Raising the level higher than 25% in the first period

He also revealed his intention to abolish most-favored-nation treatment in trade.

De-risking → decoupling trend likely to change

Goldman Sachs: “Chinese investors are concerned about a return to power”

Former U.S. President Donald Trump announced his intention to impose ultra-high tariffs of more than 60% on Chinese products if he wins the November presidential election. He foreshadowed a much stronger protectionist trade policy than during his first term in office, when he imposed a 25% tariff on Chinese products under the ‘America First’ policy. It is five times the current average tariff of 12% between the United States and China, as calculated by Bloomberg News.

As the possibility of former President Trump coming back to power increases, the ‘Trump effect’, in which the global financial market fluctuates whenever he makes a statement related to trade policy, is already becoming visible. However, former President Trump distanced himself from the possibility of a ‘second US-China trade war’, leaving room for negotiations with China when he returns to power.

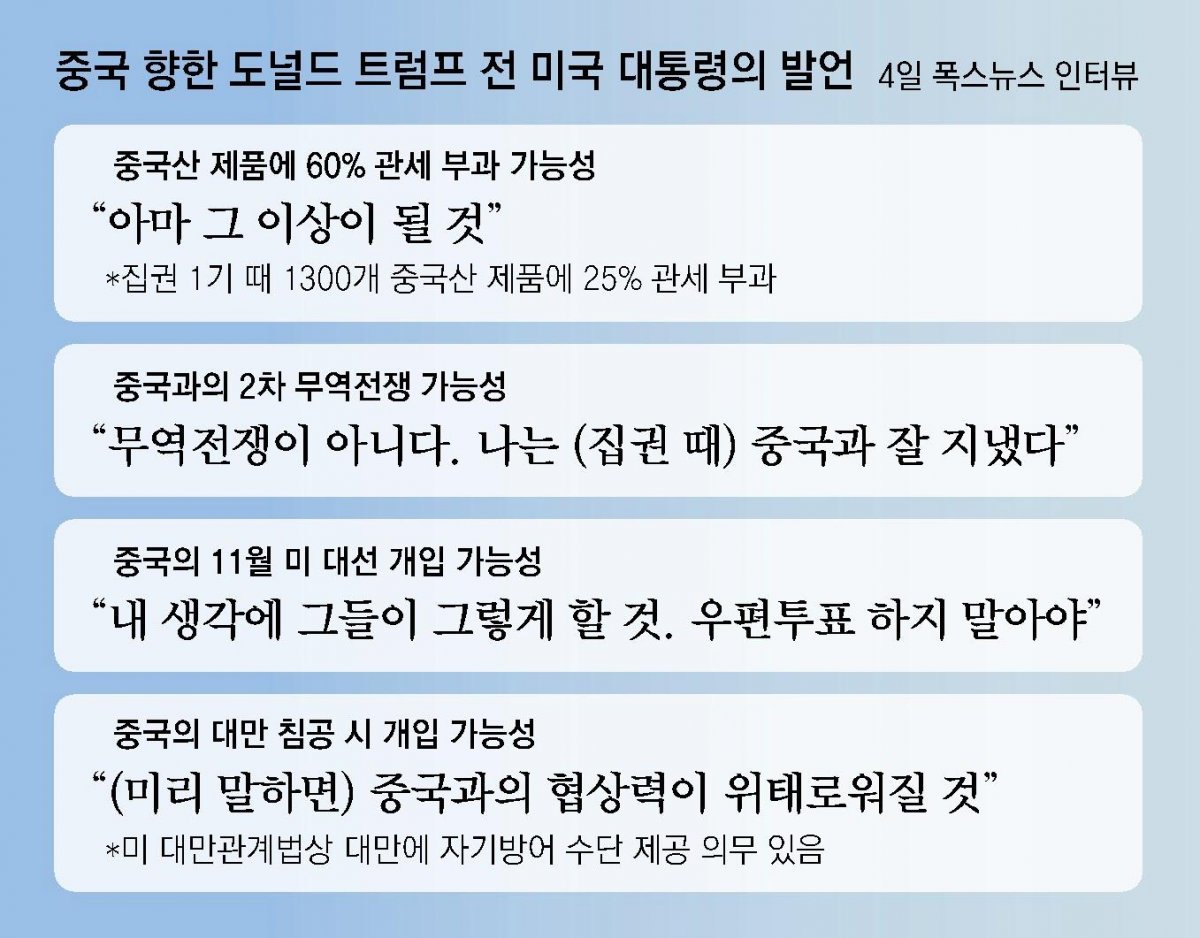

In a Fox News interview on the 4th (local time), former President Trump was asked whether he would consider imposing a 60% tariff on China when he returns to power, and answered, “No.” “It’s probably more than that.” When asked whether he would impose both tariffs and sanctions on China, he said, “We have to do that. “China took advantage of the United States,” he claimed.

Previously, the Washington Post reported that former President Trump was considering imposing a 60% tariff on Chinese products. If they come back to power this time, they plan to abolish the Most Favored Nation (MFN) treatment for China and impose ‘Column II’ tariffs on enemy countries with an average tariff rate of 40%. The plan is to raise the tariff rate on Chinese products to at least 60% by adding a ‘universal basic tariff’ that imposes an additional tariff of up to 10 percentage points on top of the current tariff on all foreign products.

In 2018 and 2019, when former President Trump was in power, he applied Article 301 of the Trade Act and imposed a high tariff of 25% on Chinese products. He argued that the reason was not because of his unilateral protectionist trade policy, but because China did not honor its trade agreement with the United States. He also claimed that “China tried to destroy the American steel industry.”

If the 60% tariff plan becomes a reality, the current ‘derisking’ policy, in which the US and China are confronting each other militarily but seeking some level of cooperation economically, will change to ‘decoupling’. Change seems inevitable.

Due to the intensifying conflict between the two countries, China’s exports to the United States last year had already decreased by 13.1% compared to the previous year. In this situation, raising the tariff rate fivefold is expected to inflict a major blow to the U.S. economy. The Tax Foundation, a U.S. think tank, expressed concern that without relatively cheap Chinese imports, an increase in U.S. consumer prices would be inevitable, resulting in annual costs of $1.5 trillion (approximately 2,006 trillion won).

Former President Trump claimed on this day, “China does not want me to be president.” He also said that when he won both the Iowa and New Hampshire Republican presidential primaries last month, “the Chinese stock market went down like crazy.”

In fact, after his remarks that day became known, many investors in the global financial market were betting on the strength of the U.S. dollar, a safe asset. U.S. investment bank Goldman Sachs also released a report stating that Chinese investors cited the possibility of former President Trump coming back to power as a major investment risk along with the economic slowdown, falling stock prices, and real estate market slump. He added, “The most asked question by Chinese investors is the impact on China if he returns to power.”

However, former President Trump maintained an ambiguous attitude, avoiding immediate answers on questions such as the possibility of a trade war with China and whether the United States would intervene militaryly in the event of China’s invasion of Taiwan. He said, “I like Chinese President Xi Jinping. “He was a good friend during my term.” He said, “I will not talk about support for Taiwan because it could weaken our ability to negotiate with China.” This leaves room for negotiation on issues where the interests of the two countries clash sharply.

Washington =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.