The Financial Supervisory Service has proposed a differential compensation plan that compensates each investor from 0 to 100% for losses from equity-linked securities (ELS) underlying the Hong Kong H Index.

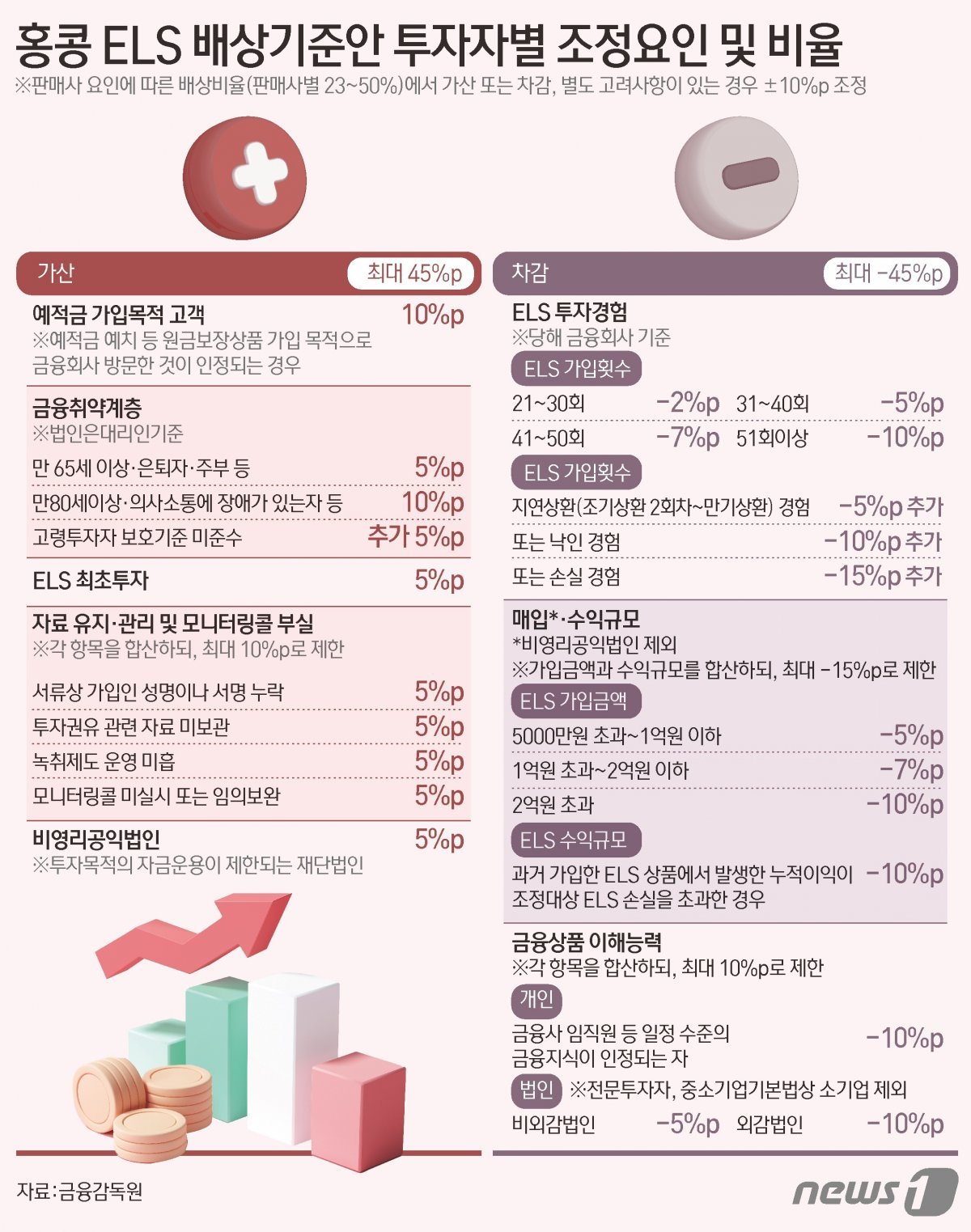

The compensation ratio for each investor is calculated by adding or subtracting the ‘additional factor for each investor’ (±45%p) from the ‘seller factor’ (basic compensation ratio + common weight = 23~50%) depending on age, investment experience, degree of incomplete sale, etc. It is decided. In addition, ‘other adjustment factors’ (±10%p) are reflected.

On the 11th, the Financial Supervisory Service announced the ‘Hong Kong H Index Basic ELS-related Dispute Resolution Standards’ containing the above contents to ensure early resolution of disputes between Hong Kong ELS sellers and investors.

◇Basic compensation ratio to banks is 20-40%… “Incomplete sales discovered in bulk”

The Financial Supervisory Service proposed a basic compensation ratio of 20-40% for banks that sold Hong Kong H-index underlying equity-linked securities (ELS). The intention is that a violation of the principle of suitability or obligation to explain that occurred in the system has been discovered and a certain portion of responsibility is assumed for all sales.

In the case of securities companies, a compensation ratio of 20 to 40% is applied mainly to cases where violations of sales principles for individual investors are confirmed because the matters pointed out collectively are not confirmed. However, in the case of some securities companies, lump sum information is confirmed only during a specific period, and in this case, it is expected that the basic compensation ratio will be applied to all investors during that period, similar to banks.

Here, a common weight of 10%p for banks and 5%p for securities companies is applied to reflect the responsibility for poor internal control that has caused and expanded misselling. In the case of online sales channels, 5%p for banks and 3%p for securities companies are applied, taking into account that the impact of poor internal control of the seller is relatively low.

In addition to these seller factors, the compensation ratio is adjusted at ±45% depending on the individual investor’s circumstances. In addition, if there are issues that were not considered or that are difficult to generalize, they are reflected as other adjustment factors (±10%p).

◇What is different from DLF compensation?

In the past, when compensating for derivative-linked securities (DLF), the Financial Supervisory Service ensured that compensation was made only when incomplete sales were recognized in individual cases. On the other hand, this time, incomplete sales were recognized in all bank sales, and the basic compensation ratio was set and the incomplete sales requirements were strictly applied.

The Financial Supervisory Service explained, “As a result of the inspection, violations of the principle of suitability or obligation to explain (collectively pointed out) applicable to all investors for each bank were discovered, so the basic compensation ratio was set.”

In addition, unlike in the case of DLF, where the Financial Supervisory Service determined the final compensation ratio in the range of 20~80%, even if the basic compensation ratio is set for Hong Kong ELS, the final compensation ratio is calculated in the range of 0~100% without any upper or lower limit by reflecting the addition or subtraction factors. I made it possible. This means that even if you are a subscriber through a bank, you may not receive compensation.

Specifically, the compensation rate can be lowered to 0% depending on deduction factors such as ELS investment experience, delayed repayment or loss and stigma experience, size of subscription amount, size of profit, and level of financial knowledge.

◇More elaborate and comprehensive consideration than in the past… “Please cooperate with voluntary compensation”

ⓒ News1

ⓒ News1Unlike the DLF, the lower and upper limits are eliminated, and it is expected that more diverse compensation ratios will emerge depending on the sales case. The Financial Supervisory Service explains that it took into account individual uniqueness more broadly and tried to strike a balance between the principles of seller responsibility and investor self-responsibility.

Lee Bok-hyeon, head of the Financial Supervisory Service, explained, “ELS products are popular products and have been sold for a long time, and the compensation plan has been designed in detail and elaborately, taking into account the characteristics of investors’ age groups and high repeat subscription rates.”

He emphasized, “Please note that these dispute resolution standards have been carefully prepared to ensure that investors who have suffered unfair losses receive reasonable compensation while not undermining the principle of ‘investor self-responsibility.’”

In addition, Director Lee asked the seller to make voluntary compensation (private settlement) in accordance with this compensation plan, and said that the seller’s post-sales efforts, such as compensation for customer damage, will be taken into consideration when determining the level of sanctions such as fines.

Director Lee added, “We ask for the active cooperation of sellers and investors so that compensation can be smoothly achieved and social and economic costs due to prolonged legal disputes are minimized.”

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.