The slowdown in the real estate market across the country is bringing a certain wave of remorse to buyers: more and more of them are worried that they have paid too much and want to cancel their purchase contract.

Brigitte Cedilot, a real estate agent in Toronto, said rising mortgage rates are weakening consumer appetite. Interest rates affect people’s purchasing powerhe explained.

The sales strategy, which consists of setting a specific date for receiving purchase offers (the popular offer datein English) brings less than usual, he says.

With prices falling, some buyers are starting to regret their purchase, especially those who concluded a settlement a few months ago and should soon own a property whose value has already fallen. .

” There are many buyers who buy recently who feel they have overpaid and they are still trying to leave their contract. “

Nationwide, the number of properties sold dropped by 25.7% last month compared to April 2021, according to the Canadian Real Estate Association. The average sale price dropped 3.8% from March to April, to $ 771,125.

The fall in average prices was more pronounced in some specific cities in Ontario, including the Toronto (-6.4%), London (-5.5%) and Hamilton (-4.2%) areas.

grief and despair

Mark Morris, a real estate attorney, said that in recent weeks more and more of his clients have wanted to cancel their real estate transaction. Between 5% and 7% of the agreements his company manages are in the situation now, against 1% overall.

I think most of them don’t want to quit because they think they can get a better deal. I think this is a sign of despairlaunched the lawyer.

” I haven’t really seen what we’ve been seeing in the past two or three weeks. “

We see hesitant buyers and sellers nervousthe lawyer added.

Along with higher rates eating up borrowers ’purchasing power, he pointed out that banks and other lenders are restricting the funds they make available to consumers in the form of mortgages.

The situation is particularly painful for people committed to buying a property before selling them, underlined attorney Laurence Dutil-Ricard. When you make a buy-sell, you need the funds from the sale to make the purchasehe says.

The problem is that activity has slowed drastically in recent weeks and some sellers are having a hard time attracting buyers. The offers are fewer and less attractive than before.

” A month ago, we didn’t think of that. It’s all gone in six or seven days, especially if you’re in Toronto. “

Even if they buy $ 50,000 or $ 100,000 more than its value now, it will come back. That’s not stress. Stress has nothing to offerhe says.

How to get out of a purchase contract

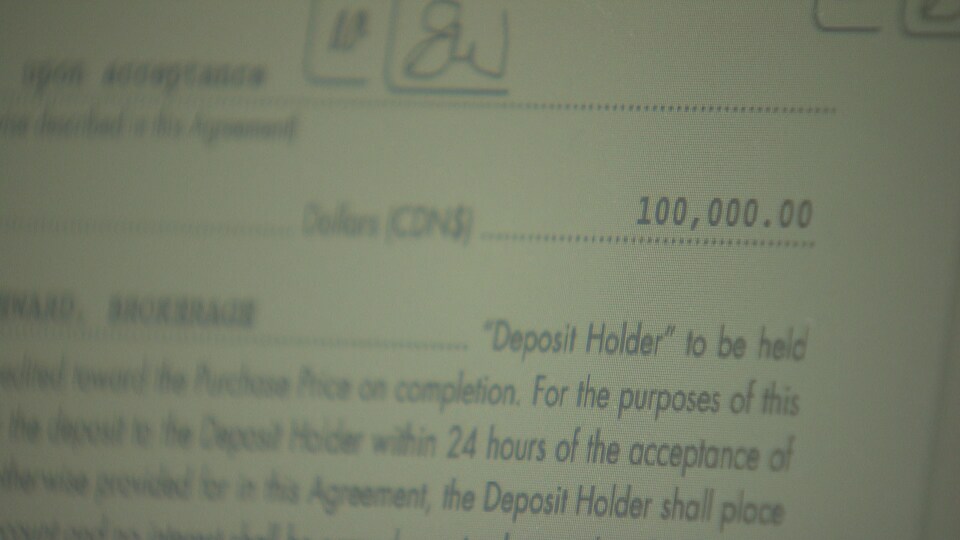

Canceling the purchase contract is a risky bet because the deposit required in some provinces, such as Ontario, will go to the seller.

If, for example, you put a $ 100,000 deposit for buying a home and you leave the purchase agreement without a good legal reason, you risk losing your deposit and maybe more.said Toronto attorney Laurence Dutil-Ricard.

Sellers can also claim damages. The properties are on the market for more days. Every day is a missed opportunity cost so they can claim more because of the market crashformally recognized by the courts, underlined the attorney.

It is always possible to negotiate an agreement that provides a refund of the deposit, whether in part or in full. The alternative is to turn to the courts, which can take years and are very expensive for both sides.underlined attorney Mark Morris.

Either way, experts expect that this slowdown in the real estate market will be temporary. This is, they say, just a shock in response to rising interest rates.

Severe inventory shortages remain a major problem, which is the root of the imbalance between supply and demand.

Source: Radio-Canada