, which could make it more difficult for private companies to raise funds through corporate bonds. If there is no intermediate link such as KEPCO’s serious deficit, there is a possibility that the recent high oil price situation will end up as a difficulty limited to the energy or industrial sectors, as it was in the past. However, with the trend of high interest rates, high oil prices can have a significant negative impact on the overall economy.”

The oil refining industry is often considered a beneficiary of high oil prices. However, investing based on this formula is not easy. This is because the overall domestic and international stock markets are in a recession phase, making it difficult to invest solely based on the single variable of international oil prices. As the U.S. Federal Reserve’s (Fed) high interest rate stance continues for a long time, even U.S. Treasury yields show strength, and the New York stock market falls on October 4, and on the same day, KOSPI fell 2.4% and KOSDAQ fell 4%. The stock prices of major domestic oil refining companies, which had been trending upward in September, also fell again due to the overall stock market slump. The stock price of a mid-sized energy company, which surged nearly 50% in September due to its high oil price theme, showed a double-digit decline.

Nam Seok-gwan, CEO of Best Income, said, “For the stock price of the domestic oil refining industry to rise, the demand for petroleum products must increase as the Chinese economy revives, but that is not the case.” He added, “The stocks that have soared in the domestic stock market in conjunction with the high oil price phenomenon appear to be the result of speculative forces entering the market. “As if to prove this, the stock price has recently fallen again,” he analyzed. CEO Nam said, “In the fourth quarter of this year, we need time to take a break from stock investment, secure cash, and find out what stocks will rise in the market next.”

“In the current high oil price situation, it appears that there will not be a sudden surge even in the sectors called beneficiary stocks. A big power needs to buy it, but it doesn’t seem like they will bother to invest in a situation where there is a better sector. There is recent speculation that China’s economy is bottoming out. “If the real economy, led by China, revives, stocks with good performance in the oil refining and petrochemical sectors amid high oil prices are expected to show an upward trend.”

*If you search and follow ‘Magazine Jin Donga’ and ‘Two Avengers’ on YouTube and portal sites respectively, you can find a variety of investment information such as videos in addition to articles.

〈This article

Weekly Donga No. 1409

It was published in〉

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.