Like the Russo-Russian war that led to an increase in the defense budget, another opportunity for defense companies

The stock market, which suffered severe price adjustments throughout September due to negative factors such as prolonged high interest rates from the U.S. Federal Reserve, began to recover in October thanks to the slowing U.S. employment indicator (bad news is good news) and falling market interest rates. appeared. However, due to the war between the two countries that broke out following the invasion of Israel by the Palestinian armed faction Hamas on October 7, the uncertainty of ‘geopolitical risk’ appears to be causing market anxiety again.

Although the stock market is not yet as shocked as it was when the Russian-Ukrainian war (Russian-Ukrainian war) broke out last year, some say it could escalate into the fifth Middle East war. Since this is a time of high sensitivity to inflation, if international oil prices continue to surge due to war in the Middle East, market participants are planning a slowdown in overall inflation, including headline inflation where agricultural product and energy prices change due to temporary volatility such as the international situation or climate. ), there is also a risk that this may change.

Wars inevitably involve unpredictable factors, such as deep-rooted ideological conflicts between countries. Therefore, from a political or diplomatic perspective, it is difficult to assert or be certain about the progress of this Israel-Hamas war in a specific direction. On the other hand, from the stock market perspective, it is meaningful to establish response strategies for each scenario by looking at changes in stock prices when similar incidents occurred in the past.

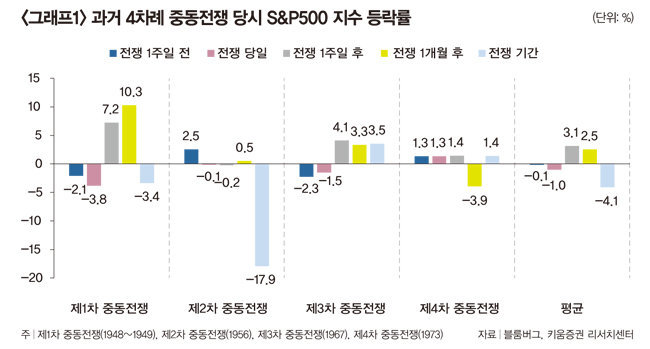

Looking at the stock market trends during the last four Middle East wars (1948, 1956, 1967, 1973), the average fluctuation rate based on the U.S. S&P 500 index was -0.1% one week before the war, -1.0% on the day, 3.1% one week later, and 2.5% one month later. %, recorded -4.1% during the entire war period (see Graph 1). Even taking into account the Second Middle East War (Suez Crisis), which had an unusually large decline in stock prices, it can be seen that the impact on the stock market was limited.

Some investors will raise concerns that it could follow the path of the Russo-Russian war, which was an unexpected black swan event. The surge in inflation caused by the Russo-Russian War led to the Federal Reserve’s tightening of austerity measures, and the KOSPI suffered a slump for several months, falling from the 2900 level at the beginning of the year to around the 2100 level throughout the year. However, it should be noted that unless the Israel-Hamas war intensifies into a large-scale participation by Western countries such as the United States, like the Russo-Russian war, the 9/11 terrorist attacks, or the Gulf War, such geopolitical events did not significantly damage the direction of the stock market. .

The current Israel-Hamas war is expected to depend on the intervention of major countries such as the United States, Saudi Arabia, and Iran, especially Iran. This is because if the war expands, the Strait of Hormuz located in Iran (accounting for about 20% of the world’s crude oil transport) may be blocked or production disruptions in surrounding oil-producing countries may occur, causing an additional surge in oil prices. This raises concerns about stagflation (increasing prices during an economic recession) in the stock market, which has become sensitive to inflation, and is a factor that may stimulate anxiety about further tightening by the Federal Reserve.

However, this is only the worst-case scenario, and it is judged to be a scenario with an extremely low probability of occurrence (less than 10%). Iran itself denies intervention, and there is insufficient evidence for the theory of Iranian intervention raised by some. Also, unlike past conflicts in the Middle East, anti-Hamas, rather than anti-Israel, sentiment is now being strengthened. The outlook for crude oil supply and demand is not as tight as it was during the oil shock of the 1970s and 1980s.

To conclude, the future direction of the war cannot be predicted hastily, and we must avoid optimism that the situation will be resolved quickly. War issues need to be approached as a scenario, and considering the above-mentioned details, the high probability base scenario (probability of 80% or more) is that the current war is highly likely to develop into a local war limited to engagement between the two countries. In this case, only short-term oil price volatility will increase, and the overall direction of the stock market, existing inflation, and the outlook for the Federal Reserve’s policy path are not expected to be damaged.

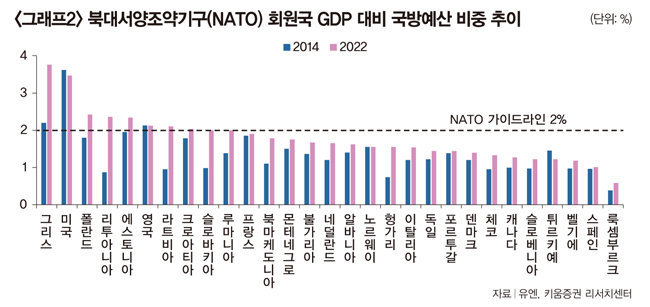

Furthermore, from a stock market perspective, there are industries that can be considered opportunities. Defense industry stocks are a representative example. If the Russo-Russian war that broke out last year instilled in each country the perception that military strength needs to be strengthened even if war does not break out, the current Israel-Hamas war is expected to further solidify that perception. In particular, in the United States, where confrontation with Russia and China is intensifying, the defense budget as a percentage of gross domestic product (GDP) was 3.5% as of last year, exceeding the North Atlantic Treaty Organization (NATO) guideline of 2% (about 2% of the global defense budget). 40% (see graph 2). In addition, through the recent National Defense Authorization Act, the defense budget was set at $816 billion (approximately KRW 1,105.108 trillion), a 9.9% increase from the previous year, thereby further spurring further efforts to secure military power.

The trend of strengthening national defense is a mid- to long-term trend. According to a forecast by the U.S. defense media ‘Aviation Week’ in October last year, this year’s global defense budget will increase from approximately $1.8 trillion (approximately 2,437.38 trillion won) to $2.2 trillion (approximately 2,979 trillion won). trillion won), and the cumulative defense budget is expected to reach approximately 2.5 trillion dollars (approximately 3385.25 trillion won) by 2032. Among these, the weapons acquisition budget, which includes weapons development, production, maintenance, and purchase, approaches $550 billion (approximately KRW 744.755 trillion, as of 2021), or approximately 28% of the total budget. Additionally, the proportion and amount of the weapons acquisition budget, including the purchase of new weapons, is expected to increase as time goes by.

As the increase in the defense budget led to increased demand for weapons, Korea signed large-scale K-9 contracts with Poland and Egypt and secured advantageous bases in major regions such as North America, Asia, the Middle East, and Europe, and this is what should be paid attention to. . The continuation of geopolitical uncertainty will be another opportunity for defense companies as it can create an environment where supply conditions are tight compared to demand for weapons.

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.