Following the Gumi stock market, the Asian stock market also rallied, raising the possibility that the aftermath of the Silicon Valley Bank (SVB) bankruptcy will end in the short term.

◇ Japanese stock rally

: As of 12:30 pm on the 15th, the Asian stock market is up 1.81% in Korea’s KOSPI, 0.28% in Japan’s Nikkei, and 0.64% in Australia’s ASX.

All Chinese stocks are also rising. Hong Kong’s Hang Seng Index is up 1.73%, and China’s Shanghai Composite Index is up 0.71%.

This is interpreted as the fact that the US stock market and the European stock market rose at the same time the previous day.

◇ U.S. stock market CPI soars all over Japan

: On the previous day, the US stock market rallied all at once as it was revealed that the consumer price index (CPI) had slowed significantly. On the New York Stock Exchange, the Dow rose 1.05%, the S&P 500 rose 1.67%, and the Nasdaq rose 2.14%.

This is because the CPI announced today was in line with market expectations.

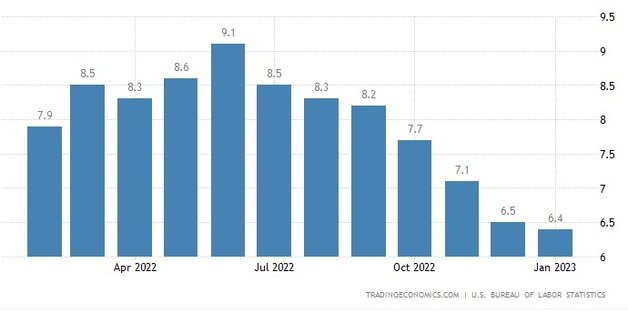

The US Bureau of Labor Statistics reported that the CPI rose 6.0% in February compared to the same month last year. This was in line with market expectations and was lower than the previous month (6.4%). This is also the lowest level since September 2021.

CPI monthly trend for the past year – Captured from the US Bureau of Labor Statistics

CPI monthly trend for the past year – Captured from the US Bureau of Labor StatisticsExcluding highly volatile food and energy prices, the growth rate of the ‘core CPI’ also fell from 5.6% in January to 5.5% in February, the lowest since the end of 2021.

As a result, the likelihood that the Fed will raise interest rates aggressively has decreased.

Shortly after the release of these indicators, the futures of the Federal Funds Rate (US base rate) traded on the Chicago Mercantile Exchange (CME) reflected the probability of the Fed raising interest rates by 0.25 percentage points at the March Open Market Committee (FOMC) as 73.8%. did. Freezing is 26.2%.

Previously, Fed Chairman Jerome Powell attended a congressional hearing last week and said, “In the case of some inflation indicators, they have reversed,” and “the Fed is ready to raise interest rates more.”

Since then, there have been many predictions that the Fed will raise interest rates by 0.5 percentage point at the FOMC to be held on March 21-22. However, the prospect of an interest rate hike of 0.5 percentage point has become ‘0’%.

A slowing CPI greatly reduced the likelihood of an aggressive rate hike by the Fed. In particular, in the context of the Silicon Valley Bank (SVB) bankruptcy and the resulting financial crisis in the United States, macro indicators such as these are expected to give the Fed room to adjust the pace of interest rate hikes.

Bank stocks, which had plummeted due to the SVB shock, soared, leading the rally in the US stock market.

◇ European stock markets all rose more than 1%

: Not only the US stock market but also the European stock market rallied simultaneously. European stock markets all ended more than 1% higher.

Germany’s DAKS surged 1.83%, Britain’s FTSE rose 1.17%, and France’s Kag rose 1.86%. As a result, the pan-European Stoxx 600 rose 1.53%.

The European stock market also led the overall stock market rally with the financial index soaring 2.5%.

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.