Credit downgrade, US NYCB stock price plunges again

Powell: “This is not a sign of a financial crisis.”

“Some banks will close and this will be a problem for years.”

WSJ “Overseas banks are more vulnerable than U.S. banks”

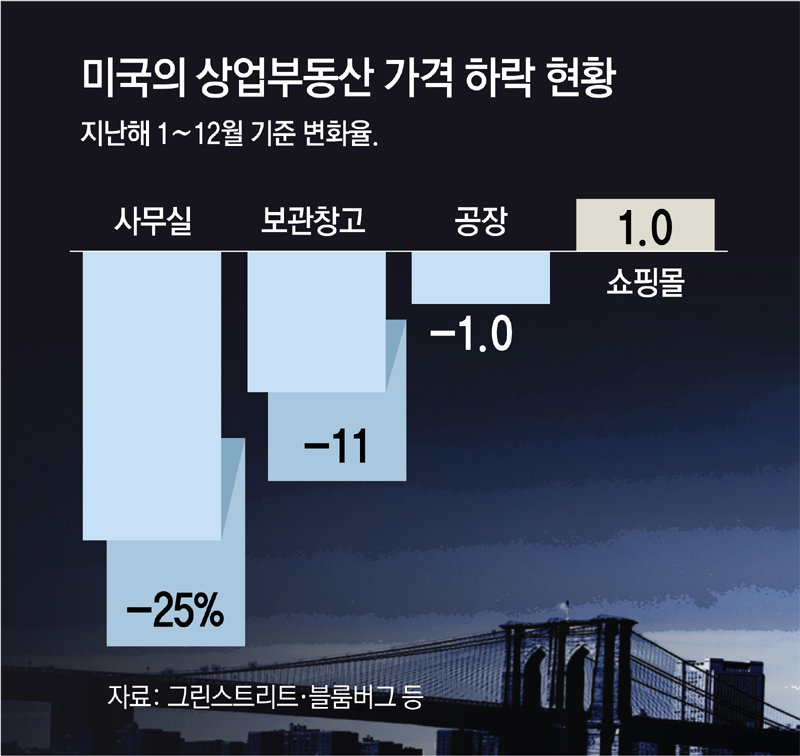

Concerns about the expansion of non-performing loans in U.S. commercial real estate, which have emerged since the beginning of the year, have not subsided. The U.S. business community predicts that “it will not spread into a global crisis like the 2008 financial crisis,” but anxiety is growing as the stock price of New York Community Bancorp (NYCB), a regional bank in New York, has fallen sharply again.

On the 5th (local time), NYCB stock price fell 10.6% compared to the previous trading day. It also fell on the 31st (37.6%) and 1st (11.1%) of last month. It seemed to stabilize for a while, rising to the 5% range on the 2nd, but it fell again after the weekend. Over the past five days, NYCB stock price has fallen 48.2%.

NYCB’s decline on this day was largely influenced by the credit rating downgrade by credit rating agency Fitch after the market closed on the 2nd. In addition, there is an analysis that the fear of ‘bank insolvency’ has grown further as expectations of an interest rate cut by the US central bank, the Federal Reserve (Fed), have been dashed. The commercial real estate crisis concentrated in large U.S. cities is also related to large banks in major overseas countries. Analysis suggests that the possibility that it may spread into a long-term negative impact on the global economy cannot be ruled out.

On the 2nd, Fitch lowered NYCB’s credit rating from ‘BBB’ to ‘BBB-‘. “We reflected the contents of last year’s fourth quarter (October to December) performance report, which included specific measures regarding losses related to two commercial real estate loans and an increase in loan loss reserves,” he explained.

The future outlook was also gloomy. Fitch was concerned that changes in work methods in the office sector would create greater uncertainty compared to the persistent low interest rate environment prior to COVID-19, increasing the risk of write-offs.

The prevailing view in the United States is that this incident will not lead to a systemic crisis like the 2008 global financial crisis. However, there is a possibility that it will act as uncertainty for a considerable period of time and put a burden on the economy.

In a CBS interview, Federal Reserve Chairman Jerome Powell said, “I don’t think this is a precursor to a global financial crisis,” but pointed out, “It will be a significant problem for several years.” Large banks are able to manage their own risks, but he is particularly concerned about the situation of small and medium-sized regional banks with many commercial real estate loans, predicting that “some banks will close or be acquired by other banks.”

Most experts believe that the real estate sector default experienced by NYCB is different from the liquidity crisis that quickly leads to a series of bankruptcies. However, he warns that it can appear ‘slowly’, ‘in unexpected places’, and ‘continuously’. This is because the loan maturity time is different for each property and the degree of exposure is different for each bank. The volume of U.S. commercial real estate loans maturing by the end of 2027 amounts to $2.2 trillion (approximately 2,907 trillion won).

Howard Lutnick, billionaire and CEO of financial services company Cantor Fitzgerald, said in a recent Fox News interview, “There will be a very ugly picture, with hundreds of trillions of won worth of debt defaults occurring over the next two years.” “He warned. Rick Ryder, Chief Financial Officer (CIO) of Blackrock, also said in a Bloomberg TV interview, “Even if it is not a systemic crisis, NYCB will not be the last bank to run into trouble with commercial real estate.”

The Wall Street Journal (WSJ) warned that not only local U.S. banks but also famous banks in major countries, such as Japan’s Aozora Bank, cannot be free from the U.S. commercial real estate crisis. In fact, Aozora Bank owned a significant portion of commercial real estate in large U.S. cities such as Los Angeles and Chicago, but its stock price was recently cut in half. There is a possibility that banks in other countries may also be facing a similar crisis.

However, analysis suggests that some regional banks that do not own a high proportion of real estate in large cities are relatively free from risk. Zions Bank Corporation, a regional bank headquartered in Salt Lake City, western Utah, said that most of the properties with loans were located in suburban areas, not large cities, and that it had no loan loss provisions.

New York =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.