HD Hyundai agrees to build 17 LNG carriers

7 more ships than expected… Ordered a total of 40 ships

Samsung Heavy and Hanwha Ocean expected to have more than 10 ships each.

Considering the drying period, it will likely be reflected in next year’s performance.

The second round of order competition for the ‘Qatar Project’, which is expected to be worth a total of 12 trillion won, has begun in earnest. This is an opportunity for the three domestic shipbuilding companies, which swept more than 80% of the total ships ordered during the first order competition last year, to aim for another large-scale order. Some predict that this will be the biggest boost to the Korean shipbuilding industry.

Qatar plans to increase liquefied natural gas (LNG) production, currently at 77 million tons per year, to 126 million tons by 2027. To this end, orders for about 100 LNG carriers were announced. Following 65 ships last year, it is expected that around 40 ships will be ordered this year.

According to the industry on the 10th, HD Hyundai Heavy Industries recently signed a memorandum of agreement (MOA) for the construction of 17 LNG carriers with Qatar Energy, a state-owned energy company in Qatar. This is the stage just before signing a full-fledged slot contract (a contract to occupy ship building space) with the shipping company that will transport LNG.

As there is no official order announcement from the Qatari government for this project, the domestic shipbuilding industry regards the signing of this MOA as a signal for the second ship order race.

The industry is paying attention to the fact that HD Hyundai Heavy Industries has secured 7 more ships than market expectations. The Qatar government first announced that it would place an order for 100 LNG carriers in 2020 in relation to this project. At the time, the ship price was about $190 million (about 256 billion won) based on a 174,000㎥ class, but now the price of the same ship has risen to $265 million (about 357 billion won). This contract has resolved concerns that the number of orders will decrease.

The prevailing opinion is that the second round of orders will in fact be monopolized by Korean shipbuilders. Last year, HD Korea Shipbuilding & Marine Engineering (17 ships), Samsung Heavy Industries (18 ships), and Hanwha Ocean (19 ships) shared 54 out of 65 LNG carriers (83.1%) from this project.

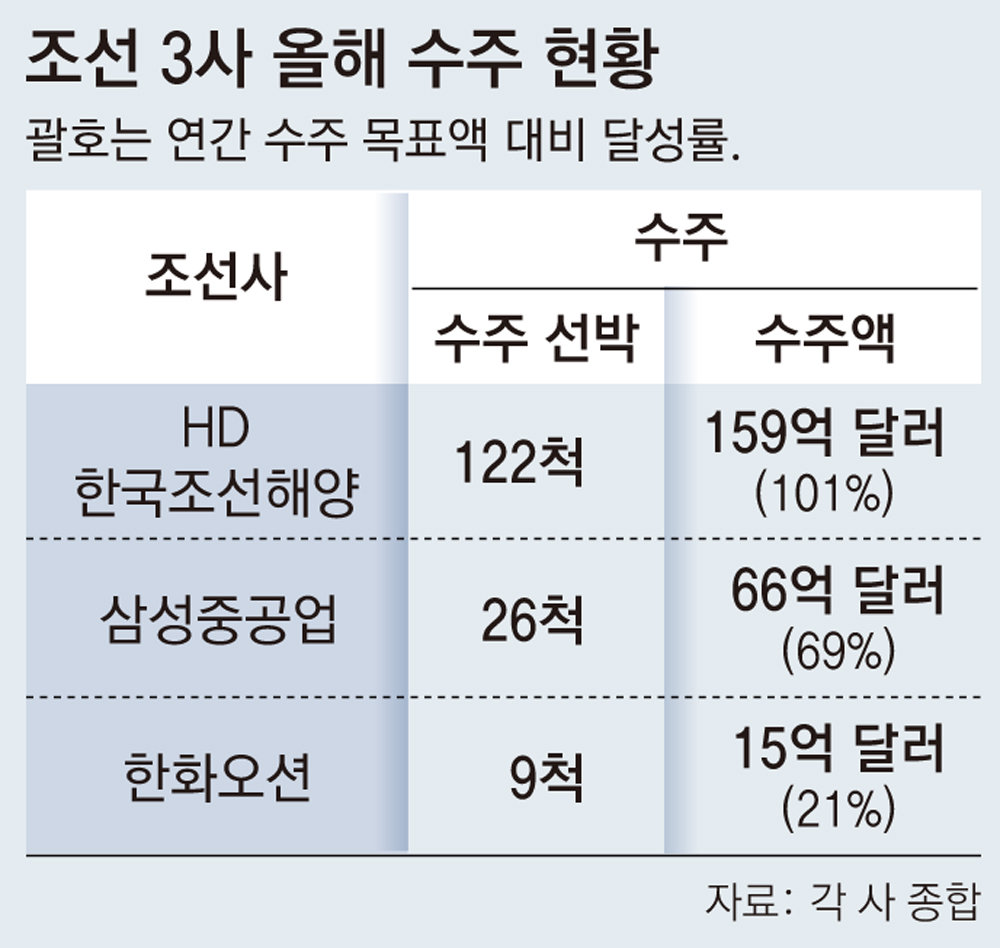

Samsung Heavy Industries and Hanwha Ocean, which are known to be currently negotiating with Qatar, are also expected to receive orders for at least 10 ships each. The two companies’ order target achievement rates for this year remain at 69% (26 ships) and 21% (9 ships), respectively. This is why we have no choice but to focus more on winning projects in Qatar.

In addition to domestic companies, Chinese shipping companies such as Hudong Zhonghua Shipbuilding and Marine Engineering, which took 11 ships at the time of the first order, are mentioned as candidates for orders.

An official in the domestic shipbuilding industry said, “Only Korea and China can build ‘membrane’ (square-shaped cargo holds that integrate the hull and cargo holds) LNG ships, which are currently the trend of LNG carriers,” adding, “Korea is far ahead in terms of technology, but (Qatar) A) There is a possibility of targeting the Chinese energy market and allocating some quantities to Chinese companies,” he explained.

The performance in this large-scale order competition is expected to lay the foundation for the Korean shipbuilding industry to produce good sales performance starting next year. Considering the ship construction period, which usually exceeds 1 year and 6 months, the orders to be secured this time will be reflected in each company’s business performance starting from the second half of next year (July to December).

In particular, there is analysis that it will play a positive role in alleviating market anxiety over the gradual decline in orders received by the Korean shipbuilding industry since peaking last year. According to Clarkson Research, a British shipbuilding and shipping market expert, Korea’s order intake from January to September was 7.42 million CGT (standard cargo ship equivalent tonnage), down 46% from the same period last year.

An industry official said, “The order backlog (remaining work) has already exceeded three years, and ship prices, which are an indicator of profitability, are continuously showing an upward trend.” He added, “Even though the overall order volume has decreased, there is a lot of demand for high value-added ships such as LNG carriers.” He said, “As this order win shows that there is a lot of market demand for the shipbuilding industry, a green light has been turned on for performance improvement in the domestic shipbuilding industry.”

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.