When Russian President Vladimir Putin turned off the gas taps to Europe, Germany feared a winter of power cuts more than any other country.

However, German authorities were quick to secure alternative sources, recognizing that a heavy reliance on Russian gas left Europe’s economic engine significantly exposed.

Today, a few months later, the lights are shining on the Christmas markets and there is a timid optimism in the air flavored with Glühwein (mulled wine).

Germany’s hastily devised strategy to survive without Russian gas seems to be working, at least for now.

“Energy security is guaranteed for this winter,” Social Democratic Chancellor Olaf Scholz told the German parliament on Wednesday, 23/11.

Searching for other suppliers

The country’s natural gas fields are being filled, in part, by an insane and expensive acquisition in the world’s hydrocarbon markets.

Similarly, on Germany’s windswept North Sea coast, engineers built the first liquefied natural gas (LNG) import terminal in record time.

LNG is natural gas cooled in liquid form to reduce its volume and make it easier to transport. And when it reaches its destination, it turns to gas again.

In Germany, such projects often take years due to excessive bureaucracy. However, authorities removed the barriers so that the job could be completed in less than 200 days.

The most important part of the terminal, the “floating storage and regasification unit” (FSRU), has not yet been secured. The FSRU, which is basically a private vessel where LNG is regasified, will be chartered for US$ 207,259 (R$ 1.1 million) per day.

In a few weeks, oil tankers from countries such as the United States, Norway or the United Arab Emirates will be able to start delivering their cargo to the port of Wilhelmshaven.

Terminal operator Uniper, which is now almost entirely controlled by the German government, declined to disclose its suppliers, but stressed that the contracts are already in place.

Berlin plans to build 5 more LNG terminals. Most are expected to be completed next year.

A race against time

Powerful German industry held its breath as the government implemented its risky strategy.

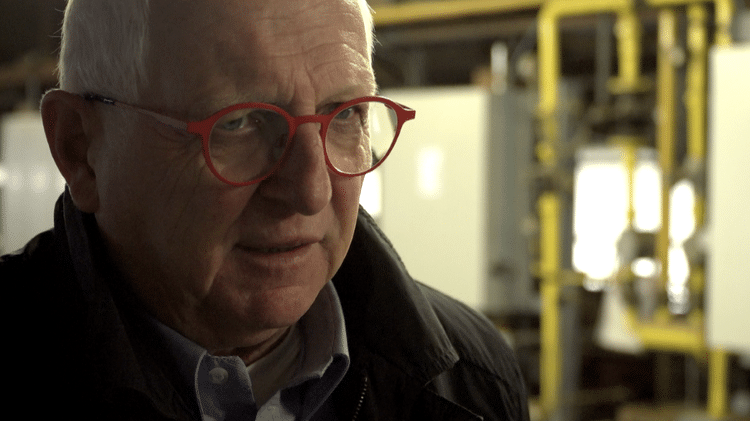

“If we don’t have gas, we have to turn off the furnace,” Ernst Buchow, owner of a brick factory half an hour outside Wilhelmshaven, tells the BBC.

The bricks it produces need to be fired in a giant kiln at temperatures up to 1,200 degrees Celsius. In the near future, the businessman hopes to switch to green hydrogen, but currently still completely dependent on gas.

“It’s not just the politicians’ fault. The industry wanted Russian gas contracts,” he adds.

Just a year ago, deals with Moscow supplied 60% of the gas consumed to Germany, mostly via the Nordstream gas pipeline.

Despite significant political and citizen opposition, the government hoped to activate the controversial Nordstream 2, which would double the amount of Russian gas reaching Europe via Germany. But the invasion of Ukraine buried these desires.

The federal power grid agency says Germany is doing without Russian fuel today.

However, experts say that LNG terminals should be operational early next year and gas consumption should be reduced by 20% in order to avoid problems during the winter months.

Coming this far may be considered a major national achievement, but it didn’t come for free.

Other side

Germany, the heavyweight in the world economy, usually gets what it wants. But its new appetite for LNG is driving global demand.

This could put poorer countries like Bangladesh and Pakistan in a vulnerable position.

“Many countries, especially emerging economies, are no longer able to provide the LNG they need because they are out of the market and have less purchasing power than Germany,” says Professor Andreas Goldthau of the Willy Brandt School of Public. at the University of Erfurt in Germany.

Goldthau warns that this puts these nations at risk of suffering power outages or having to resort to “dirtier” energies such as coal to avoid just this scenario.

What about Germany’s plans to complete its transition to a green model? After all, LNG is a fossil fuel.

Everyone involved in the Wilhelmshaven project insists that LNG is a “transition” fuel.

Uniper has pledged to build an infrastructure to process green hydrogen along with the LNG terminal.

This ignited the ambitious plans of the Wilhelmshaven city council. Mayor Carsten Feist assured him that the LNG terminal would not bring much business to the city. But this will come true with your plans to create a green energy hub.

“Most of the energy transformation we need to have a habitable climate on our planet in 50 to 100 years, much of what is needed in Germany, will take place in and through Wilhelmshaven,” he says.

cumbersome cost

But the most staggering cost of Berlin’s strategy to reduce its dependence on Russian gas is monetary.

The six LNG terminals forced the German government to spend about US$6.3 billion. This is more than double what ministers initially budgeted for, and could increase further next year.

Germany learned too late the value of a secure energy supply and is now paying a heavy price for it.

– This text was published at https://www.bbc.com/portuguese/internacional-63769249.

source: Noticias

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.