Customized products aimed at customers raising seed money

Up to 3.9% per annum on 6-month term deposits

A parking account with an annual interest rate of 3.5% is also available.

Maturity dispersion effect for existing high-interest products

“I don’t know what I’ve been doing all this time without using the parking account (remittance deposit/withdrawal account).”

“The interest is so high that I check the balance every day.”

Recently, short-term fund management products such as parking accounts have been attracting attention from investors in the online investment community. This is because the U.S. Federal Reserve (Fed) announced a cut in the base interest rate next year, and financial institutions are releasing high-interest products targeting customers who want to raise seed money.

According to the Korea Federation of Banks announcement on the 20th, as of this day, the interest rate on term deposits with a six-month maturity at the five major commercial banks, including KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup Bank, was 3.70-3.90%. The upper interest rate is higher than that of one-year maturity products (3.70-3.75%).

KB Kookmin Bank’s ‘KB Star Term Deposit’ 6-month maturity product has a maximum interest rate of 3.90% per annum, which is 0.15% points higher than the 1-year maturity product (3.75%). NH Nonghyup Bank’s ‘NH All One e-Deposit’ and Shinhan Bank’s ‘So Convenient Term Deposit’ also have interest rates for products with short maturities that are 0.10% points and 0.05% points higher, respectively. Considering the characteristics of term deposits, where the longer the maturity, the higher the interest rate, this is an unusual phenomenon.

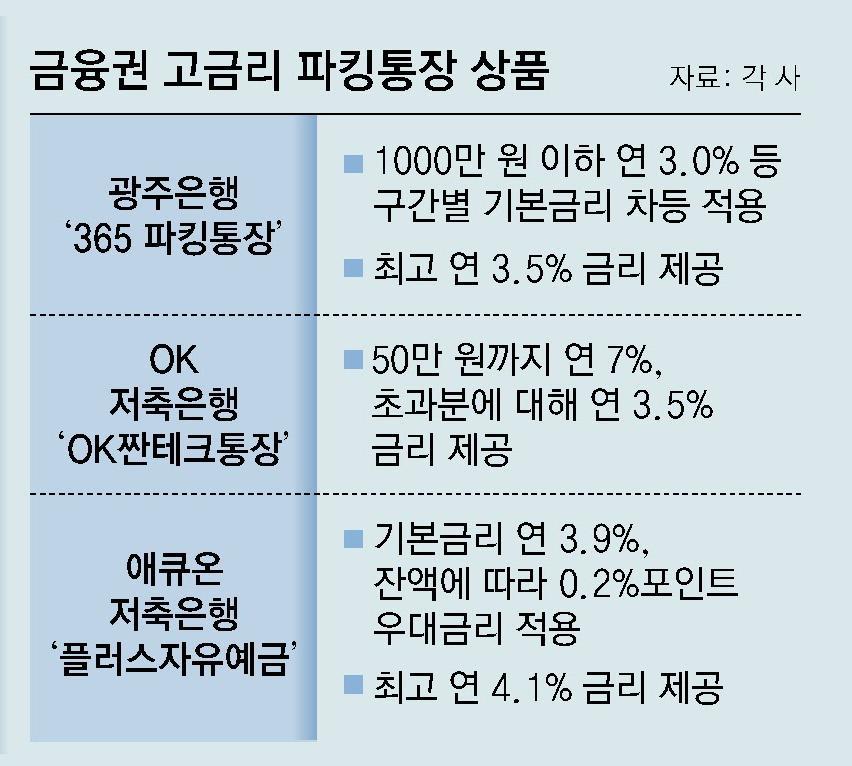

High-interest parking accounts are also being released one after another. Gwangju Bank applied a basic interest rate of 3.00% per annum to amounts under 10 million won on the 4th of this month and a preferential interest rate of 0.50% points per year to accounts with amounts under 10 million won for accounts signed up until December 4th of next year, with a maximum interest rate of 3.50% per annum. Launched ‘365 Parking Account’ that provides interest rates.

The situation is the same for savings banks. Earlier this month, OK Savings Bank launched the ‘OK Chantech Account’, which offers an annual interest rate of 7% up to 500,000 won even if you deposit it for just one day. Last month, Accuon Savings Bank raised the interest rate on its parking account product, ‘Plus Free Deposit,’ to a maximum of 4.10% per annum.

The increase in interest rates on financial products that allow the financial sector to manage funds in the short term is due to the expectation that central banks in major countries will end their tightening policy sooner than expected. On the 13th of this month (local time), the U.S. Federal Reserve hinted at cutting the benchmark interest rate three times next year following the regular meeting of the Federal Open Market Committee (FOMC). This is to absorb demand to raise investment funds in preparation for the stock market rally caused by interest rate cuts.

In fact, as of the end of last month, the balance of term deposits of 6 months or less at the four major commercial banks excluding NH Nonghyup Bank was KRW 52.7738 trillion, an increase of KRW 2.6289 trillion from the end of October (KRW 50.1449 trillion). During the same period, the balance of demand deposits at the five major commercial banks also increased by 578.7 billion won. Demand deposits can be deposited and withdrawn freely and have the characteristics of standby funds.

Some analyzes say that this is the result of a combination of consumers’ demand for short-term funds and financial companies’ risk diversification goals. An official from a commercial bank said, “If the high-interest deposits and savings that were secured during the Legoland incident are reinvested as products with a one-year maturity, the situation where maturities are concentrated in the fourth quarter (October to December) will be repeated next year.” He added, “From the financial company’s perspective, short-term funds “It is necessary to spread out the maturities even by providing more interest rates,” he explained.

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.