Impact of low yen… Up 29% in 11 months

Foreign investment flocks to improve Japanese corporate performance

“If you look at the stock market, it looks like we’ve come out of the ‘lost 30 years’”

Concerns grow about a consumption slump due to the prolonged weak yen

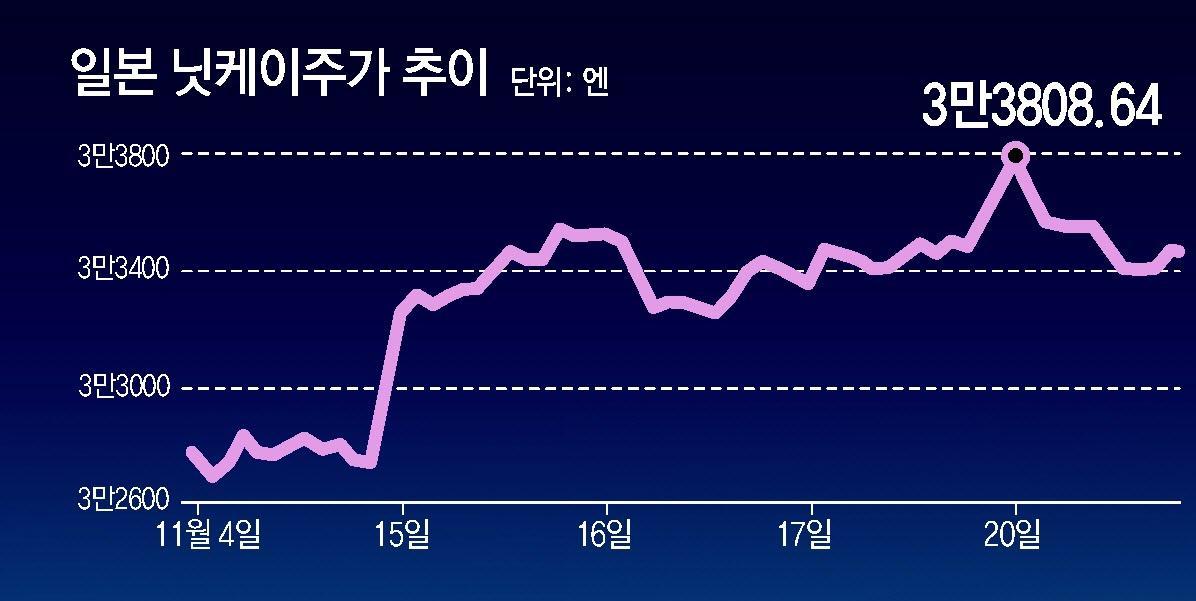

The Nikkei Stock Average, a Japanese stock market index, hit its highest level in 33 years and 8 months during trading on the 20th. It was the highest since March 1990, when the bubble economy collapsed. Looking at the stock market alone, it is possible to interpret that we have finally escaped the ‘lost 30 years’.

This stock market boom was largely due to improved performance of major Japanese companies due to the prolonged record weak yen. Due to the reorganization of the global supply chain, companies that have moved out of China are also enjoying the effect of directing their investments to Japan. However, as it is the only major country in the world that adheres to financial easing, there are voices concerned about the side effects of excess liquidity and the impact of future interest rate hikes. The tendency for the economy to be swayed by external variables is also growing stronger as exchange rates, rather than structural improvement, determine growth rates.

On this day, the Nikkei stock average rose to 33,808.64 yen, exceeding the intraday high of 33,753 yen 33 years ago. In the afternoon, there were a lot of ‘sell’ orders, and it finished at 33,388.03 yen, down 0.59% (197.17 yen) from the previous trading day. The Nippon Keizai Shimbun analyzed, “After reaching the highest level in 33 years and 8 months, the buying trend slowed down in the atmosphere that the goal had been achieved, and in the afternoon, the selling trend to realize profits was strong.”

The Japanese stock market rose 29% over about 11 months from the end of last year to the 17th of this month. It is the highest in the world, exceeding the growth rate of the U.S. Standard & Poor’s (S&P) 500 (18%), KOSPI (10.4%), and Euro STOXX 600 (7%) during the same period.

As Japanese companies perform well globally, foreign investment is flocking to the country. The net profit of Japanese listed companies in the first half of this fiscal year (April to September) is expected to increase by 30% compared to the same period last year, hitting an all-time high. As the rush to escape from China intensifies due to the U.S.-led global supply chain reorganization, large-scale investments are being made by semiconductor companies such as Taiwan’s TSMC and America’s Micron.

As corporate performance and investment improved, the Organization for Economic Co-operation and Development (OECD) predicted in its September economic outlook that Japan would grow 1.8% this year, overtaking Korea (1.5%) in growth rate for the first time in 25 years.

In addition, the US Consumer Price Index (CPI) growth rate was lower than expected, which also affected the possibility of an interest rate hike by the US Federal Reserve (Fed). When interest rate increases slow down, money flows into stocks that are classified as risky assets. For this reason, the US Dow Jones Industrial Index rose 1.9% from the 13th to the 17th of last week (local time), and the S&P 500 index rose 2.2% during the same period. This is the first time since July of this year that the two indices have risen for three consecutive weeks.

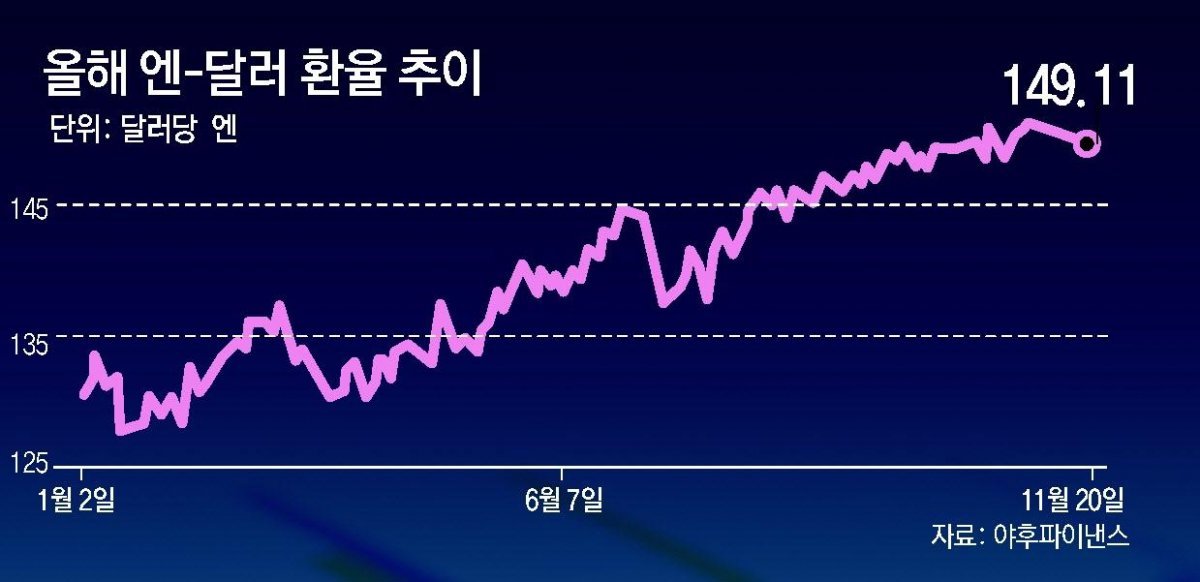

What is driving Japan’s recent remarkable economic growth is the prolonged low yen phenomenon.

In the Tokyo foreign exchange market on the 20th, the yen-dollar exchange rate was traded at 149.11 yen, down 1.34 yen (an increase in the value of the yen) from the previous day. Although it fell below 150 yen, the value of the yen has fallen by more than 17% since the beginning of the year compared to 128 yen in January of this year.

However, as the low yen phenomenon continues, import prices rise and consumption is depressed, which is having a growing negative impact. Bloomberg News predicted that Japan’s growth in the fourth quarter (October to December) could slow, saying, “There is a risk that consumption will freeze due to rising prices due to the low yen and sluggish wage increases.”

If the movement of selling yen and buying dollars weakens, the value of the yen may rise. This is a factor that could cause the performance of Japanese companies, boosted by exports, to deteriorate at any time. This is why it is pointed out that the improvement in physical constitution due to economic recovery has not yet been achieved.

Tokyo =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.