[홍콩發 ELS 충격파]

More than 70% of listed companies are mainland Chinese companies… The stock market takes a direct hit due to China’s real estate downturn.

Hong Kong currency linked to US dollar ‘peg system’… Liquidity dries up as interest rates rise along with the U.S.

“China’s economic recovery is slow… “Conservative response”

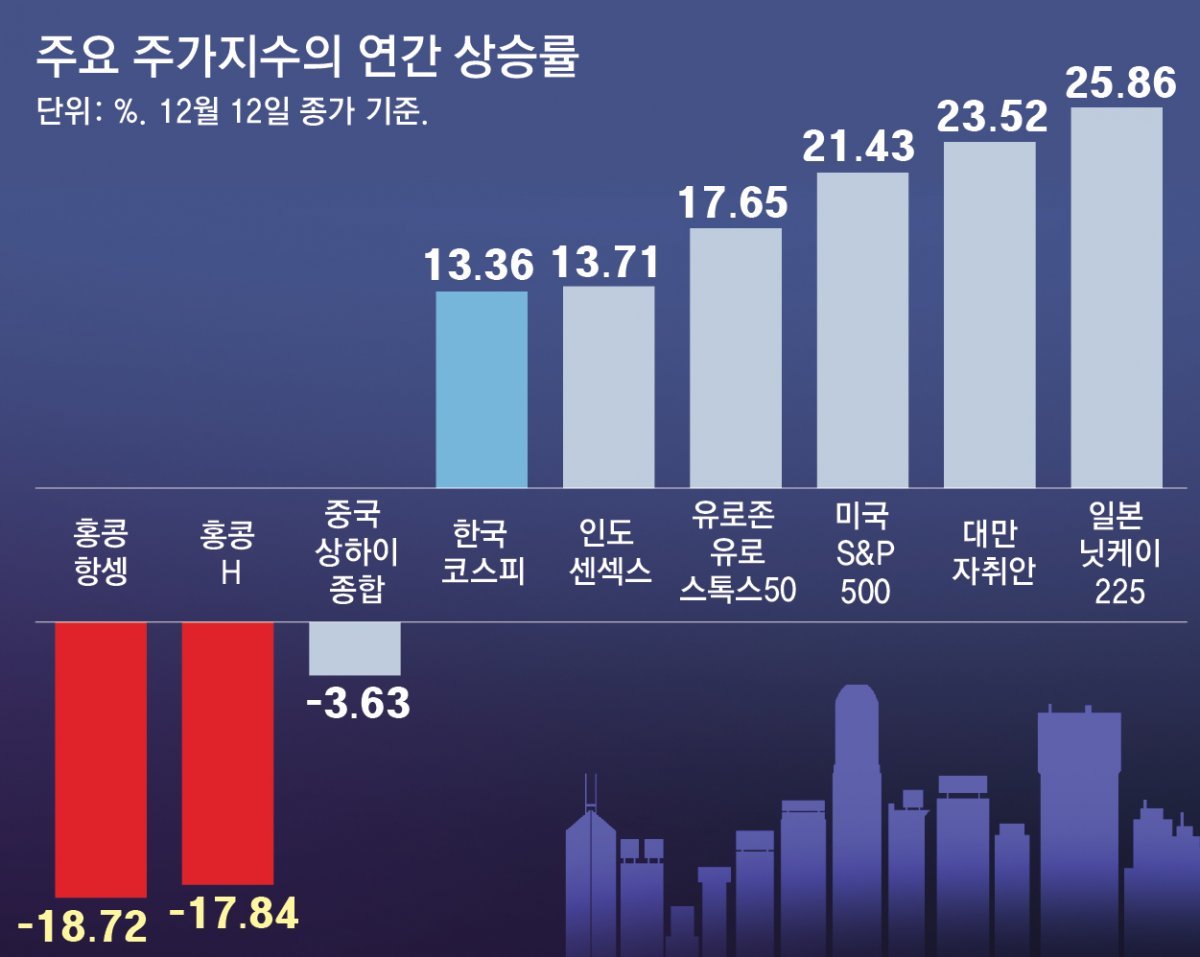

As negative news from China and the United States coincided, the Hong Kong stock market fell into a historic recession. This year alone, the stock index has fallen nearly 20%, recording the worst performance among major global stock markets. Hong Kong authorities have tried to boost the stock market by cutting taxes, but there are no signs of a rebound.

Hong Kong’s Hang Seng Index, which started at the 20,000 level early this year, continued to plummet and fell to the 16,000 level. The H index, which is mainly used as an underlying asset for equity-linked securities (ELS) sold domestically, also reached an 18.8% decline rate this year. The H index has fallen particularly sharply recently. On the 13th, it closed at 5,550.90, down 1.13% from the previous day. It has fallen 10% in 20 days since the 23rd of last month. The size of Hong Kong banking ELS, which is due to mature next year, amounts to 13 trillion won.

This is unusual in that it is a global stock market boom period in which stock indexes in major countries such as the United States, Japan, and Korea recorded double-digit increases. This is a much worse performance than China’s Shanghai Composite Index, which is suffering from an economic slowdown. The Hong Kong stock market has been falling for four consecutive years, the longest decline since the Hang Seng Index was introduced in 1969.

The Hong Kong stock market has recently caught up with India as well. According to the World Federation of Exchanges, the market capitalization of companies listed on the Indian stock exchange (USD 3.989 trillion) at the end of November surpassed that of Hong Kong (USD 3.984 trillion). It lost its position as the world’s 7th largest stock market to India. On the 28th of last month, the Hang Seng Index was even overtaken by Taiwan’s Jiaquan Index. This is the first time this has happened in 31 years.

The sluggish performance of the Hong Kong stock market is also confirmed in the performance of initial public offerings (IPOs). According to Bloomberg, Hong Kong’s IPO size this year is $5.1 billion, less than one-fifth of the 10-year average ($31 billion). This is the lowest figure since 2001, right after the dot-com bubble burst.

More than 70% of the listed companies on the Hong Kong stock market are mainland Chinese companies. At the beginning of this year, there was a prediction that the Hong Kong stock market would benefit as China escaped zero corona, but it was completely wrong. This is because consumers are closing their wallets as the debt crisis grows due to China’s real estate recession. The Hong Kong stock market, where Chinese real estate developers such as Biguiyuan and Chinese e-commerce companies such as Alibaba and Meituan are listed, was hit hard.

The conflict between the US and China over high-tech hegemony also had an impact. Last month, Alibaba shocked the Hong Kong stock market by withdrawing its plans to spin off and list its profitable cloud division. The reason for the withdrawal was the difficulty in obtaining important semiconductors due to the United States’ semiconductor export regulations.

There are also structural factors that are independent of China. Hong Kong adopts a peg system that links the value of its currency (Hong Kong dollar) to the US dollar. For this reason, when the U.S. central bank sharply raised its base interest rate, Hong Kong had to follow suit and raise its interest rate to 5.75%, the highest level in 16 years. At a time when overseas investors are already reducing their investments in China, Hong Kong’s tight monetary policy has further dried up liquidity. Shin Seung-woong, a researcher at Shinhan Investment & Securities, explains that the reason for the Hong Kong stock market’s slump is “a unique structure in which corporate profits are affected by the Chinese mainland economy and interest rates are affected by U.S. monetary policy.” The negative factors in the Chinese and U.S. markets overlapped.

In October of this year, the Hong Kong government introduced a tax reduction measure to restore the stock transaction tax that had been raised in 2021 (0.13% → 0.10%) to stimulate the stock market, but it is not seeing much effect. As stock trading volume plummeted, 30 small and medium-sized securities firms closed this year alone. “The wave of securities firm closures and layoffs in Hong Kong is the worst I have ever seen,” Edmund Hui, CEO of Bright Smart Securities in Hong Kong, told Bloomberg.

The accelerated Chineseization of Hong Kong after the enactment of the National Security Act in 2020 is also a factor that reduces the attractiveness of Hong Kong for investment. Moody’s downgraded Hong Kong’s credit rating forecast to ‘negative’ on the 6th. This was because “political and economic relations with mainland China have become closer, and autonomy has been weakened by the National Security Act.”

For the Hong Kong stock market to rebound next year, negative news from the United States and China must be resolved. First of all, it is positive that the US Federal Reserve’s tightening is coming to an end. However, it is still difficult to predict the timing of an interest rate cut in the United States. The Chinese economy is still recovering slowly, although the government is introducing various stimulus measures. In particular, the consumer price index has fallen for two consecutive months, showing clear signs of a decline in consumption. As the US-China summit held last month failed to achieve any significant results, there are no signs of resolution of the conflict between the US and China.

Securities companies are setting their sights low. Shinhan Investment & Securities proposed the H index range for the first half of next year as 5,000 to 7,000. Park In-geum, a researcher at NH Investment & Securities, predicted that the lower limit of the H index would be 5,400, saying, “The strength of China’s economic recovery is weak.” Jeon Jong-gyu, a researcher at Samsung Securities, suggested the H index of 5,500 as the lower end but urged people to “respond conservatively.”

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.