Iron ore prices rise 17% since the beginning of this year

Falling behind the low-price offensive of Chinese and Japanese products

The construction industry, which has high demand, is expected to perform poorly next year.

“Due to bad news, we need to tighten our belts for a while.”

The steel industry is experiencing a ‘triple whammy’ of rising steel raw material prices, low price offensives from China and Japan, and a recession in the construction economy. There are also predictions that it will be difficult to expect a rebound next year.

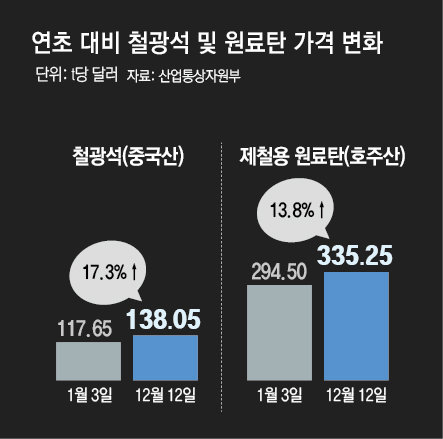

According to raw material price information from the Ministry of Trade, Industry and Energy on the 13th, the import price of Chinese iron ore was calculated to be $138.05 per ton as of the previous day. It increased by 17.3% compared to the beginning of the year (January 3). In addition to iron ore, raw material for steelmaking (made in Australia), a key raw material for making steel products, also rose to $335.25 per ton. It is 13.8% more expensive than the beginning of the year.

It is natural for product sales prices to rise as costs rise, but it is currently difficult for domestic companies to adjust their prices upward. This is because products from China and Japan, which are major steel exporters, are sold at relatively low prices in the global market. As China’s domestic real estate market slumps, it is actively exporting cheap products overseas based on cheap labor costs. In the case of Japanese steel products, thanks to the low yen phenomenon, which is at its lowest level in 30 years, they are enjoying the ‘sale effect’ even if they are virtually idle.

This month’s price for heavy plate products (SS275), which are mainly used in building ships, is 1,075,000 won per ton for both POSCO and Hyundai Steel. The import distribution price is 805,000 won. Imported products are only 74.9% of the price of domestic companies. In December last year, the price of imported steel compared to domestic steel was 78.3%, a smaller gap than now.

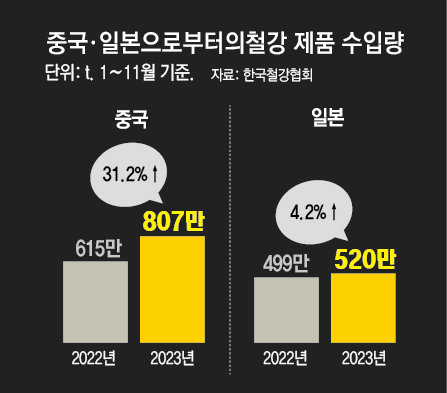

Imports of steel products are increasing significantly as imported steel products fall below three-quarters of the price of domestic products. According to the Korea Steel Association, 8.07 million tons of steel products were imported from China and 5.2 million tons from Japan from January to November this year. There was an increase of 31.2% and 4.2%, respectively, compared to the same period last year. A steel industry official said, “Domestic shipbuilding companies are using cheap products from Chinese or Japanese steel companies for non-core parts of ships.” As imports increase, the sales of domestic steel companies are bound to be affected.

The construction industry, which involves a lot of steel, is showing no signs of improving. According to the Korea Chamber of Commerce and Industry’s ‘2024 Industrial Weather Forecast Survey’, the construction industry was the only one among the 10 industries surveyed to be forecast as ‘rainy’ (very negative). This is because the sluggish construction economy continues due to the decline in real estate prices and a decline in orders, especially in private construction, is expected. Regarding the steel industry, the Korea Chamber of Commerce and Industry forecasted next year’s outlook as ‘cloudy’ (negative), saying, “Frontline industries, including the downturn in construction, which is the industry with the largest demand, will be sluggish.” An industry official explained, “If we are having difficulties in the domestic market, we have to overcome them through exports to India or Southeast Asia, but with China and Japan’s strong offensive, even this is not easy.”

The fact that demand for electrical steel sheets, which domestic steel companies have developed as high-value products, is not increasing as quickly as expected is also cited as a reason why it is difficult to expect performance improvement. The securities industry predicts that the annual operating profit of POSCO Holdings and Hyundai Steel this year will decline by 10% and 20%, respectively, compared to last year. In the end, there is also a gloomy outlook that we have no choice but to hope that the global economic downturn will be resolved immediately.

Min Dong-jun, Professor Emeritus of the Department of Materials Science and Engineering at Yonsei University, said, “If the war in Ukraine ends and demand for the reconstruction industry increases or if China’s real estate market revives, domestic companies may have some breathing room.” He added, “As the industry situation will be difficult next year and there are many international variables, domestic companies will “We must carefully monitor the situation and conduct careful management,” he said.

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.