Thanks to the exchange rate, export performance is the highest ever

With the increase in foreign tourists, there is a ‘double turn’

Toyota’s net profit increased by 120% compared to last year

Korea is in deep recession in semiconductors, petrochemicals, etc.

Major Japanese companies, which have been going through a tunnel of slump for a long time due to the ‘lost 30 years’, are showing remarkable performance this year. This is largely due to the increase in exports and the number of foreign tourists due to the prolonged low yen phenomenon.

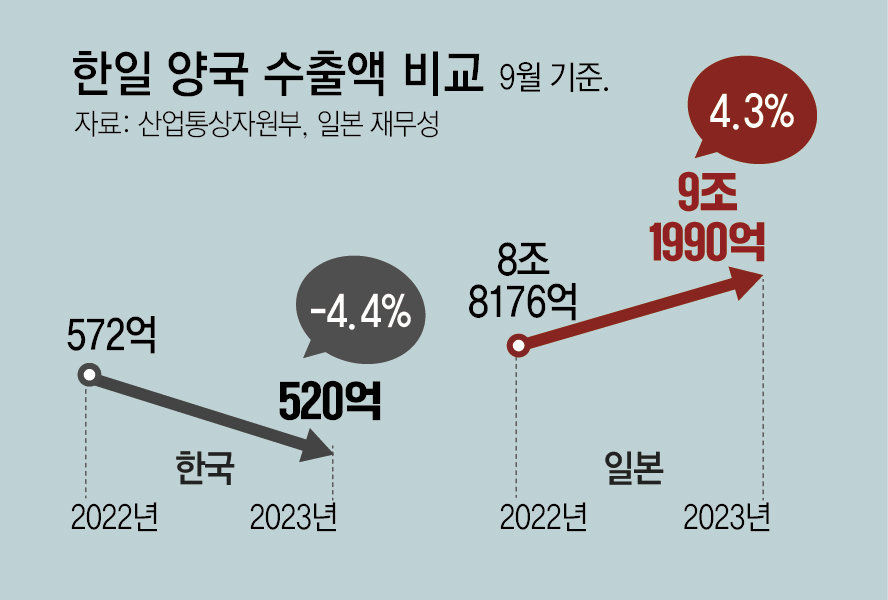

Like Japan, the Korean won has also been depreciating against the U.S. dollar throughout the year, but the performance of major Korean companies has been worse than that of Japan. It is pointed out that the decline in Korea’s exports is largely due to the decline in competitiveness of our companies and industries.

According to the Nippon Keizai Shimbun on the 6th, the net profit of Japanese listed companies in the first half of this year (April to September) is expected to increase by 30% compared to the same period last year, reaching an all-time high. The net profit of Japanese listed companies in the first half of last year was also the largest ever at 21 trillion yen (about 182 trillion won).

Japanese companies’ all-time high profits were achieved through the ‘double combination’ of manufacturing export conglomerates and travel-related companies.

Toyota Motor Company, the company with the largest market capitalization, recorded a net profit of 2.5894 trillion yen (approximately 22.48 trillion won) in the first half of this year, a 120% increase from a year ago. The net profit of ANA Holdings, the parent company of the largest airline All Nippon Airways (ANA), in the first half of this year was 93.2 billion yen, up 377% from the same period last year. This is also the highest ever. The net profits of other major companies, including Tokyo Disneyland operator Oriental Land, auto parts company Denso, and Mitsubishi Heavy Industries, are all at the highest level.

The biggest reason for the strong performance is the weak yen phenomenon. Japanese companies, while making business plans for this year, predicted an exchange rate of around 130 yen per dollar. However, the yen-dollar exchange rate in the Tokyo foreign exchange market at the end of last month rose significantly to reach 151.69 yen.

This is interpreted as a strong influence of the movement to sell yen and buy dollars, euros, etc., as Japan still maintains negative interest rates, unlike the United States and Europe, which have successively raised their base interest rates. The weak yen has the disadvantage of encouraging a rise in import prices, thereby increasing the hardships of life for the common people. However, this is a positive factor for export companies as they can sell products cheaper than companies in competing countries.

On the other hand, Korean companies’ slump is prolonged. Samsung Electronics’ operating profit in the third quarter of this year (July to September) was 2.4336 trillion won, a 77.6% decrease from the same period last year. SK Hynix recorded an operating loss of 1.792 trillion won in the third quarter.

When comparing all listed companies, the gap between Korea and Japan widens. According to the Korea Exchange, the operating profit (KRW 53.1083 trillion) of 615 companies listed on the stock market in the first half of the year was 52.4%, and the net profit (KRW 37.6886 trillion) was 57.9%, a decrease compared to the same period last year. Major industries that lead the Korean economy, such as semiconductors, petrochemicals, oil refining, steel, and construction, have fallen into a recession.

The government expects the export increase to continue, citing the fact that exports in October of this year turned positive for the first time in 13 months and the trade balance achieved a surplus for five consecutive months. Since the Korean economy is highly dependent on exports, the government expects that the economy will improve as exports increase.

However, it is difficult to view the improvement in performance in a short period of time as a recovery of the basic strength of the Korean economy. In a recent report, the Bank of Korea said, “Even if the slump in the information technology (IT) industry eases after the second half of this year, it will be difficult for exports to rebound as much as in the past due to changes in the industrial structure and competitiveness of each country,” adding, “Efforts to secure technological competitiveness are necessary.” “It is necessary,” he pointed out.

Tokyo =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.