Last weekend, as a large number of profit-taking listings were put up for sale, Nvidia fell more than 5%.

On the New York Stock Exchange on the 8th, Nvidia recorded $875.28, down 5.55% from the previous trading day. This is the largest drop since May 31 of last year.

As a result, the market capitalization also decreased to $2.188 trillion. Due to the sharp drop on this day, the market capitalization of about $130 billion (about 172 trillion won) disappeared in one day. This is one of the largest daily market cap declines in U.S. stock market history.

There was no special negative news related to NVIDIA on this day. It appears to be an adjustment due to the sudden increase.

The previous day, Nvidia had been rallying every day recently, with its stock price surging more than 3% and exceeding $900, breaking an all-time high.

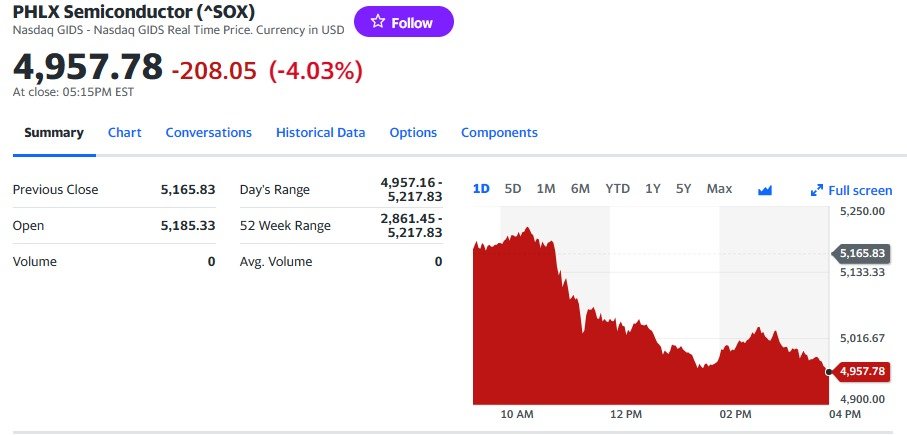

Daily trend of the Philadelphia Semiconductor Index on the 8th – Yahoo Finance capture

Daily trend of the Philadelphia Semiconductor Index on the 8th – Yahoo Finance captureBut on this day, it plummeted. This appears to be because a large number of profit-making properties were put up for sale.

As Nvidia plummeted, the U.S. stock market also took a big hit. Once Nvidia plummeted, all large American technology stocks, excluding Apple, were unable to avoid weakness.

In particular, when Nvidia plummeted, the Philadelphia Semiconductor Index, a semiconductor group, plummeted 4.03%.

As a result, the U.S. stock market fell all at once. Dow fell 0.18%, S&P 500 fell 0.65%, and Nasdaq fell 1.16%. In particular, the decline in Nasdaq was large.

Last weekend, the U.S. stock market was weak due to the Nvidia shock.

What is important is whether the Nvidia shock will last. Although there are concerns about a bubble in some quarters, most experts on Wall Street believe that Nvidia still has upside potential.

“It doesn’t mean the long-term upside potential is over,” Sam Stovall, chief investment strategist at CFRA Research, said of Nvidia’s stock price action. He added, “Investors got a little ahead of the curve and reached an overbought situation, and some appear to have realized profits.”

He diagnosed, “Despite the sharp drop today, NVIDIA has risen more than 70% this year, and there is ample room for upside.”

Most other experts also believe that there is room for further upside.

First of all, the highest target price of major investment banks on Wall Street is $1,400. The current stock price is $875, which means there is room for it to rise by about 60% in the future.

NVIDIA’s price-to-earnings ratio (PER) as of today is around 73. Usually, PER around 20 is appropriate.

However, in the case of technology stocks that are doing well, they often rise to the 70s to 80s. Tesla once exceeded 100. Accordingly, most experts believe that last weekend’s sharp drop was a healthy adjustment following the recent surge.

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.