LG Ensol had a 27.8% non-Chinese market share last year.

China’s CATL increased by 4.7% in one year to 27.5%

The three Korean companies’ reduced market share is taken over by Chinese companies.

Take control with cost-effectiveness… EU investigates market disruption

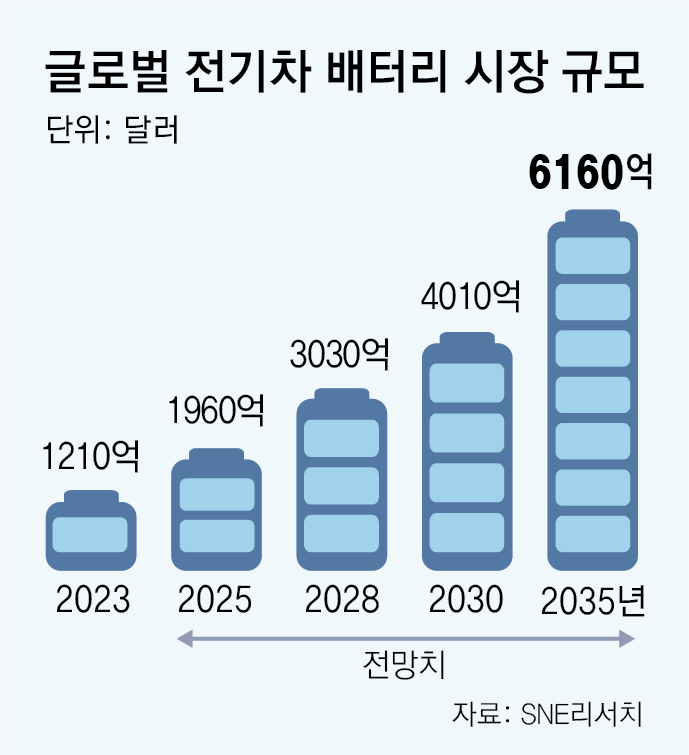

Chinese battery companies that have grown based on the domestic market are breaking out of their home market and increasing their dominance in the global market. CATL is threatening its No. 1 position in the global electric vehicle battery market excluding China, narrowing the market share gap with LG Energy Solution to 0.3 percentage points. BYD, which beat Tesla and ranked first in electric vehicle sales last year, is making rapid progress by taking advantage of its vertical business structure that extends from batteries to finished vehicles.

On the 13th, SNE Research announced that global electric vehicle battery usage excluding China last year was 319.4GWh (gigawatt hours), a 43.2% increase compared to the previous year. LG Energy Solution, the world’s No. 1 company in the non-Chinese market, had a market share of 27.8%, down 2.1 percentage points from the previous year. The combined market share of the three companies, including SK On and Samsung SDI, decreased by 5.2 percentage points to 48.7%. Japan’s Panasonic’s market share also fell from 15.8% to 14.0% during the same period.

It was Chinese companies that took the reduced market share. CATL’s market share in the global battery market excluding China was 27.5% last year, up 4.7 percentage points from 22.8% in 2022. The gap with LG Energy Solution was drastically reduced from 7.1 percentage points to 0.3 percentage points in 2022.

CATL performed well in Europe with its cost-effectiveness in NCM batteries, which the Korean battery industry focuses on. The company has secured a stable supply chain for lithium hydroxide and precursors through subsidiaries and equity investments, and has invested in research and development (R&D) while reflecting the costs saved in this process in product prices. It is reported that the technology gap with Korean three-way batteries has also been reduced to two years. In December 2022, CATL began production of next-generation lithium iron phosphate (LFP) batteries, which are cheaper, have increased driving range, and enable fast charging at its first overseas plant, its plant in Thuringia, Germany, and plans to complete its plant in Hungary next year. .

BYD’s market share outside of China also increased significantly from 0.6% to 2.1%. BYD’s biggest advantage is its vertical structure that produces everything from battery cells to electric vehicle management systems (BMS). As its influence in the global automobile market grows, battery sales also increase. In the past, BYD was called a ‘counterfeit BMW’ due to its poor engine and design, but last year it sold 3.02 million electric vehicles and surpassed Tesla to become the number one electric vehicle.

The New York Times (NYT) analyzed on the 12th (local time) that BYD succeeded in two bets and became a ‘Tesla killer.’ In 2016, Audi designer Wolfgang Egger was hired to change the overall design of the product, and in 2020, the ‘Blade Battery’ was launched. Blade batteries are LFP batteries manufactured using the ‘cell-to-pack’ method, in which cells are manufactured into a long, flat shape like a blade, skipping the module, and placing the cells in a pack. By filling the space excluding the module with additional cells, the performance that is inferior to that of a ternary battery has been overcome to some extent.

Experts analyze that Chinese battery companies are growing mainly in the European and Southeast Asian markets even as they are having difficulty entering the U.S. market due to the conflict between the U.S. and China. However, the European Union (EU) has been investigating whether Chinese electric vehicle and battery companies received government subsidies to disrupt market prices since September last year as Chinese companies’ growth grew rapidly.

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.