It is important to know and take advantage of the deductible expenses to reduce the tax payable or to guarantee more repayment in Income Tax. Health expenses are the expenses that provide the biggest decrease since there is no limit on the amount to be declared. And because of this, Federal Revenue has more control over what is stated in the return.

Not all health expenses are accepted. For example, medicines bought from a pharmacy cannot be declared even if they are for continuous use. See what can and cannot be entered as healthcare expenses in this article and how to report these expenses on the return.

To benefit from health expenses, you should choose the full statement template. If you do not know which tax model is best for you, report all allowable medical expenses and at the end of the filling check the result for each model in the program itself. It is possible to include expenditure on their own health, their dependents or those who are fed.

What can be declared

The expenses listed below are deductible from the Income Tax return, provided that it is duly proven by the receipt or invoice with the name or CPF of the owner, his dependents or the child support.

The receipt or invoice must contain the name of the clinic or specialist, a description of the consultation or treatment, the signature and stamp of the professional council number, together with the relevant CNPJ or CPF.

- Consultations, sessions and treatments with any specialty doctor, dentist, psychologist, physiotherapist, occupational therapist and speech therapist in Brazil and abroad.

- Laboratory tests, diagnostic imaging and radiological services

- Admission to hospitals and clinics in Brazil and abroad

- Health plan in Brazil (paid abroad plans and business plans are not accepted)

- Nursing homes and geriatric institutions, provided that they have the quality of a hospital for this purpose.

- Schools and institutions specializing in the education of the physically or mentally handicapped

- Orthopedic instruments and prostheses, orthopedic insoles and shoes, wheelchairs, walkers, orthopedic screws and plates

- Dental instruments and prostheses, dentures, dental implants, dental screws and plates

- Aesthetic or reconstructive plastic surgery (prostheses must be included in the hospital bill)

- Pacemaker, intraocular lens for cataract surgery

What cannot be declared

The expenses listed below, although healthcare-related, are not recognized by the IRS for income tax deduction purposes due to lack of statutory provision. Therefore, they cannot be declared.

- Medicines purchased or imported from a pharmacy, even if they are for continuous use (with the exception of medicines included in the hospital bill)

- Nurses or therapeutic attendants (with the exception of nursing care included in the hospital bill)

- Paid health plan abroad

- Health plan (MEI) on behalf of your company or plan paid by the company you work for

- Glasses, contact lenses, hearing aids and the like

How to report expenses in the statement

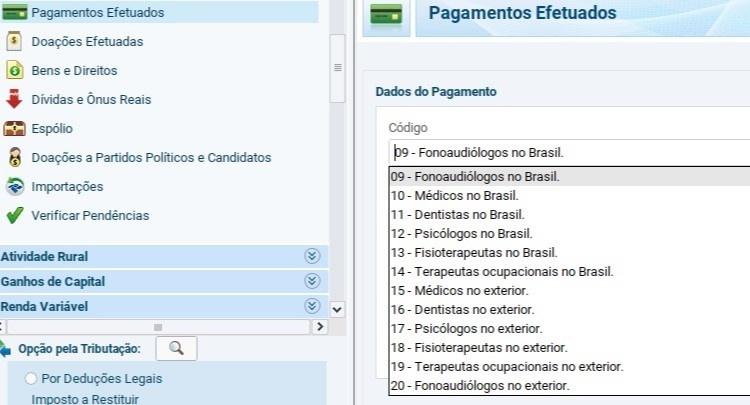

Medical expenses must be reported in the “Payments Out” form. Find the plug in the menu on the left side of the program screen. Click “New” and select the code according to the expense to report.

Note that there is a large list of special codes for health expenses from 09 to 26.

For example, when choosing the code “10 – Doctors in Brazil”, you must indicate whether the expense was incurred by you (the owner), a dependent, or child support. Enter the doctor’s name and CPF and the amount paid to the specialist. Click “OK” to complete filling out the form.

Repeat the process for each professional, clinic, or hospital for which you want to report costs. Report your expenses, your dependents, and your meal on separate pages.

If you have multiple expenses with the same professional or clinic – for example, if you have had several physical therapy sessions – collect receipts or invoices and write the total amount on the statement form.

Don’t forget to report refunds for consultations and exams

Stay tuned for appointments and examination reimbursements made according to the health plan. Refunded amounts cannot be used for Income Tax deduction. Ask the plan operator for a report detailing any refunds paid to you.

Report the total reimbursement amounts in the files of each professional, hospital or clinic. In the “Non-deductible installment / refunded amount” field, enter the total refund amount in 2021.

The IR 2022 program will automatically calculate the result of the difference between the amount paid to the professional only and the amount reimbursed by the health plan and consider it a deduction.

Keep receipts for 5 years

If Revenue suspects any irregularity, it may ask for proof of expenses incurred. It is therefore essential that all receipts are retained for at least five years. If the statement is changed, keep it for five years from the last change.

Invoices and receipts must include the name, address and CPF or CNPJ number of the person receiving the payments.

It is possible to import the file containing the health plan information (if your plan provides it), making it easy to complete your statement. To do this, click on the “import health plan file” option in the lower corner of the first screen of the “Payments made” form.

source: Noticias

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.