“It’s been a month and a half since I put my house on the market, but no one is looking for it.”

“People are hesitant to buy a house,” said Christine Papadopoulos, a homeowner whom we met at an apartment in the Marais district, the fashion center of Paris, France, on the 10th. Mr. Papadopoulos, who is also the manager of the Century 21 Alfamare branch of a certified real estate agency, said, “As interest rates rise, banks are raising the loan threshold significantly out of fear that more borrowers will be unable to repay their debts. Buying a house has become more difficult.” On this day, there were about 10 advertisements for sale lined up in front of his real estate agency.

The French real estate market, which was expecting a housing sales boom ahead of next year’s Paris Olympics, is rapidly cooling down. Interest rates have tripled in the past year and three months, reaching the 4% range, and consumers are having difficulty securing housing funds. Another real estate agent said, “People who do not own a home have completely stopped coming.” The same goes for other European countries. Recently, the average house price in 20 European countries fell for the first time in 9 years. There are concerns that housing prices will fall further due to prolonged high interest rates and that the recession in the European housing market will further delay the global economic recovery.

The European housing market is in an overall downward trend, with interest rates rising from virtually zero until last year to more than 4% recently. According to the housing price index for the second quarter of this year (April to June) released last month by the European Union (EU) statistical agency Eurostat, the average house price in 20 EU countries fell 1.7% compared to the same period last year. This is the first decline in house prices since the first quarter of 2014. The decline was large in Germany (-9.9%), Denmark (-7.6%), and Sweden (-6.8%). In particular, Reuters reported that in Germany, 22.2% of housing construction companies canceled ongoing projects last month. This is the highest in 32 years since 1991.

In the UK, where the mortgage interest rate is close to 7% per annum, house prices in July of this year have already fallen 3.8% compared to the same month last year, the largest in 14 years since 2009. Even in the UK, loan costs are rising, making it difficult for homeless people to buy a house. Robert Gartner, Chief Economist at Nationwide, told Reuters, “A first-time homebuyer who uses 20% of the purchase price as a deposit will need to cover 43% of the purchase cost with a loan at current interest rates, compared to 32% a year ago.” . In France, daily Le Monde reported that the number of first-time homebuyers this year has decreased by a quarter compared to four years ago.

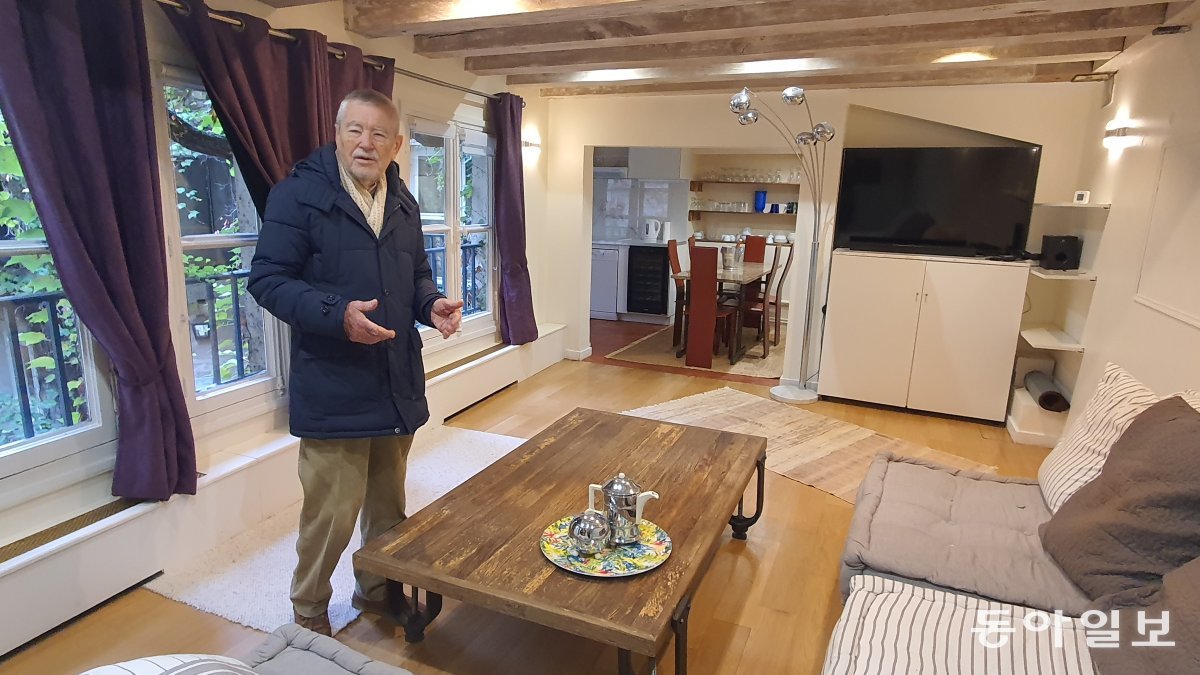

View largerBernard LeBreton introduces his house for sale in downtown Paris, France, on the 10th (local time). Paris =

View largerBernard LeBreton introduces his house for sale in downtown Paris, France, on the 10th (local time). Paris = There is optimism that the European housing market will recover soon. This follows the analysis that the European Central Bank (ECB) raised the benchmark interest rate 10 times in a row from July of last year to September of this year, but then froze it at 4.5% last month, suggesting that ‘the peak interest rate is approaching.’ However, as the ECB has announced that it will continue its war on prices, further interest rate hikes cannot be ruled out.

Homeowners who are concerned that the housing market will become more difficult say that complex tax systems and regulations must be reformed. Bernard LeBreton, a multi-home owner who was showing another house in the Marais district of Paris, said, “Selling prices will pick up only when the government reforms foolish taxes such as property tax and changes the administrative procedure of having to fill out about 100 pages of documents every time you buy a house.”

Denmark recently reformed its tax system in recognition of landlords’ complaints. According to the Danish Internet media The Local, the authorities have decided to change the method of assessing real estate values to calculate property taxes starting next year. Accordingly, some homeowners will receive the largest property tax reduction ever.

The Economist Intelligence Unit (EIU), a British think tank specializing in business information and market research, said, “Housing mortgage loan interest rates will stabilize in the second half of this year, but house prices will hit bottom due to rising construction costs due to high labor and material costs,” adding, “The degree of monetary tightening and the fixed interest rate “Considering the proportion of loans, there is a possibility that the United States will experience a longer real estate market downturn than the Nordic countries,” he predicted.

Paris =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.