Millennials Own 51%

The pace of home ownership is slower than that of older generations

A lot of people who own a house are in debt

“Half of us earn a month and live on for a month”

In the United States, the proportion of the millennial generation, that is, the population in their 30s and older, ‘buying their own home’ has exceeded 50%. However, there are many views in the United States that it is difficult to view positively the fact that half of the young people own their own home.

Young people who bought a house during the novel coronavirus infection (Corona 19) pandemic are suffering from falling house prices and high interest rates, like the ‘young people’ in Korea, and half of them who do not have a home are giving up on buying a house. Bloomberg News reported on the 19th.

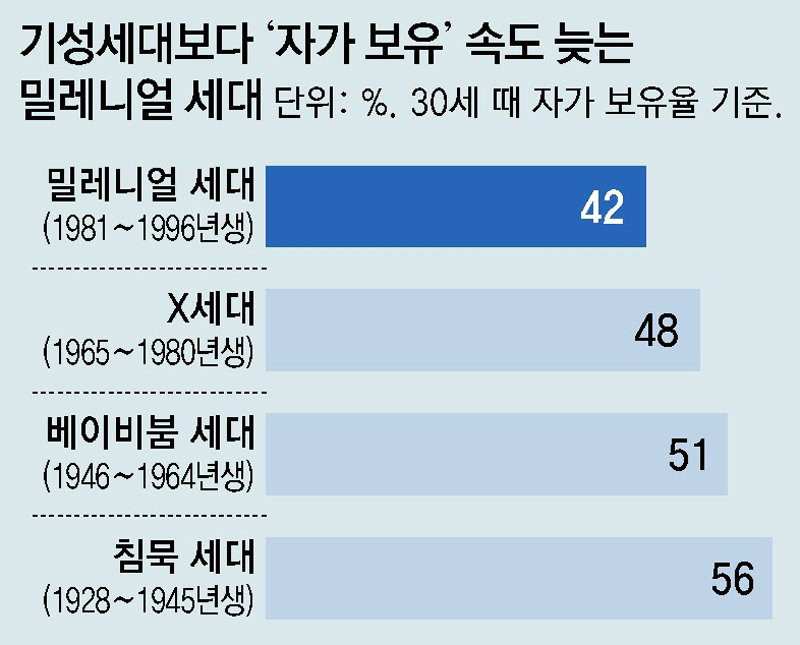

According to the US Census Bureau, the home ownership rate of Americans born between 1981 and 1996 (27 to 42 years old as of this year, the millennial generation) recorded 51.5% last year. The self-ownership rate of young people in the United States is higher than the 2021 self-ownership rate (25%) of Koreans in their 30s. However, compared to the older generation in the United States, the speed of owning a house is slow. According to the US real estate information company ‘Apartment List’, 42% of millennials own a house at the age of 30. In comparison, 48% of Generation X, the immediate generation above, and 51% of Baby Boomers, the generation above them.

The millennial generation, who came of age before and after the global financial crisis in 2008, is also the generation that experienced the corona pandemic during the stable period of establishing a place in society. Rob Warnock, senior researcher at Apartment List, said, “Millennials were hit hard by the financial crisis, and even during the economic recovery, they tend to postpone major events such as buying a house or giving birth while moving to the city in search of work.”

The rise in homebuying among US millennials has been particularly pronounced in large cities. The U.S. real estate information company ‘Rental Cafe’ analyzed 110 large cities and found that in 29 places, the number of homes owned by millennials has more than doubled over the past five years. Noting that the median income of this generation has increased by 44% in five years, Rentcafe analyzed that “one of the factors was that they were able to increase their savings as they lived with their parents or delayed moving more often during the pandemic.” .

However, the millennials, who have recently bought a new house in the past 1 or 2 years, are in a similar situation to the Youngkkeul people in Korea. The median home price in the U.S. last month fell 3.3 percent from a year earlier, the biggest drop since 2012, according to real estate brokerage firm Redfin. The US mortgage (home mortgage) interest rate, which was in the 2-3% range in 2020, is now over 6%.

As a result, many of them went into debt. According to the Federal Reserve Bank of New York, the debt of the millennial generation increased by 27% over the past three years to more than 3.8 trillion dollars (approximately 5027 trillion won) in the fourth quarter of last year (October-December). “The ‘value for money’ of buying a home is now at its lowest level in history,” said Mike Shadlock, investment advisor at Sitka Pacific Capital Management. “Many homebuyers may end up effectively being stuck in their homes.”

The pessimism of the ‘other half’, who have not yet had their own home, is growing stronger. As a result of a survey of millennials currently living in rental housing by Apartment List, 24.7% of respondents said they had no plans to buy a house in the future. It has nearly doubled from 13.3% three years ago. Two out of three people who said they wanted to buy a house also didn’t have a savings account for a security deposit. Only 15% of people had more than $10,000 (about 13 million won) in savings to buy a house.

Researcher Warnock said, “Many millennials bought homes on a large scale during the early days of the pandemic when interest rates were very low, but this was a ‘flash’ phenomenon. Lower-middle-class millennials who were unable to buy a house at that time were further reduced in their economic capacity as interest rates rose sharply afterwards.” Bloomberg News pointed out that “the proportion of those who earn a month and live for a month is almost 50%.”

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.