Leading the way for startups to expand overseas after domestically

Investment in overseas VC, creation of 8.9 trillion won fund

Expanding influence by becoming a global LP

Korea Venture Investment Corporation (KVIC) is playing a role as a priming agent for startups in the global market following the domestic one. We are actively supporting the overseas expansion of domestic companies through the ‘Overseas VC Global Fund’.

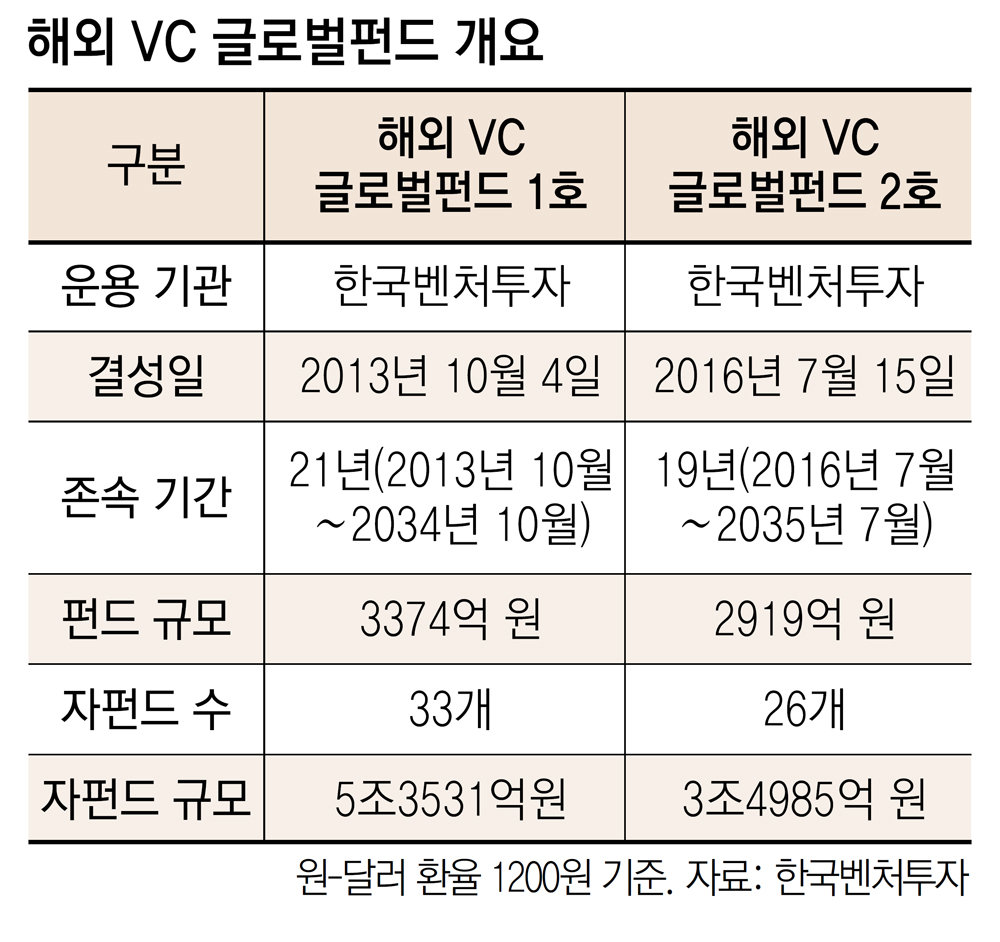

Korea Venture Investment, a fund-of-funds management institution, launched a global fund in 2013 to contribute to revitalizing the domestic venture ecosystem and help domestic startups advance overseas. A total of 629.3 billion won was invested to create a sub-fund worth about 8.9 trillion won.

So far, there are 59 sub-funds formed by investing money in overseas venture capital (VC), such as Altos Ventures (USA), TransLink Capital (USA), Patek Partners (France), and Vertex Ventures (Singapore). The number of domestic startups that have attracted investment from these funds is 472 (worth 1.064 trillion won). More than double the investment has already been made.

In order to make more active investments, Korea Venture Investment presents a condition to overseas VCs that they must invest more than one multiple of their investment in domestic startups. As the size of the global fund’s investment increases, the scale and number of cases of domestic startups attracting overseas investment also increases.

Global Fund has become the foundation for the growth of ‘K Unicorn.’ Unicorn companies are unlisted start-up companies with a corporate value of more than 1 trillion won. Major investment companies include Viva Republica (Toss), Woowa Brothers (Baedal Minjok), HyperConnect (Azar), Carrot Market, Bucket Place (Today’s House), Moloco, and The Pink Pong Company (Smart Study). .

This year’s budget for overseas VC global fund investment projects is KRW 88.3 billion (KRW 64.9 billion for general, KRW 13 billion for cross-border cooperation, and KRW 10.4 billion for unicorn projects). As a result of the general field investment project selection, the competition rate at the time of application was 7.6 to 1. A total of 45 funds submitted investment proposals. Seven funds from five countries, including the United States, Singapore, Japan, the United Kingdom, and France, were finally selected. The plan is to create a new sub-fund worth more than 1.1 trillion won.

Based on its overseas VC network and diverse experience, it joined hands with the Government Employees Pension Service to create the ‘GEPS Global VC Fund’ worth 50.5 billion won. It is planned to form a sub-fund worth 2 trillion won through the parent fund.

In addition to investment projects, we are also pursuing various support measures. To expand the overseas expansion of domestic startups, the ‘Global Jump Up Program’ and ‘Non-face-to-face IR’ are being carried out, while also supporting collaboration programs with other organizations such as KOTRA. We are also passing on our know-how to mother funds and venture investment-related organizations in emerging countries such as Vietnam.

Efforts are also being made to create joint funds between countries. Korea Venture Investment signed a memorandum of agreement (MOA) with Saudi Venture Investment (SVC), a Saudi Arabian fund management institution. Korea Venture Investment and Saudi Venture Investment participated as major investors (LPs) in the Korea-Saudi joint fund. Accordingly, a fund worth a total of 160 million dollars (about 208 billion won) is being created.

In line with this demand for global cooperation, overseas offices will also be expanded. Following Silicon Valley in the US in 2013, Shanghai in China in 2014, and Singapore in 2015, the company will open its fourth overseas office in London, England on the 22nd. There are a total of 231 UK VCs, making it the largest in Europe.

Yoo Woong-hwan, CEO of Korea Venture Investment, held a face-to-face meeting with British Investment Minister Dominic Johnson and requested cooperation so that the new overseas office could become a bridgehead for the Korean and European venture ecosystems. We decided to strengthen our partnership so that excellent startups from both countries can attract overseas investment and advance into both countries.

Recently, ‘Global VC Connect 365 in SF’, a support program for attracting investment for domestic startups, was held in Silicon Valley. We focused on providing practical help, such as sharing US investment trends and providing one-on-one IR coaching between startups and VCs.

CEO Yoo said, “We are gradually expanding our influence overseas and becoming a global LP. If global funds with overseas VCs are activated, the domestic venture ecosystem can secure sustainability. “We will do our best to globalize domestic venture startups,” he said.

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.