JPY rises as a safe haven asset after SVB bankruptcy

Highest rate of increase among currencies in 10 major countries

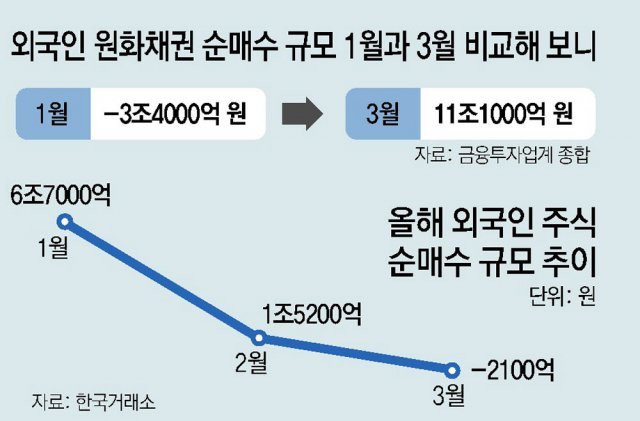

Won-denominated bond sales to foreigners last month 11 trillion

“Incentives for foreign exchange gains are growing for baby steps in the US”

Asia is attracting attention as an ‘investment haven’ as financial market uncertainty grows after the banking crisis that originated in the US and Europe. The Japanese yen is re-emerging as a safe asset, and the number of foreigners buying won-denominated bonds, whose balances sharply declined at the end of last year, is increasing.

According to CNBC and others on the 2nd (local time), the Japanese yen, which fell sharply in the second half of last year (July-December), took a sharp turn to strength after the bankruptcy of Silicon Valley Bank (SVB) on the 10th of last month. The bankruptcy of the SVB and the merger and acquisition of Swiss Credit Suisse took a hit on major currencies such as the US dollar and the Swiss franc, and demand for safe assets is flocking to the yen. According to Bloomberg News, the yen rose 3.8% as of the 28th of last month, surpassing the Swiss franc (2.8%) and the British pound (2.4%) among the world’s 10 major currencies excluding the US dollar, showing the highest rate of increase.

The yen-dollar exchange rate was in the range of 137 yen before the 10th of last month when SVB went bankrupt, but at the end of last month it fell to the range of 130 to 132 yen (the value of the yen rises). On the 3rd, the dollar-yen exchange rate was traded in the 133 yen range as of 4:00 p.m. in the Tokyo Foreign Exchange Market. Bloomberg News reported, “As the atmosphere of preference for yen investment spreads on Wall Street, the trend that was extremely weak last year is reversing.” In other words, the yen, which reached its lowest level in 32 years last year due to ‘zero interest rates’ and prolonged economic recession, is regaining its status as a safe asset.

The Korean bond market is also benefiting. According to the financial investment industry, foreigners bought a total of 11.941 trillion won worth of won-denominated bonds last month. It is the largest monthly net purchase by foreigners since June of last year (12.753 trillion won).

This can be interpreted as the effect of increased incentives for arbitrage trading as expectations that the Fed’s base rate hike cycle is nearing its end amid the SVB crisis increased. Some foreigners who invest in won-denominated bonds use their dollars as collateral to borrow won from the foreign exchange market and then invest in government bonds and monetary stabilization securities. After that, profits are made through the price difference between the interest rate of won-denominated bonds and the won-denominated funding cost. Ahn Jae-gyun, a researcher at Shinhan Investment & Securities, said, “After the Fed’s baby step (a 0.25 percentage point hike in the base rate) last month, the pressure on the king dollar has eased and concerns about an additional increase in the won-dollar have weakened. “In addition, the sluggish fundamentals (basic physical strength) of the Korean economy and expectations for a change in the Bank of Korea’s tightening stance are reflected here, so demand for won-denominated bonds is increasing,” he analyzed.

On the other hand, stocks are still being ignored. Foreigners’ net purchases of stocks plunged from 6.7 trillion won in January to 1.52 trillion won in February, and switched to net selling of about 210 billion won last month.

Bond preference is also prominent among domestic investors. According to Korea Investment & Securities, as of the 21st of last month, 67.4% of the new investments of super-wealthy people with a deposit balance of 3 billion won or more this year were concentrated in bonds. The number of cases of investing a lump sum of more than 1 billion won in bond products has more than doubled compared to last year.

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.