Expectations for an early interest rate cut have been dashed.

Some say, “It may be postponed until September.”

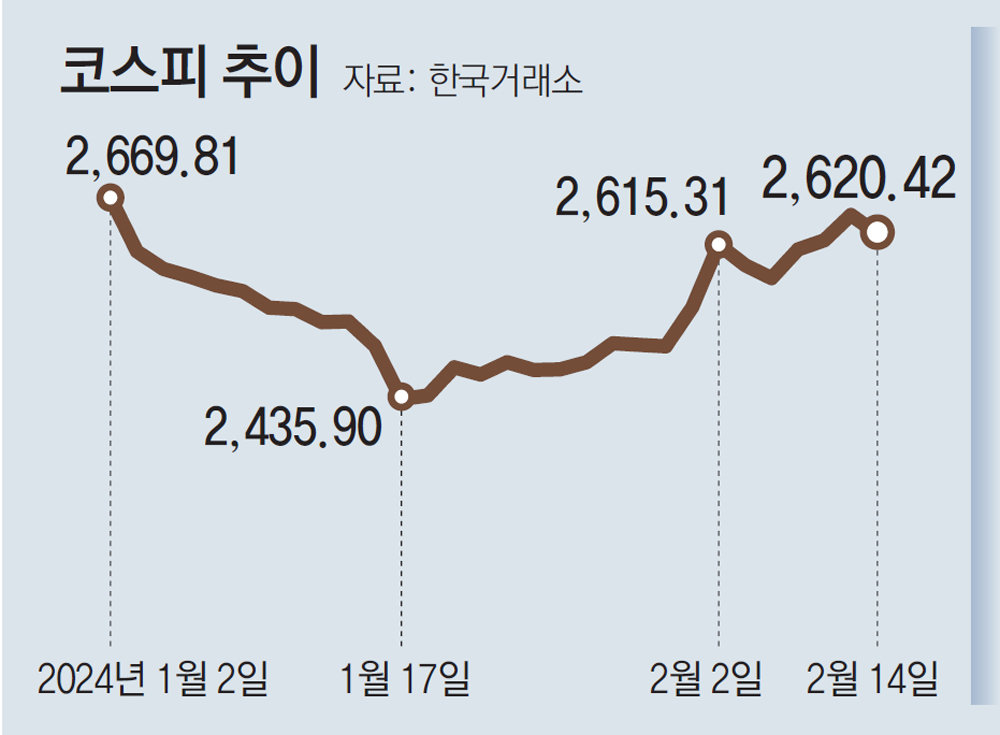

KOSPI, strong this month, fell 1.1% yesterday

The won-dollar exchange rate also closed at 1335.4 won.

As the U.S. inflation rate exceeded expectations, expectations for an early interest rate cut by the Federal Reserve (Fed) were dampened. Wall Street, which initially predicted May of this year as the time for an interest rate cut, is now focusing on a cut in June. Due to concerns about prolonged high interest rates, the domestic stock market fell on the 14th and the won-dollar exchange rate soared.

The U.S. Department of Labor announced on the 13th (local time) that the Consumer Price Index (CPI) in January rose 3.1% compared to the same month last year and 0.3% compared to the previous month. They exceeded market expectations of 2.9% and 0.2%, respectively. Core CPI, excluding highly volatile food and energy prices, also jumped 3.9% compared to the previous year and 0.4% compared to the previous month. This also exceeded market expectations (3.7%, 0.3%). It was analyzed that the recent rise in prices in the United States was driven by housing costs and food prices.

Accordingly, on this day, the Dow Jones Industrial Average closed at 38,272.75, down 1.35% from the previous trading day. The Standard & Poor’s (S&P) 500 index and Nasdaq index both plunged by more than 1%. The decline in the stock market today was interpreted as a result of concerns that if inflation continues, the Fed’s interest rate cut could be delayed, which could have a negative impact on the stock market.

Meanwhile, the outlook for a May interest rate cut has been the trend on Wall Street, but after the CPI announcement today, the possibility of a June interest rate cut seems to be increasing. According to the Chicago Mercantile Exchange’s FedWatch, which predicts future base interest rate levels through futures trading, the probability that the Federal Reserve will lower interest rates in May exceeded 50% as of the 12th, but has fallen to around 40% as of the 14th. Conversely, the probability that the Federal Reserve will freeze interest rates in May increased from about 40% to more than 50% during the same period. Peter Cardillo, chief economist at Spartan Capital Securities, told Reuters, “If inflation stays higher than expected for another month or two, we may miss June (cut) and have to wait until September.” Previously, Federal Reserve Chairman Jerome Powell also emphasized the timing of the interest rate cut, saying, “We can only cut interest rates when we have confidence that prices are falling to 2% sustainably.” This means that if inflation does not show a steady decline enough to satisfy the Federal Reserve, the interest rate cut can be delayed.

The KOSPI, which had been strong this month, was also put on hold due to the price shock in the United States. On the 14th, KOSPI closed trading at 2,620.42, down 1.10% (29.22 points) from the previous trading day. At one point during the day, it fell to 2,601.99, threatening the 2,600 level. In particular, the decline of financial stocks classified as beneficiaries of the ‘Corporate Value Up Program’ was notable. Samsung Fire & Marine Insurance plummeted 7.37%, while KB Financial Group (-3.44%), Hana Financial Group (-3.78%), and Woori Financial Group (-2.50%) also fell.

As the sense of austerity increased, the value of the dollar also soared. On this day, the won-dollar exchange rate in the Seoul foreign exchange market closed at 1335.4 won, up 7.3 won from the previous trading day. The yen-dollar exchange rate also rose to the 150 yen per dollar range (the value of the yen fell) in about three months since November last year.

New York =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.