[美 SVB 파산 후폭풍]

Small and medium-sized bank stocks plunged more than 60% despite the evolution of Biden’s “safety of US banks”

Temporary suspension of stock trading in 12 banks… KOSPI 2.56%↓, the largest drop in 亞

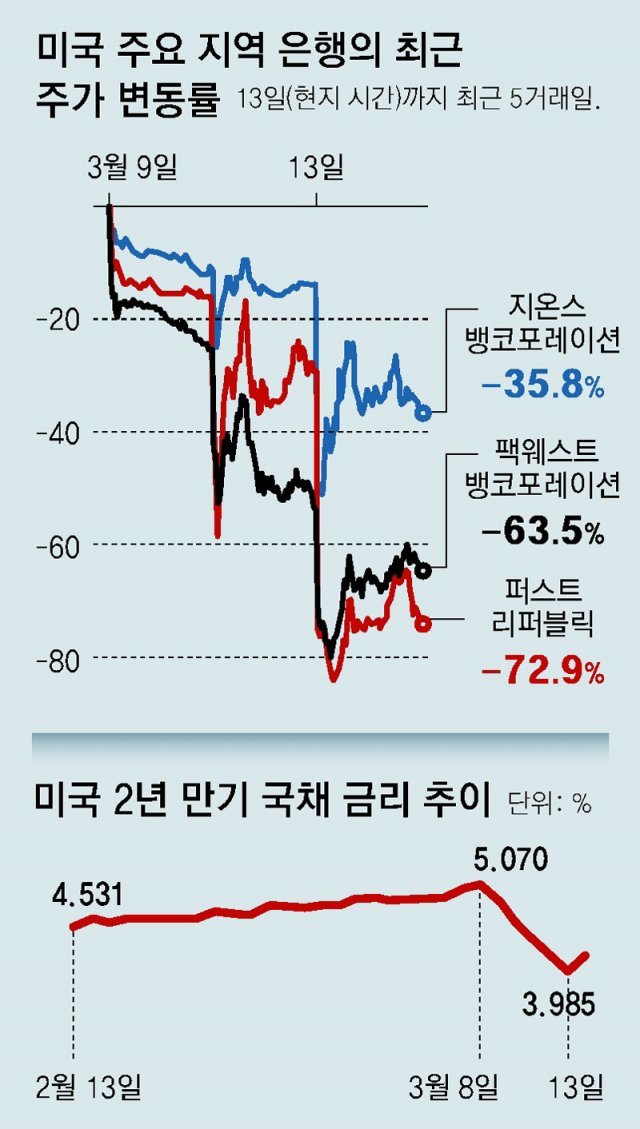

Even US President Joe Biden tried to block the storm after the bankruptcy of Silicon Valley Bank (SVB), shouting full deposit guarantee, but on the 13th (local time), the stock prices of local small and medium-sized banks plummeted in the US New York Stock Exchange, and anxiety that additional banks would go bankrupt It’s still there. According to Bloomberg, on the 13th and 14th, the market capitalization of global financial stocks evaporated by 465 billion dollars (approximately 607 trillion won). It is equivalent to Thailand’s Gross Domestic Product (GDP) as of the World Bank in 2020. The domestic stock market fell more than 2% on the 14th due to financial risk concerns from the US, recording the biggest drop this year.

President Biden said in a speech just before the opening of the stock market on the 13th that “the US banking system is safe,” but he could not calm the fears of investors. Shares of First Republic Bank, based in San Francisco, California, and Western Alliance, based in Phoenix, Arizona, plunged 61.8 percent and 47.1 percent, respectively, on the day. Trading in 12 banking stocks was also temporarily suspended this morning.

The day before, the US central bank Federal Reserve System (Fed) announced that it would support “virtually unlimited liquidity for one year as long as there is collateral,” but the shock of the closure of two banks, including SVB and Signature Bank, continues.

On the 14th, Asian stock markets were also not free from this aftermath. In particular, the KOSPI fell 2.56% from the previous day to 2,348.97, showing the largest drop among stock markets in major Asian countries. This is the largest drop since September 2 last year (-3.02%). Foreigners sold about 640 billion won worth of stocks, leading the index plunge. The KOSDAQ index also closed at 758.05, down 3.91%.

This is interpreted as the fact that the potential risk of US Treasuries, which were considered a representative safe asset, has become a reality. According to the US Federal Deposit Insurance Corporation (FDIC), as of the end of last year, the unrealized book loss alone reached 620 billion dollars (approximately 810 trillion won) due to the sharp decline in US bond prices.

As it is pointed out that the cause of this situation is the Fed’s repeated rate hikes that began in March of last year, it seems that the Fed’s move to raise interest rates will also be put on hold. Japan’s Nomura Securities and others predicted that the Fed would cut the benchmark interest rate at the March Federal Open Market Committee (FOMC) to be held on the 21st and 22nd. For the time being, volatility and uncertainty in the global financial world as a whole are also expected to increase.

Additional bankruptcy fears hit the financial market

U.S. Treasury yields fall by the most in 36 years… Stock markets in Japan, Taiwan, and Hong Kong also fluctuated all at once.

Community-based banks vulnerable to environmental changes

…

Moody’s Downgrades Signature Bank’s Rating

“Neither Washington Mutual (a bank that went bankrupt during the 2008 global financial crisis) nor FTX (a U.S. virtual currency exchange that went bankrupt in November last year) said there were no problems right up until the brink of bankruptcy.”

“Is it the answer to transfer to a bank called ‘Buddhism for a Great Magic’?”

On the 13th (local time), depositors of small and medium-sized banks based in the U.S. argued over whether to join the ‘large-scale deposit withdrawal (bank run)’ on social media. As Silicon Valley Bank (SVB) on the 10th and Signature Bank on the 12th went bankrupt one after another, and local bank stocks such as First Republic Bank plummeted on the New York Stock Exchange on the 13th, anxiety among depositors and shareholders is rapidly amplifying.

In a speech to the public right before the stock market opened on the 13th, US President Joe Biden said, “I will fully guarantee SVB’s deposits.” SVB’s ‘Bridge Bank’, established by the Federal Deposit Insurance Corporation (FDIC), also started operations. Silicon Valley information technology (IT) companies and start-ups, which are SVB’s main customers, have been freed from anxiety that they will not be able to pay their employees’ salaries. However, the market is still unable to erase the sense of crisis, ‘Where will the next bankruptcy be?’

On the New York Stock Exchange on the 13th, the shares of First Republic (-61.9%), Western Alliance (-47.1%), and Zeons (-25.72%), which are small and medium-sized banks based in the region, fell sharply. They are based in San Francisco, California, Phoenix, Arizona, and Salt Lake City, Utah, respectively.

These banks have operated by finding niche markets in special areas. SVB has also maintained a close relationship with wine companies in the California Bay Area as well as the tech industry. First Republic, which received $700 million in emergency funding from the US Federal Reserve and JPMorgan amid concerns about a bank run last week, is investing in Silicon Valley, including CEO Mark Zuckerberg. It is famous for its sales oriented to the wealthy customers. The proportion of high-end home mortgage loans is also high.

As customers were concentrated on a specific group, they were vulnerable to changes in the macro environment, such as the Fed’s high-intensity tightening. It is also pointed out that management lacked the capacity to manage the rapid increase in deposits thanks to the low interest rate policy during the pandemic. Princeton University professor Paul Krugman, winner of the Nobel Prize in Economics, pointed out on Twitter that “SVB has accumulated cash (deposits) but lacks experts.” It is a diagnosis that he did not know where to make profits, so he overpurchased US Treasury bonds and was hit directly by the Fed’s interest rate hike.

Moody’s, a credit rating agency, gave Signature Bank an investment grade of ‘C’ on the 13th. It said it was also considering downgrading the ratings of five U.S. regional banks, including First Republic.

Customer deposit guarantees have calmed the immediate anxiety, but there are observations that it is unclear how long small and medium-sized US banks can endure. This is because customers are already taking money out of small and medium-sized banks and moving it to large banks. “If this situation continues to escalate, small and medium-cap banks will run out of liquidity,” David Ellison, portfolio manager at the Hennessy Fund, told Reuters.

There are also concerns that this crisis could spread to large financial companies with large holdings of long-term bonds, such as Charles Schwab, the largest online stock trading company in the United States. On the 13th, Charles Schwab stock also fell 11.6%. Mike O’Rourke, chief market strategist at John Trading, predicted to CNN, “The biggest problem right now, the ‘crisis of confidence,’ will only subside if we can survive for up to 48 hours without further bankruptcy.”

The aftershock of the SVB crisis also hit Asian stock markets on the 14th. On the 14th, the KOSPI finished at 2,348.97, down 2.56% from the previous day. The KOSDAQ market, which is centered on growth stocks, took a bigger hit and closed at 758.05, down 3.91% from the previous day. Japan’s Nikkei Average also fell 2.19 percent. Stock markets in Taiwan and Hong Kong also fell by 1%. Treasury yields, which pushed regional banks into crisis, were greatly shaken by the spread of the crisis. On the 13th, the two-year US Treasury bond yield fell by about 0.50 percentage points during the intraday to below 4% at one time due to the Fed’s prospect of intensive tightening and the preference for safe assets. It was the biggest drop since Black Monday in 1987.

New York =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.