Discussion on whether to raise the public-private TF in the wake of ‘bank run’

Financial Services Commission conveys its position on ‘future review’ to the National Assembly

There seems to be concern about funds being diverted to savings banks.

It has also been pointed out that ‘profits from raising the limit are limited to a small number of people’

In the wake of the bankruptcy of Silicon Valley Bank (SVB) in the U.S. and the Saemaeul Geumgo bank run (large-scale deposit withdrawal) crisis, it was pointed out that the depositor protection limit should be increased to 100 million won, but the current system was changed as the financial authorities conveyed their opinion to the National Assembly that additional review is necessary. is expected to be maintained.

According to Rep. Kim Hee-gon of the People Power Party, a member of the National Assembly’s Political Affairs Committee, on the 9th, the Financial Services Commission, through the ‘deposit insurance system improvement review plan’ reported to the Political Affairs Committee on the 5th, “discussed the pros and cons in the future and whether to raise the (depositor protection limit) considering the market situation.” “There is a need to review this,” he said. As a result of forming a public-private joint task force (TF) since March of last year to examine the overall deposit insurance system, in effect, the position of ‘maintaining the status quo’ was put forward.

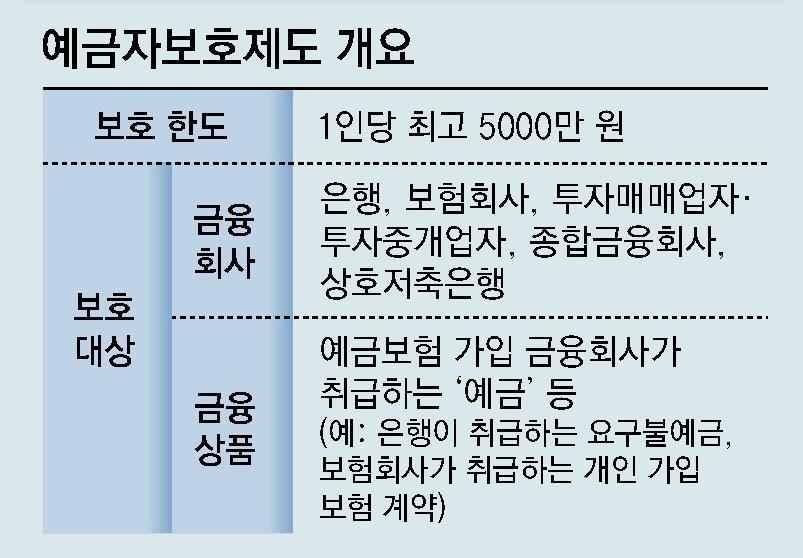

The current depositor protection system guarantees payment of up to 50 million won per person if a financial company falls into an insolvent state such as bankruptcy. The same level has been maintained since 2001, when it was converted to a partial protection system. As of last year, it was only 1.17 times the gross domestic product (GDP) per capita, so the depositor protection limit ratio lags behind developed countries such as the United States (3.33 times) and Japan (2.27 times). In addition, as the SVB bankruptcy in March of this year and the Saemaeul Geumgo bank run crisis in July occurred one after another, voices calling for an increase in the protection limit grew louder.

Nevertheless, the reason the authorities decided to maintain the current system for the time being was because they took into account concerns about funds being concentrated in secondary financial institutions and the increased burden on consumers due to the increase in deposit insurance premiums. As a result of research conducted by the Korea Deposit Insurance Corporation, it was estimated that if the depositor protection limit is raised to 100 million won, funds will move from banks to savings banks, resulting in a 16-25% increase in savings bank deposits. Although the impact on the overall market is limited, if excessive competition for receipt occurs within the industry, the possibility of a shock to some small companies cannot be ruled out.

The report also pointed out that, compared to the increased burden on financial consumers, the benefits of raising the limit may be limited to a few. It was predicted that when the limit is increased to 100 million won, the proportion of depositors within the protection limit will only increase by 1.2 percentage points from the current 98.1% to 99.3%.

However, within the public-private joint task force, there appeared to be strong opinions for and against raising the protection limit. Private sector experts argued that raising the limit should be considered in terms of improving financial consumer confidence. There was also an opinion that in times of crisis, full protection rather than raising the limit may be necessary. On the other hand, the financial industry opposed this, saying, “The effect of strengthening consumer protection is not significant, but there are concerns that the burden on the industry will increase, and the application of separate limits on pension savings and accident insurance premiums is being promoted, so it is necessary to first observe the effect of system improvement.” did.

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.