As the U.S. Federal Reserve (Fed) decides on the policy interest rate two days later, attention is being paid to whether it will ignite the ‘March interest rate cut rumor’ or, conversely, extinguish it. The likelihood of a U.S. interest rate cut in March, as evaluated by the global financial market, is fluctuating around the 50% level.

If the Federal Reserve signals a rate cut in March, the Bank of Korea will be freer from the uncertainty of U.S. monetary policy. However, the Bank of Korea has recently clearly shown caution against a ‘premature interest rate cut’, so even in this case, it is expected to be difficult to estimate the timing of the Bank of Korea’s rate cut for the time being.

According to the global financial market on the 30th, the Federal Open Market Committee (FOMC), the Federal Reserve’s monetary policy meeting, will be held on the 30th and 31st local time. The FOMC results announcement and Chairman Jerome Powell’s press conference are scheduled for early morning on the 1st of next month, Korean time.

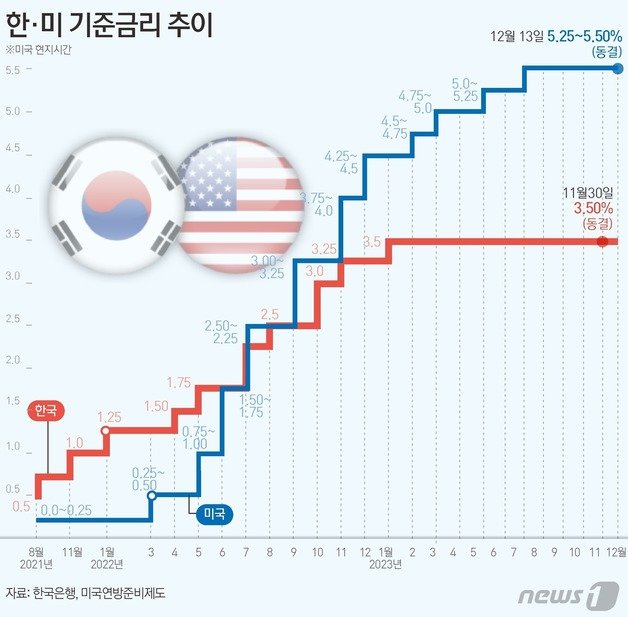

There is no disagreement with the observation that the US policy interest rate will be frozen at 5.25-5.50% this time. The key is what message Chairman Powell will give at the press conference regarding the expected path of future interest rates.

In particular, it is important to mention the possibility of an interest rate cut in March or to revise the wording of the statement. Since Chairman Powell announced at the FOMC in December of last year that “there was discussion of an interest rate cut,” the market has been inflating expectations that the Federal Reserve will begin an early cut in March.

News 1

News 1Of course, in the new year, the US economic growth rate and inflation rate were confirmed to be higher than expected, so the heightened expectations at the end of the year subsided slightly. As of the previous evening, the federal funds rate futures market reflected a 50.5% chance that the Federal Reserve’s policy interest rate would be lowered by one level to 5.00-5.25% in March. The March cut forecast, which had reached 73.4% a month ago, quickly retreated.

However, if Chairman Powell makes more comments this time that are closer to the dovish (preferring to ease monetary policy) compared to the hawk (preferring to tighten monetary policy), the market’s expectations of a rate cut may rise again.

On the other hand, if Chairman Powell calms market expectations and pursues a balance by making fundamental comments about the direction of monetary policy, expectations for an early rate cut will be pushed back to May or June.

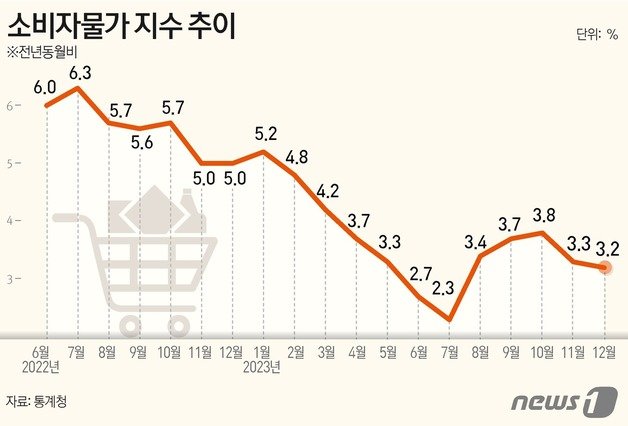

First of all, experts believe that there is a high possibility of leaning towards the latter. This is because prices are still at a level where it is not certain that the 2% target will be achieved (CPI increase rate 3.4%, PCE 2.9% in December last year).

Ji-na Kim, a researcher at Eugene Investment & Securities, predicted, “Chairman Powell will focus on delaying expectations of a cut,” and added, “The possibility of an interest rate tantrum is low, but it is expected to be difficult to stop the upward trend in interest rates.” Researcher Kim added, “Expectations for an early cut in March will mostly disappear, and the market will re-reflect expectations for a cut in May or June.”

Lim Jae-gyun, a researcher at KB Securities, predicted, “The Fed will have to revise the statement’s wording in order to make cuts in March, but the wording will be maintained this time.” Researcher Lim said, “If the phrase is deleted, expectations of a cut will become stronger, increasing the risk of stimulating demand.” Chairman Powell acknowledged the slowdown in prices and the possibility of a cut this year, but said that the possibility of a cut currently reflected in the market is excessive, thereby pushing back expectations. “We will work hard to achieve this,” he explained.

The Federal Reserve’s attitude, which will be confirmed the day after tomorrow, will also affect the Bank of Korea’s decision on the base interest rate.

Last year, the Bank of Korea announced that with the end of the Federal Reserve’s rapid interest rate hikes, it became possible to make monetary policy decisions more independently from the United States. However, as the policy interest rate reversal between Korea and the United States continues with a gap of 2 percentage points, the largest ever, it is difficult to imagine a rate cut before the United States.

Most experts predict that the Bank of Korea will lower interest rates as the timing of the U.S. rate cut becomes visible throughout the year, or that the U.S. will lower interest rates first and the Bank of Korea will follow suit. It will be a different story if a major incident that shakes financial stability occurs before then, but for now, I think there is little chance of a preemptive cut.

The first plenary session of the Monetary Policy Committee of the new year was held at the Bank of Korea this month. News 1

The first plenary session of the Monetary Policy Committee of the new year was held at the Bank of Korea this month. News 1In particular, considering the Bank of Korea’s attitude toward the domestic economic situation, the general opinion is that it is difficult to expect a faster rate cut than in the United States.

First of all, the Bank of Korea is showing strong caution against hasty interest rate cuts because it is unclear when the inflation rate will converge to the stabilization target of 2%. In a report published the day before, the Bank of Korea analyzed past cases of major countries, including Korea, entering a period of price stabilization and emphasized that “re-entry into a period of price stabilization cannot be assured simply by a decline in basic inflation (inflation rate).”

The report said, “Historically, cases of failure to enter a period of price stabilization were often due to carelessness about last mile risks,” and “the base effect that follows a price shock technically was mistaken for entry into a period of price stabilization.” “It was a case where the policy authorities hastily switched to an easing stance,” he said.

At the same time, he argued, “We need to be patient and continue our efforts to comprehensively analyze and judge so as not to place excessive significance on the temporary positive signals of some price indicators.”

News 1

News 1In other words, if the Federal Reserve shows an easing stance the day after tomorrow, conditions will be created for the Bank of Korea to fully focus on domestic prices, but it should be seen that this does not mean the timing of the cut will be brought forward. There is still a situation where we need to be “patient” and check the price indicators in the future.

On the other hand, if the Federal Reserve delays the market’s expectations of a cut, we must continue to pay close attention not only to domestic prices but also to when the direction of U.S. monetary policy will change. In addition to domestic prices, U.S. monetary policy also acts as an uncertainty, so it is highly likely that the interest rate freeze will remain in place.

Of course, even if the March cut rumor recedes, it is pushed back by expectations of a May-June cut. This is why this FOMC is evaluated as not a variable that will fundamentally change the situation surrounding Korea’s monetary policy.

Lee Jeong-hoon, a researcher at Eugene Investment & Securities, said, “Even if a cut in March is difficult, expectations for a cut in the second quarter are valid,” adding, “We are not concerned about further tightening by the Federal Reserve or prolonged high interest rates like last year. “As the upward movement of interest rates and exchange rates is limited, a good environment (in the financial market) will be maintained,” he predicted.

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.