Reduced from 166 to 94 in 3 years

“Chinese real estate downturn exposes limitations”

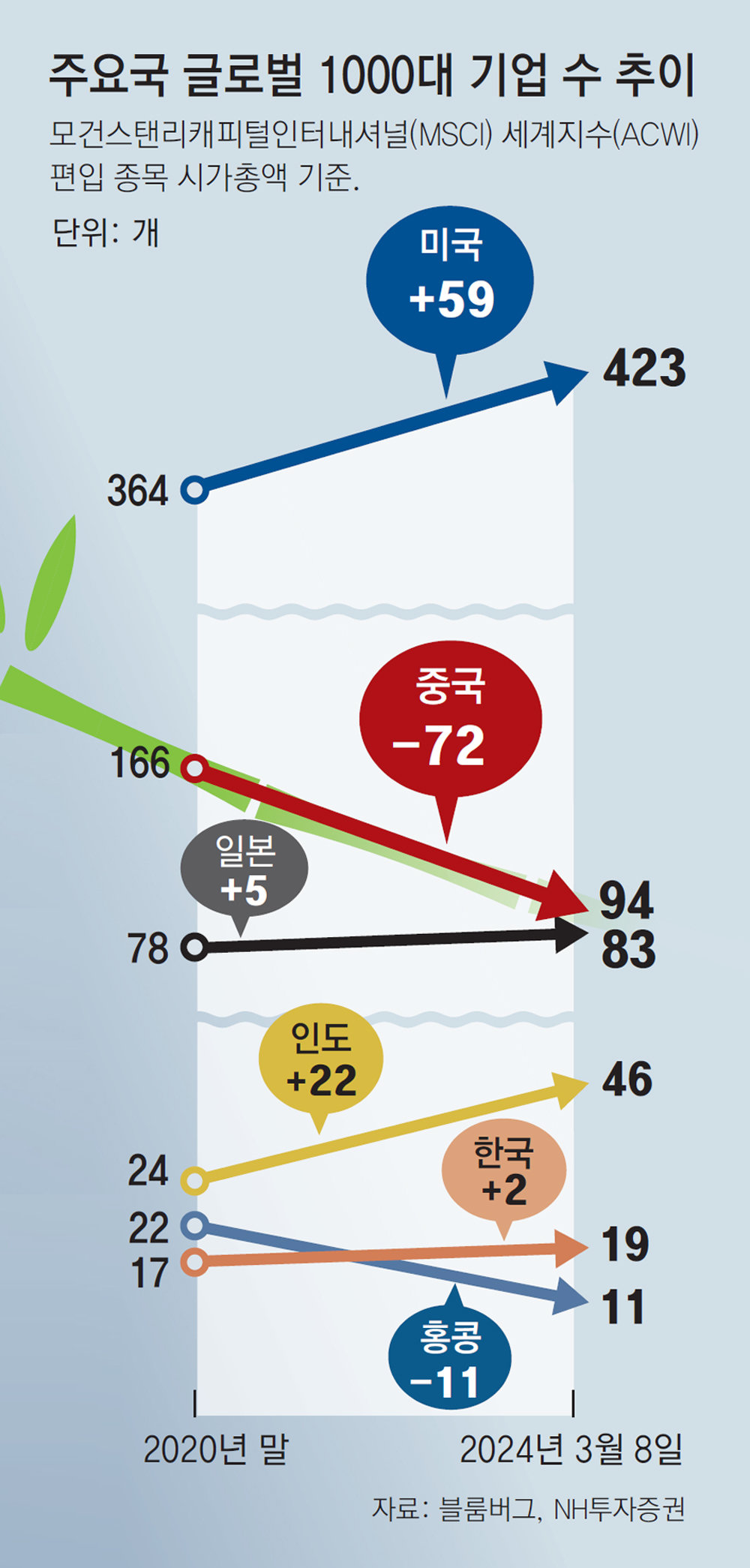

American companies advance…加 – India’s size increases

19 Korean companies, including Samsung, were mostly pushed down the rankings

The number of Chinese companies included in the top 1,000 global companies (based on market capitalization) has plummeted by more than 40% over the past three years due to pressure to reorganize the global supply chain led by the United States. China’s semiconductor leader SMIC was expelled from the top 1,000 companies, and big tech companies such as Tencent and Alibaba were also significantly pushed down the rankings. The global market capitalization rankings were reorganized as countries such as the United States, Canada, and India filled the positions left by Chinese companies.

On the 11th, the Dong-A Ilbo commissioned NH Investment & Securities to conduct a survey of the top companies by market capitalization in the stock markets of 47 countries included in the Morgan Stanley Capital International (MSCI) World Index (ACWI). As of the 8th, the number of Chinese companies in the top 1,000 was 94. It was just that. It reached its highest point at the end of 2020 with 166 companies entering the top 1,000, but fell by 43.4% in three years.

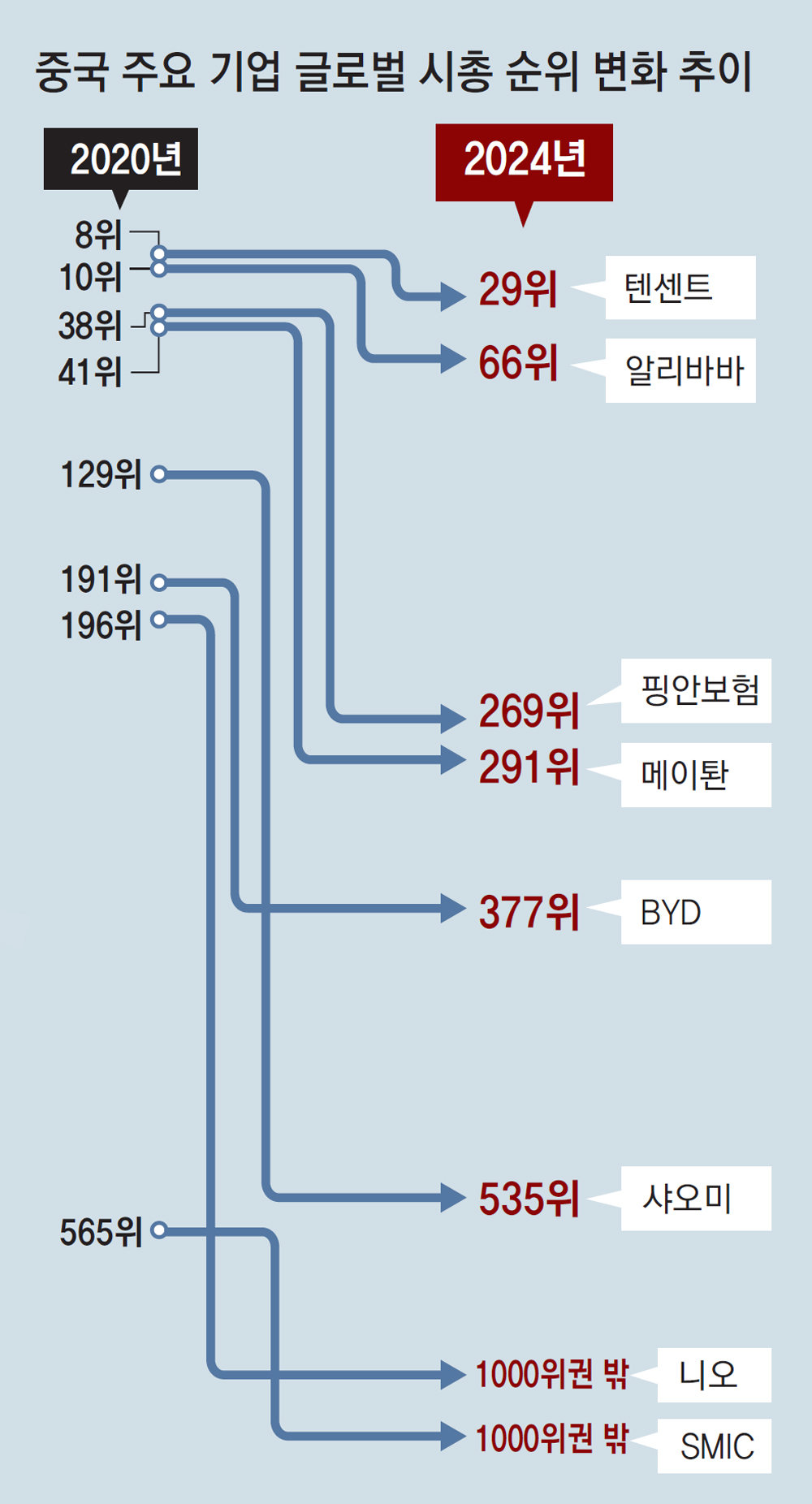

Due to the reorganization of the global supply chain, materials companies such as rare earths were hit hard. Currently, only three Chinese companies survive as part of the global 1,000 companies: gold and copper producer Zijin Mining, steel company Baoshan Steel, and chemical company Wanhua Chemical. Compared to the end of 2020 (12 places), 9 places disappeared. Changshin Advanced Materials, the world’s No. 1 secondary battery separator company, was pushed out of the rankings as its market capitalization was cut by one-third from $19 billion to around $6 billion. SMIC, China’s largest semiconductor company, also ranked 565th at the end of 2020, but was hit hard by the US-China trade conflict and dropped out of the top 1,000 companies.

As Chinese companies left the country in large numbers, the influence of the United States grew. There are a total of 423 American companies in the top 1000 global companies, an increase of 59 from the end of 2020 (364). Except for Saudi Arabia’s Aramco (4th place), the top 10 were all occupied by American companies.

While China is slowing down, Canadian and Indian companies are also rapidly increasing their size. The number of Canadian materials companies in the global top 1,000 doubled from three in 2020 to six this year. India’s largest steel companies, such as JSW Steel and Tata Steel, also appear to be making rapid progress, with new names being added.

In Korea, 19 companies were listed in the top 1,000 companies, but the rankings overall fell. In particular, Samsung Group performed poorly, with Samsung Electronics, which was 14th at the end of 2020, falling to 28th.

Experts say that growth has reached its limit due to the recession in the real estate sector, which accounts for a quarter of the Chinese economy, and the resulting structural problems. Political issues such as the Chinese government’s bashing of Big Tech and the ‘Zero Corona Policy’ are also having a negative impact on the stock market. The number of Chinese financial companies in the top 1000 global companies decreased from 46 at the end of 2020 to 25 recently, and the rankings of Tencent and Alibaba, which were considered representative innovative companies and were listed in the global ‘top 10’, fell to 29th and 66th, respectively.

Lee Hyeong-seok, a researcher at the Hyundai Research Institute, predicted, “As structural problems with the Chinese economy have emerged, the investment attractiveness of Chinese companies has decreased,” and added, “Because variables such as the U.S. presidential election are also significant, recovery will be difficult for the time being.”

However, some predict a stock market recovery due to the Chinese government’s economic stimulus package and the undervaluation of Chinese companies since the middle of last year. Jeon Byeong-seo, head of the China Economic Finance Center, said, “In February of this year alone, more than 10 trillion won worth of foreign investment poured into the Chinese stock market.”

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.