US follows export restrictions on advanced semiconductors to China

“Survey of supply and demand conditions” targeting older semiconductors

China counterattacks ban on export of rare earth processing technology

Intensifying hegemony conflict, watching the impact of Korean companies

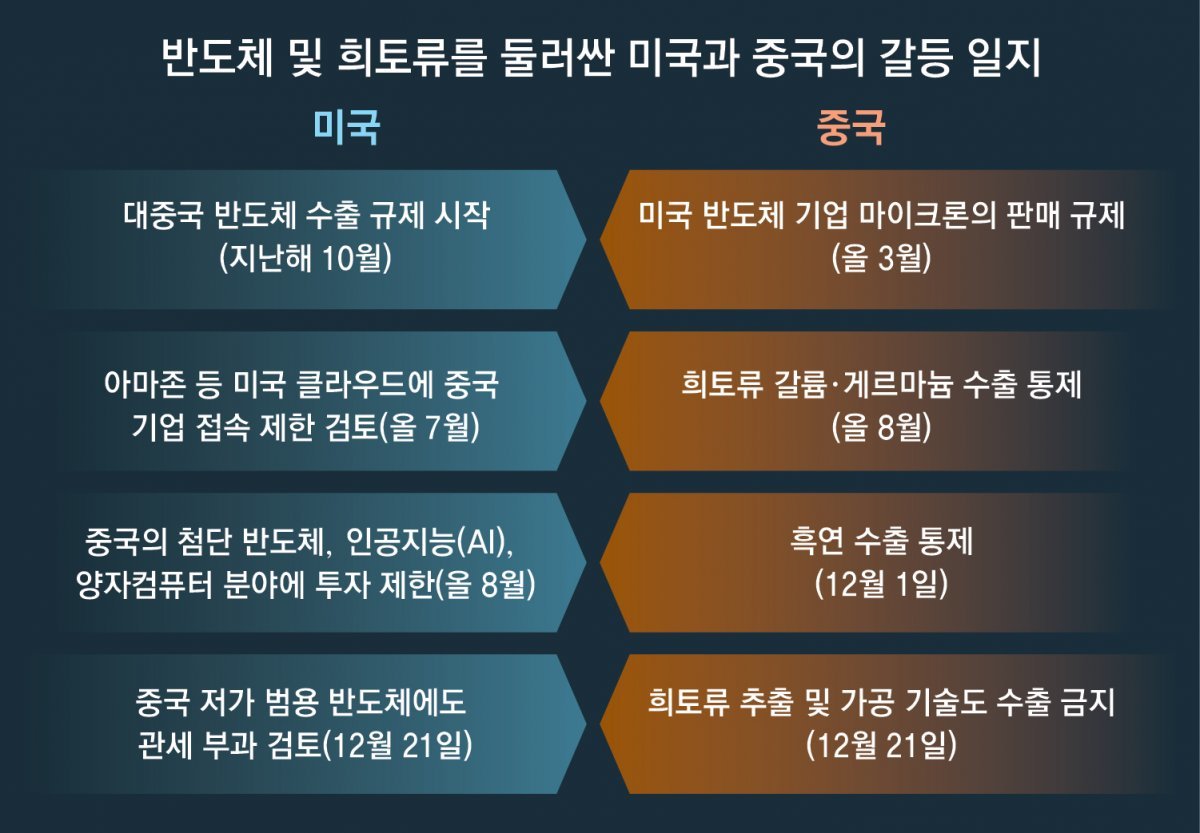

The hegemonic conflict between the United States and China over the supply chain of semiconductors and key minerals and rare earths is intensifying. When the United States, which has been regulating the export of state-of-the-art semiconductors to China since October of last year, announced on the 21st (local time) its intention to regulate even low-cost general-purpose semiconductors made in China, China also ‘fought back’ by saying it would ban the export of processing technology for rare earth elements, a strategic material. I put it. Korean semiconductor companies operating in both the U.S. and China also seem unable to avoid the fallout in any way.

The U.S. Department of Commerce said on this day, “Starting next month, we will begin an investigation to determine how U.S. companies procure general-purpose semiconductors.” revealed. Secretary of Commerce Gina Lermondo also said, “We have seen worrisome signs that China is expanding its production of general-purpose semiconductors, preventing U.S. companies from competing in the market,” and added, “We are concerned about foreign government non-compliance that threatens the U.S. general-purpose semiconductor supply chain.” “Tackling market behavior is a matter of national security,” he emphasized.

China increased its market share by focusing on the older general-purpose semiconductor market as the U.S.’s advanced semiconductor regulations blocked the way to enter the market. Accordingly, an official of the Joe Biden administration also told Bloomberg News that U.S. sanctions on general-purpose semiconductors “may include tariffs or other trade measures.” This is interpreted as an attempt to reduce dependence on China by significantly raising tariffs on Chinese general-purpose semiconductors imported by U.S. companies.

On the same day, China’s Ministry of Commerce and Ministry of Science and Technology announced a revised version of the ‘China Export Ban and Restriction List’, which restricts the export of rare earth manufacturing and refining technology. According to the International Energy Agency (IEA), China accounted for about 60% of the world’s rare earth production and about 90% of the rare earth processing and refining industry. This measure is expected to take a particular hit on the supply and processing of rare earth elements used in electric vehicles, medical devices, and weapons. When the U.S. survey of general-purpose semiconductors begins, Korean companies that have entered the U.S. market are also likely to be included in the survey. An official from the Ministry of Trade, Industry and Energy said, “The specific scope and plan of the investigation have not yet been determined, but we will cooperate with the U.S. government considering the impact on our companies.”

| general purpose semiconductor |

| Low-performance semiconductors produced using old equipment. It usually refers to a semiconductor larger than 28nm (nanometer, 1nm is 1 billionth of a meter). Although it has a slower processing speed than the latest semiconductors of 10 nanometer level or lower, it accounts for most of the world’s demand. |

Intensifying hegemony conflict between the US and China

U.S.: “China cannot distort the semiconductor market”… Survey on supply and demand conditions in the general-purpose semiconductor supply chain

China “US abuses export controls and discriminates against companies from other countries”… Control of rare earth minerals and even processing technology

The U.S. Joe Biden administration has drawn its sword against low-cost general-purpose semiconductors made in China. China, which has been blocked from entering the state-of-the-art semiconductor market due to U.S. regulations that began in October of last year, is actively fostering its domestic general-purpose semiconductor market through subsidies and tax benefits, and this cannot be ignored, he said. “We will investigate,” he said. Not only that, he also hinted at the possibility of imposing tariffs on Chinese semiconductors.

China, which has been controlling the export of major mineral resources such as gallium, germanium, and graphite throughout this year, also says it will not sit quietly. China has also banned the export of technologies for processing and refining key mineral resources. According to the U.S. Geological Survey (USGS), from 2018 to 2021, the United States’ dependence on imports of rare earth elements from China amounts to 74%.

Our government and the semiconductor industry are also closely watching the actions of both countries. In particular, the impact is expected to vary depending on which products are specifically included in the general-purpose semiconductors regulated by the United States. As the aftermath of the situation cannot be predicted, it is pointed out that active response at the public-private level is necessary.

The U.S. Department of Commerce announced on the 21st (local time) that it will investigate the general-purpose semiconductor supply chain of 100 companies in major fields such as defense, automobiles, and aerospace starting next month. Commerce Secretary Gina Lemondo said in a CNBC interview, “This investigation is intended to be a preemptive response,” and “We will take all necessary measures to protect American companies through tariffs, export controls, and cooperation with allies.” . He declared a hard-line response, saying, “We cannot allow China’s subsidies to distort the entire semiconductor market.”

A general-purpose semiconductor is a semiconductor manufactured using an old process. In the industry, it usually refers to a semiconductor larger than 28 nanometers (nm·1nm is 1 billionth of a meter). In semiconductors, the narrower the circuit line width, the faster the processing speed and the lower the power consumption. Accordingly, leading semiconductor companies such as Samsung Electronics have recently focused on developing cutting-edge semiconductors below the 10 nanometer level.

However, when looking at overall semiconductor demand, the proportion of general-purpose semiconductors is higher than that of state-of-the-art semiconductors. In particular, the Center for Strategic and International Studies (CSIS), a U.S. think tank, analyzed that 95% of the automotive semiconductor market is general-purpose semiconductors.

Accordingly, China, too, is betting its life and death on the general-purpose semiconductor market, where it is easy to ‘expand sales’, although its symbolism as a ‘leading semiconductor country’ is low. It is reported that authorities are preparing a semiconductor support plan worth at least 1 trillion yuan (approximately 182 trillion won), most of which will be invested in general-purpose semiconductors. Chinese semiconductor companies such as SMIC also decided to build 26 new factories in the general-purpose semiconductor field by 2026.

According to US market research firm Trend Force, China’s share of the global general-purpose semiconductor market is expected to increase from the current 29% to 33% in 2027. This is why Minister Lemondo criticized China, saying, “China is producing subsidized (general-purpose) semiconductors so that American companies cannot produce (the corresponding) semiconductors.”

China’s Ministry of Commerce and Ministry of Science and Technology also posted on their websites on the 21st that they are banning the export of technologies such as extraction, refining, and processing of rare earth elements.

Rare earth elements, known as the ‘rice of high-tech industry,’ are 17 rare minerals used in cutting-edge products such as automobiles, medical devices, and weapons. As the United States’ semiconductor regulations were strengthened, China responded in August this year by imposing export controls on gallium and germanium, key materials for semiconductor production. From the 1st of this month, exports of graphite, a key material for secondary battery anode materials, were also regulated.

Meanwhile, it has now been decided to ban rare earth processing technology. When asked about this on the 22nd, Chinese Foreign Ministry spokesperson Wang Wenbin (王文斌) claimed, “This is a routine measure to adapt to technological developments.”

There was opposition to the survey on the status of general-purpose semiconductors in the United States. The Chinese Embassy in the United States said, “The United States is abusing export control measures to provide discriminatory and unfair treatment to foreign companies.”

The domestic industry is closely watching the direction of the situation. Samsung Electronics focuses on cutting-edge semiconductor processes below 7 nm, but also has some general-purpose semiconductor processes. An industry official said, “General-purpose semiconductors have a very wide and diverse range of uses, so the U.S. investigation itself will not be easy,” and added, “We are watching to see whether it will end up being for the purpose of identifying the supply chain, or if regulatory measures will be taken, even if only on a limited basis.”

Washington =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.