Of the 393 absolutely dependent items, 55% are medium

Half of major semiconductor raw materials are imported from China… There is only 5.8 days of lithium reserves.

Concerns over the ‘second element number crisis’ repeating every year… The ‘Supply Chain Stabilization Act’ has been in hiatus for over a year.

Among the items imported for more than 10 million dollars (approximately 13.1 billion won) as of October this year, it was found that about 200 items were more than 90% dependent on China. The dependence on China for key semiconductor raw materials such as silicon wafers and hydrogen fluoride was around 80%. As concerns over a second urea crisis increase due to China’s restrictions on urea exports, anxiety is growing not only about urea but also about other items that depend on China. There are concerns that if China weaponizes resources and controls exports, the domestic industry could be shut down.

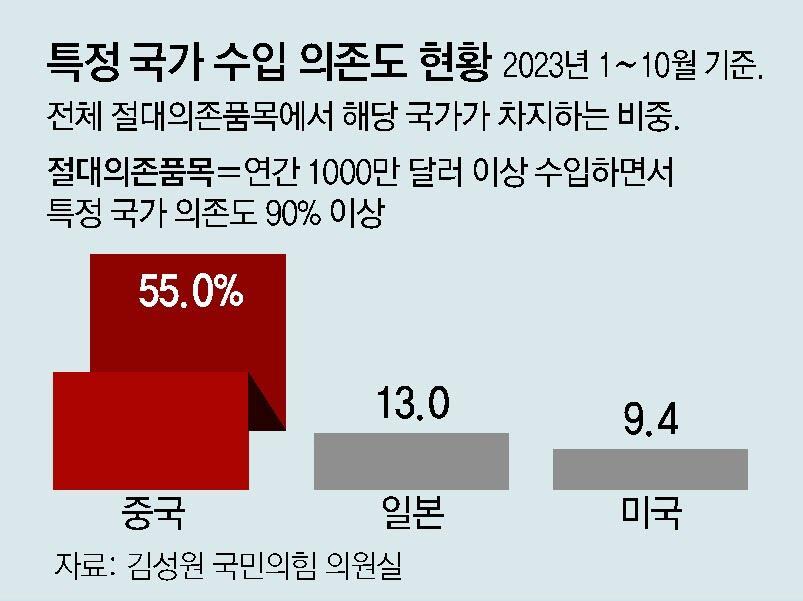

According to data received by People Power Party lawmaker Kim Seong-won from the Ministry of Trade, Industry and Energy on the 6th, among the items imported worth more than $10 million from January to October of this year, there were 393 ‘absolutely dependent items’ that depended more than 90% on a specific country. Among these, 216 items were more than 90% dependent on China, or 55% of the total. This is a much higher level compared to Japan (13%) and the United States (9.4%). Last year and again in 2021, China accounted for the highest proportion of absolutely dependent items.

In particular, more than half of the major raw materials for semiconductors, which are the backbone of the domestic economy, are imported from China. The public’s dependence on hydrogen fluoride, which is needed to make semiconductors, is 62%, and for neon and xenon, it is 81% and 64%, respectively. Rare earth metals, for which China has already begun export control by mandating export reporting, were imported from China in the first half of this year (January to June), accounting for 79.4%. The dependence on the public for rare earth permanent magnets, a core material for secondary batteries, is 85.8%.

The stockpile of rare metals, which is one of the measures to reduce dependence on China, is less than 40% of the targeted amount. According to data received by People Power Party lawmaker Lee Jong-bae’s office from the Korea Mines and Reclamation Corporation, the average stockpile of 14 types of rare metals managed by the government as of the end of October this year is 39.8 days’ worth. Excluding rare earth elements, which have a stockpile target of 180 days, the stockpile target for the remaining metals is 100 days. In particular, as of the end of last year, lithium reserves, which depended 64% on China, were only 5.8 days’ supply. If the supply of lithium from China is interrupted, companies will be able to survive without problems for less than a week.

The high dependence on China for raw materials is due to relatively cheap import costs. The cost of importing the elements that have recently become a problem is about 10 to 20 percent cheaper in China than in other countries such as Vietnam. From a company’s perspective, there is no incentive to exclude Chinese products that have lower import costs, including logistics costs.

There are voices in the industry that due to the high dependence on China, it is inevitable that the company will be greatly influenced by China’s decisions. An official from Company A, a urea-related company, said, “Problems such as restrictions on urea exports will be repeated every year,” and added, “We understand that the Chinese government’s intention is to monitor fertilizer price trends around spring, when the farming season begins.” Going forward, China will have no choice but to adjust its export volume ahead of spring in order to maintain stable domestic fertilizer prices.

Accordingly, it is pointed out that government policies should be supported to diversify raw material suppliers. The ‘Basic Act on Support for Supply Chain Stabilization for Economic Security’, which the government is pushing legislation to support diversification of import sources and expansion of stockpiles, has been pending in the National Assembly for over a year since October of last year. The bill has been submitted to the National Assembly’s Legislation and Judiciary Committee for review on the 7th, but it is unclear whether it can be passed by the Legislation and Judiciary Committee immediately as there are many bills that are already pending.

“If the government supports the supply chain through law, the perspective on Korea will change,” said Kang Cheon-gu, a visiting professor at the Department of Energy and Resources Engineering at Inha University. “There will be,” he said.

Sejong =

Sejong =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.