[글로벌 상업부동산 위기]

Global commercial real estate prices plummet

US loan maturity of 1,236 trillion this year, red flag

Korean financial companies are also concerned about investment losses… The risk exposure of the four major financial holding companies is 16 trillion won.

The person in charge of overseas alternative investment at a domestic commercial bank is suffering from the plummeting prices of U.S. commercial real estate. Although the safest priority loan was made in the Manhattan area of New York, the heart of the United States, the possibility of large-scale losses increased as asset prices plummeted. The possibility of loss on senior loans for overseas real estate means that asset prices have plummeted by more than 60%. Bank A’s real estate investment assets in the United States, including this loan, amount to 1 trillion won.

As the overseas commercial real estate crisis spreads, it is causing a storm in the domestic financial world. The possibility of large-scale losses is emerging for domestic financial companies that have invested tens of trillions of won in related assets, and individual investors who subscribe to overseas real estate public offering funds are also facing concerns about a ‘second stock-linked securities (ELS) crisis’ as their losses grow like a snowball. there is.

According to the American Mortgage Bankers Association (MBA) on the 12th (local time), $929 billion (approximately KRW 1,236 trillion), or nearly 20% of the U.S. commercial and multi-family housing real estate loan balance ($4.7 trillion), will mature within the year. Some predict that U.S. commercial real estate prices could fall by up to 15% this year, leading to further insolvency. Billionaire investor Barry Sternlicht, CEO of Starwood Capital, also recently warned that “more than $1 trillion in losses will occur in the commercial real estate market in the future.”

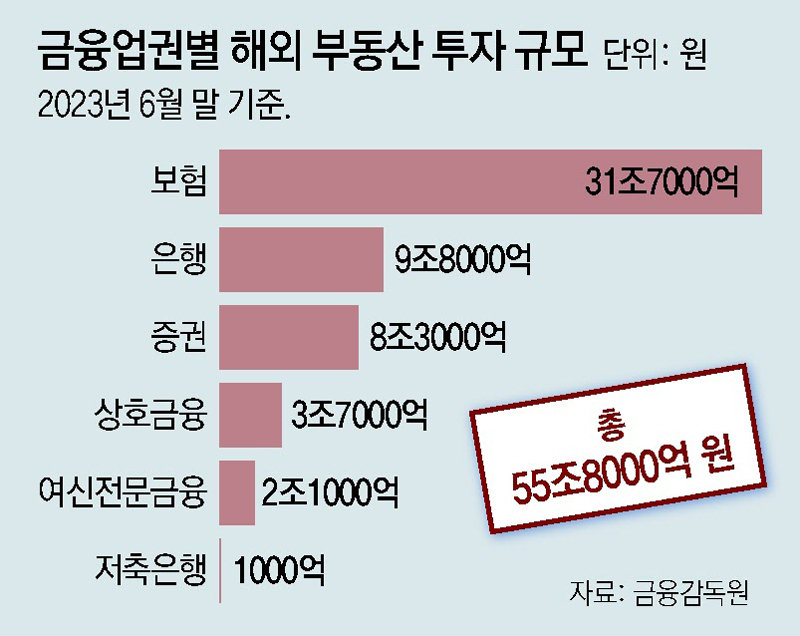

The effects of insolvency are also reaching domestic financial companies. As of the end of June last year, domestic financial companies’ overseas commercial real estate investments amounted to 55.8 trillion won, of which 25%, or 14 trillion won, will mature this year. The amount held by commercial banks is also significant. According to the Financial Supervisory Service, as of the end of last year, the overseas commercial real estate exposure (risk exposure) of Korea’s four largest financial holding companies amounted to 16.5 trillion won. Last year, the four major financial holding companies accumulated loan loss provisions of about 9 trillion won, the largest ever, but with overseas real estate loan losses expected recently, they are expected to need to accumulate more provisions this year. Dong-Hyeon Ahn, a professor of economics at Seoul National University, said, “It is necessary to distinguish between the good and the bad about overseas real estate assets,” and added, “Investment institutions must coordinate with each other to quickly liquidate non-performing assets and take measures such as making additional investments in high-quality assets.”

Personal investment worth 410.4 billion won out of 436.5 billion won due this year

The Japanese building investment fund has a rate of return of -82%.

As overseas real estate values plummet, the losses of individual investors who invested in overseas real estate public offering funds are also snowballing.

As of the 13th, the cumulative rate of return since the fund establishment of ‘Aegis Global Real Estate Investment Trust No. 229’, which invested in the Trianon Building in Frankfurt, Germany, amounts to -81.89%. ‘Korea Investment New York Office Real Estate Investment Trust No. 1’ (-30.91%) and ‘Korea Investment Belgian Core Office Real Estate Investment Trust No. 2’ (-15.96%), which invested in buildings in New York, USA and Brussels, Belgium, are also suffering losses.

The possibility of loss is also increasing as real estate prices fall in areas such as the Sapporo Hotel in Japan and the NASA headquarters building in Japan, which Hana Alternative Investment Asset Management invested in through a public offering fund. Mirae Asset Global Investments also sold an office building in Dallas, Texas, which it acquired through a public offering fund, at a price that was about 20% lower than the purchase price in October last year.

Overseas real estate public offering funds maturing this year total KRW 436.5 billion, of which KRW 410.4 billion was invested by individuals. The number of investors exceeds 10,000. If the maturity extension fails, large losses are expected. Some are warning that overseas real estate public offering funds could cause a ‘second Hong Kong ELS incident.’

The problem of overseas commercial real estate insolvency is suffocating financial companies around the world. New York Community Bancorp (NYCB), a regional U.S. bank that financed U.S. commercial real estate, faced a loss of $260 million (approximately 350 billion won) in the fourth quarter of last year (October to December) alone. Germany’s Deutsche Bank increased its loss provisions related to global real estate investments in the fourth quarter of last year to 4.7 times compared to the previous year. Aozora Bank, a small and medium-sized Japanese bank, also recorded its first loss in 15 years due to provisions related to commercial real estate loans.

Due to the downward trend in commercial real estate prices, the insolvency crisis of global financial companies is expected to spread further. Green Street, an American data analysis company, said, “The assessed value of commercial real estate is still too high,” and predicted, “Commercial real estate values could fall by up to 15% further this year.”

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.