China’s ban on sales of Micron

U.S. House of Representatives “If Korea fills the gap with Micron,

The postponement of the import regulation of semiconductors from China must be withdrawn.”

Request for first disclosure to refrain from expanding sales of Korean products

In the US Congress, a voice came out saying, “The US administration’s postponement of restrictions on the import of semiconductor equipment (for Korean companies into China) should not be used to fill Micron’s vacuum in the Chinese market.” It is argued that if Samsung Electronics and SK Hynix fill the vacancy in a situation where China has partially banned Micron, the largest memory semiconductor company in the US, from selling in China, the suspension of regulation on these companies should be withdrawn. Analysts say that South Korea has been forced to choose between the pressure of the United States to participate in regulations on China and the possibility of China’s economic retaliation amid intensifying competition for high-tech semiconductors between the United States and China.

Mike Gallagher (Republican Party), chairman of the U.S.-China Strategic Competition Special Committee of the U.S. House of Representatives, told Reuters on the 23rd (local time), “The U.S. Commerce Department granting export licenses to foreign memory semiconductor companies operating factories in China is used to fill the Micron void. It should not be used,” he said. He continued, “As our ally South Korea experienced exactly the same economic coercion directly from the Chinese Communist Party (with Micron), we must prevent (Korean companies from Micron) from filling the void.”

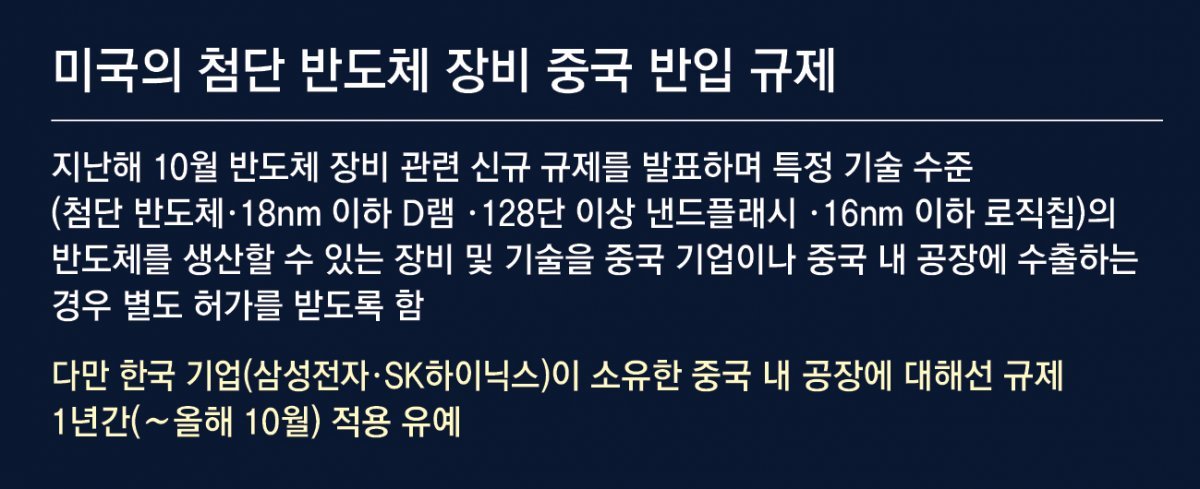

Samsung Electronics and SK Hynix are operating memory semiconductor factories in China. In October of last year, the U.S. Department of Commerce issued regulations on importing high-tech semiconductor equipment from China, suspending regulations on these companies for one year. Chairman Gallagher’s remarks mean that the suspension of regulation must be withdrawn as a kind of ‘disadvantage’ for Korean companies that want to bring Micron’s share of sales to China.

It is the first time that the US has openly asked South Korea to refrain from expanding sales of memory semiconductors to China. Voices calling for public participation in regulation are also growing in the US Congress.

“We are in contact with the business world as well as allies and partners to address China’s restrictions on Micron,” said Senate Democratic Leader Chuck Schumer. We will make it clear to the Chinese government that we cannot.”

In the midst of this, the Korean government has made an official request to the US government to ease the subsidy guardrail (safety measures) provisions of the US Semiconductor Act.

According to the US Government Official Gazette on the same day, the Korean government and the Korea Semiconductor Industry Association (KSIA) submitted an official opinion on the 22nd, saying, “We request the US government to review the current definition of key terms such as ‘substantial expansion’ in the regulation.” It is reported that the government has requested that Korean companies receiving subsidies from the US expand their cutting-edge semiconductor production capacity in China from 5% to 10%.

U.S. Congress “Should impose full sanctions on Chinese semiconductors”

When it becomes a reality, exports of Korean companies to China are blocked

Nvidia CEO “Concerned about damage to the US industry”

As China imposed a ban on sales of Micron, the largest memory semiconductor company in the US, the semiconductor competition between the US and China is escalating into a war of retaliation. The U.S. Congress requested the Joe Biden administration to impose high-intensity export restrictions on Chinese memory semiconductor companies. US pressure on Korean semiconductor companies, which can determine the success or failure of Chinese sanctions, is also intensifying. In the end, voices came out saying that Korean companies that fill Micron’s share of sales in China should be penalized. It is to make a choice between the United States and China in the midst of the reorganization of the semiconductor block centered on the camp.

Mike Gallagher (Republican Party), chairman of the US House Special Committee on US-China Strategic Competition, told Reuters on the 23rd (local time), “US technology flows to Chinese semiconductor companies such as Changsin Memory Technologies (CXMT) and Yangtze Memory Technology (YMTC) regardless of specifications. He insisted that CXMT should be immediately put on the export control list (entity list) following YMTC. U.S. companies cannot export without government permission to companies on the Commerce Department’s export control list.

In particular, Chairman Gallagher’s mention of “regardless of specifications” is interpreted as meaning that the Foreign Direct Production Regulation (FDPR), which is currently limited to advanced semiconductor equipment and AI semiconductors, should be expanded to the entire Chinese semiconductor industry. FDPR, a measure that bans exports of products using US technology to China even if they are products of foreign companies as well as US companies, has been taken against Huawei. If this plan becomes a reality, the way for domestic companies to export semiconductors to China could be virtually blocked.

In addition to Chairman Gallagher, the representative ‘popular hardliner’, the voices of the US Congress calling for a high-intensity response to China are growing. Senate Minority Leader Chuck Schumer and House Foreign Relations Committee Chairman Michael McCall (Republican Party) expressed their intention that “the United States and its allies must stand together against China’s economic aggression.”

The spark of the US-China conflict over the Micron sanctions is spreading to Korea in earnest. As Chairman Gallagher pressures Korean companies not to fill Micron’s production void in China, there are observations that it may affect the extension of the ban on Samsung Electronics and SK Hynix’s semiconductor equipment imports to China, which ends in October. However, the dilemma is that if China cooperates with the US, there is a growing concern that China will retaliate against domestic semiconductor companies.

The government showed a cautious attitude, saying that it is a matter for companies to decide. An official from the Ministry of Trade, Industry and Energy said on the 24th, “It is not appropriate for the government to present its position on the issue at this time.” However, a high-ranking official in the presidential office said, “We will protect our core interests while establishing our position taking into account the ROK-US relationship.” The official added, “It is not technically easy to limit who is who due to the sales structure of general-purpose semiconductors.”

There are also voices of concern in the United States about the ‘retaliation war’ between the United States and China.

Jensen Huang, CEO of Nvidia, an American semiconductor company, warned in an interview with the British Financial Times (FT) that day that the semiconductor war between the United States and China would “cause enormous damage to the American technology industry.”

CEO Hwang pointed out, “The Biden administration’s semiconductor export regulations are rather holding back Silicon Valley technology companies,” and “China has started developing its own semiconductors against US competitors.” “China accounts for about one-third of the total sales of US tech companies, so it is an important market that cannot be replaced,” he said.

The Diplomat, an American diplomatic magazine, also pointed out in an editorial that day, “China’s authoritarian regime will be able to rapidly grow the semiconductor industry,” and pointed out that “the United States is not in a dominant position in the semiconductor war.”

Washington =

Sejong =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.