Nikkei index exceeds 40,000 yen for the first time in history

Semiconductor stocks rise by up to 63% this year… Export companies perform well amid prolonged weak yen

Expectations for a virtuous cycle of rising prices and wages… Negative interest rates could be lifted this month

“Japanese companies’ ability to make money has become stronger. Active investment in growth areas is also supported.”

Japanese Prime Minister Fumio Kishida expressed confidence in his country’s economy and made this assessment at the National Assembly on the 4th. Chief Cabinet Secretary Yoshimasa Hayashi, a spokesperson for the Japanese government, also appeared encouraged by the rise in stock prices, saying on this day, “The Kishida administration aims to completely escape from deflation (falling prices in an economic recession) and create a new growth-type economy.”

The rise of the Japanese stock market is scary. As soon as the ‘cast iron coffin lid’ that has been suppressing the stock market for 34 years is opened, it is running without hesitation, hitting the ‘40,000 yen level’, which was difficult to imagine until now. Encouraged by the strong economic indicators shown by the rising stock market, the Japanese government is considering declaring an ‘escape from deflation’ for the first time in 23 years.

The biggest factor driving up the Japanese stock market is the rise of semiconductor stocks in the U.S. stock market. A rally in artificial intelligence (AI) and semiconductor stocks continued, with the U.S. semiconductor company Nvidia soaring 260% in the past year, driving up the stock prices of semiconductor-related stocks in the Japanese stock market.

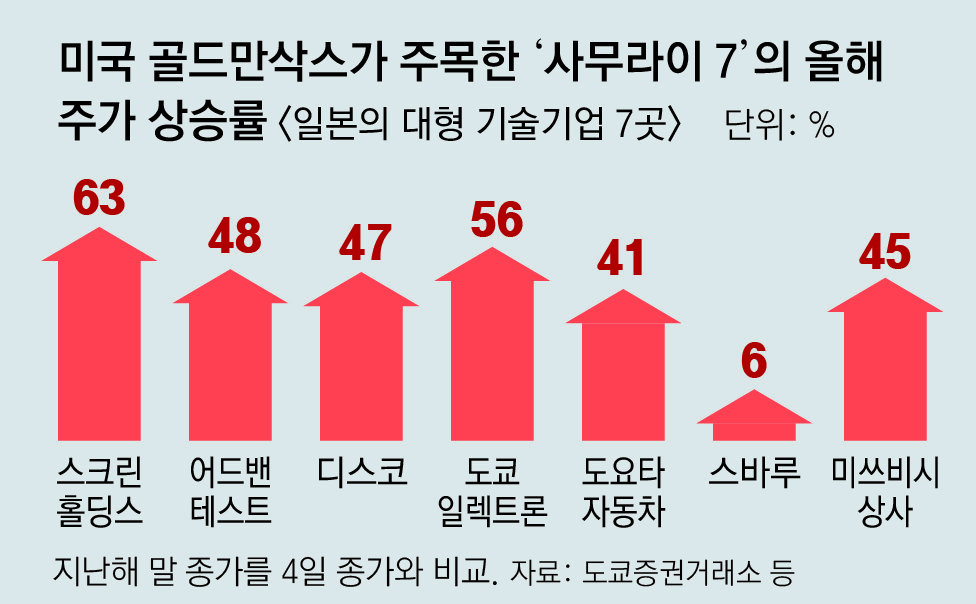

Goldman Sachs selected seven companies, including semiconductor equipment companies Screen Holdings, Advantest, Disco, and Tokyo Electron, automobile companies Toyota and Subaru, and general trading company Mitsubishi Corporation, as the ‘Seven Samurais’, saying they lead the Japanese stock market.

The upward trend of these stocks is dazzling. The closing price of Screen Holdings, a leading Japanese semiconductor manufacturing equipment company, today (19,500 yen) rose 63% in two months compared to the end of last year. Other semiconductor manufacturers, Tokyo Electron (56%) and Advantest (48%), also rose significantly.

As the price competitiveness of Japanese export companies has increased due to the prolonged low yen, the stock price of Toyota Motor Company, a major export company, has risen 41% compared to the end of last year.

The Nippon Keizai Shimbun recently analyzed the Japanese stock market as a phenomenon known as ‘alienation anxiety syndrome (FOMO).’ As the upward trend led by semiconductor stocks and export stocks continues, investors are rushing into the market out of impatience to not be left out of the surge.

Accordingly, some say that the Japanese stock market has recently become overheated. Tokyo Electron’s expected price-to-earnings ratio (PER) increased from 38 times at the end of last year to 58 times as of March. A higher PER ratio, which represents the stock price relative to net assets, means that the stock is overvalued in the market.

However, in the Japanese stock market recently, expectations for a further rise are greater than caution against overheating.

Japan’s NHK Broadcasting said, “The Nikkei stock average has risen, but the number of stocks rising is only about a quarter of all listed companies. “We are paying attention to the remarks this week by the Chairman of the Federal Reserve System (Fed), the U.S. central bank, and the Governor of the Bank of Japan, the central bank of Japan, as well as the announcement of U.S. employment indicators,” a market insider reported. A Mizuho Securities call center official said, “We are flooded with calls every day. “In particular, the investment sentiment of customers who had been neglecting their stock accounts has revived,” he said.

Kyodo News analyzed, “As large corporations begin to raise wages significantly, the view that a virtuous cycle in which prices and wages rise side by side is becoming a reality is spreading, leading foreign investors to re-evaluate Japanese stocks.”

As the economic recovery becomes clear, at least in numbers, the Japanese government is considering declaring an escape from deflation for the first time in 23 years. Although there is criticism that Prime Minister Kishida has a ‘political purpose’ to raise his approval rating, which is at its lowest level, many people recognize that the situation has clearly changed from the economic recession that lasted for about 30 years. The market predicts that the Bank of Japan will announce the lifting of negative interest rates as early as this month or April.

Tokyo =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.