[글로벌 상업부동산 위기]

Commercial real estate crisis New York on-site reportage

Working from home has become routine, office workers do not come back

As the vacancy rate rises, building prices halve… “US office value evaporates by $1.2 trillion”

An 8-story building located on 32nd Street in the center of Manhattan, New York, USA on the 8th (local time). The space where the 99 Cent Shop, a discount store loved by New Yorkers for over 30 years, once stood was empty. When I went up to the third floor, there were design drawings piled up on one desk, and divisions were drawn on the floor. The empty office on the 5th floor was also filled with desks and chairs.

“It used to be a building filled with hospitals, law firms, and corporate offices. But through the pandemic, it has been empty for three or four years. “Now it will be residential apartments.”

Tony Park, CEO of PD Properties, a real estate company we met at the site, said, “Now we can’t make a profit with an office,” and added, “We are building eight one-bedroom apartments on one floor of about 5,000 ft² (about 465 ㎡). “There is,” he said.

New York, USA, which led the ‘skyscraper era’, is becoming the epicenter of a crisis that can shake banks not only in the United States but also around the world due to a slump in commercial real estate. While New York Community Bancorp (NYCB), a local bank in New York, has already been rated as unsuitable for investment by credit rating agencies due to the risk of non-performing commercial real estate loans, the specific name of the bank is being discussed as to who will be the next hitter.

The exterior of this office building. This building, which once housed law firms and hospitals, was sold last year for $37 million (about 49.2 billion won), half the price before the pandemic. New York =

The exterior of this office building. This building, which once housed law firms and hospitals, was sold last year for $37 million (about 49.2 billion won), half the price before the pandemic. New York = The 32nd Street Building in front of Penn Station, New York’s central train station, was built in 1920, but was crowded with people for over 40 years after being renovated in the 1980s. At its peak, the rental income per floor was about $25,000 (approximately 33.21 million won) per month. CEO Park said, “When we made a purchase offer before the novel coronavirus infection (Corona 19), the building owner did not respond even if we offered $80 million.”

But after the pandemic, the situation has changed 180 degrees. This is because people stopped visiting due to the shift to working from home. In the beginning, I just held on and hoped that the pandemic would end. However, even after taking off the masks, office workers did not return. The ‘new normal’ era of working from home and working at the office has arrived.

The US Federal Reserve’s (Fed) intensive tightening policy was another variable. The price of this building fell to $50 million in February last year as the loan interest became too high. After the commercial real estate crisis broke out in March of the same year, it was eventually sold for $37 million. It was cut in half in just four years.

The lending bank for this building is Signature Bank, which went bankrupt last year. NYCB, which acquired Signature Bank, also saw its stock price plunge by 54% this year due to recent concerns about non-performing commercial real estate loans. The credit rating has also been downgraded to ‘speculative grade’.

The real estate decline is not limited to the 32nd Street building. Recently, it was diagnosed that 30 offices in the Empire State Building are empty across New York City. The ‘Flat Iron’ building, one of New York’s iconic buildings, is currently under construction to be converted into residential apartments after being vacant for four years.

An official from a New York real estate investment company said, “Educational institutions, hospitals, and law firms that are currently in the building will either drastically reduce their space or move to a newly built luxury building with lower rent once the contract is over.” He added, “It is fortunate that the building was successfully converted to apartment use.” “This is not easy due to regulations, so it is only a matter of time before old buildings collapse under the burden of loans,” he said.

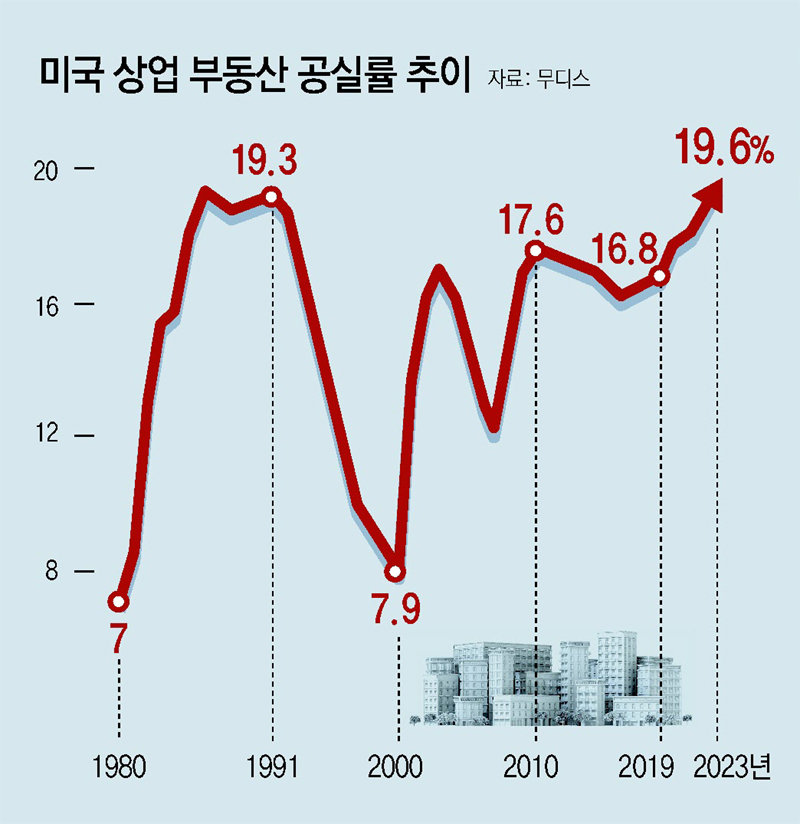

Experts warn that the ‘era of skyscrapers’, a symbol of New York’s prosperity in the 20th century, is at a turning point, and that an unexpected crisis may arise in the process. According to Moody’s, the vacancy rate for commercial real estate across the United States in the fourth quarter of last year (October to December) was 19.6%, the highest since the survey began in 1979. Barry Sternricht, CEO of Starwood Capital Group, said at a recent conference, “The office is going through an existential crisis,” and expressed concern, “The value of U.S. office assets has fallen by $1.2 trillion, and no one knows where this loss has gone.” .

Dana Peterson, Chief Economist at the Conference Board, also said at a recent foreign press conference, “Last year’s banking crisis ended with the intervention of the authorities after the serial bankruptcy of three banks, but if 20 banks experience crises simultaneously, it will be a huge challenge.” He predicted, “In particular, U.S. commercial real estate could spread to overseas banks such as Europe or Japan that have invested in it, causing serious problems.”

New York =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.