Announcement of detailed plan for IRA tax deduction exclusion

Adjustment of shares of domestic companies through Chinese joint ventures is inevitable.

Meeting with government, LG Ensol, Samsung SDI, etc.

Joint ventures with a Chinese stake of 25% or more are excluded from the U.S. Inflation Reduction Act (IRA) electric vehicle subsidies. Korean companies that have been actively cooperating with Chinese companies that dominate the battery materials and mineral supply chain have found it inevitable to revise their strategies within a short period of time.

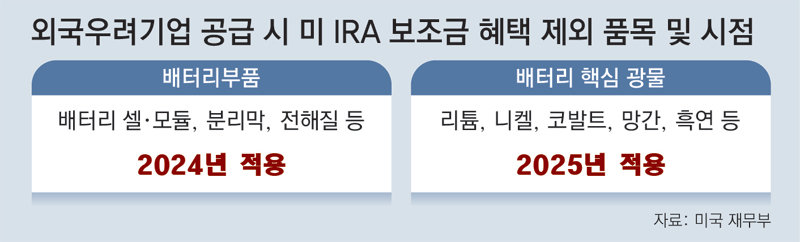

On the 1st (local time), the U.S. Joe Biden administration announced detailed regulations for ‘foreign concern companies (FEOCs)’ that will exclude them from IRA tax deductions. According to this regulation, from 2025, if electric vehicle manufacturers use key minerals procured from Chinese companies in batteries, they will be classified as companies of concern and will not receive subsidies. In the case of a joint venture (JV), if the Chinese stake is more than 25%, it is excluded from the subsidy. Following semiconductors, China’s influence in batteries has also been limited to 25%.

China’s Huayu Cobalt owns a 49% stake in LG Chem’s cathode material plant in Gumi, Gyeongbuk, where a total of 500 billion won will be invested by 2025. In order to supply its products to battery companies for the North American market, LG Chem must purchase at least a 24% stake from Huayu Cobalt by the end of next year. LG Chem said, “We must immediately adjust our shareholding ratio for the cathode material plants we plan to build with Hwayu in Saemangeum, Jeollabuk-do, Morocco, and Indonesia,” adding, “It is a burden to have to invest hundreds of billions of won in additional investments in a high interest rate situation.”

POSCO Group, which is cooperating with China’s CNGR and Huayu Cobalt, has also begun preparing response measures, such as adjusting the joint venture’s shares, selling certain factory products only to batteries for use outside of North America, and speeding up securing a non-Chinese supply chain.

The Ministry of Trade, Industry and Energy held a public-private joint meeting with LG Energy Solutions, Samsung SDI, and SK On on the 2nd and announced that it would support the diversification of suppliers, including key minerals. However, the Ministry of Trade, Industry and Energy explained, “With the announcement of detailed regulations, uncertainty in corporate management and investment is expected to be significantly improved.”

Burden of investment of hundreds of billions of won, including securing additional shares

‘Fire in the foot’ such as change in financing method

“Expected level… Interpretation of “resolving uncertainty”

“Either we have to reduce the proportion of China in the production process or secure additional shares in the joint venture, or it will inevitably become a burden for the company.” (An official from Company A, a battery materials company)

Officials in the domestic battery industry clearly appear nervous about the possible fallout from the detailed regulations for ‘Foreign Concerned Enterprises (FEOC)’ of the US Inflation Reduction Act (IRA), which were released on the 1st (local time). There are some positive interpretations that “uncertainty has been resolved,” but this is because companies need to revise both their short-term and mid- to long-term strategies.

The places that are on fire right now are those that have been securing supply chains through joint ventures with Chinese companies. Korean battery and battery material companies have been cooperating with Chinese companies by establishing joint ventures (JVs) to diversify their channels for securing key minerals, usually holding shares in a ’50 to 50′ or ’51 to 49′ ratio. . However, as the U.S. government considers companies that are in fact under Chinese control if the Chinese side holds more than 25% of the shares or voting rights, they are bound to be excluded from subsidies as is.

LG Chem transferred a 49% stake in its Gumi cathode materials production corporation (LH-HY BCM) in Gyeongbuk to the cathode materials subsidiary of China’s Huayou Cobalt on April 22 this year. LG Chem and Huayou Cobalt plan to invest 500 billion won by 2025 to build a plant capable of producing 60,000 tons of cathode materials per year. It is the world’s largest on a single scale.

POSCO Holdings is establishing a nickel refining corporation in Pohang that can produce nickel sulfate. POSCO Future M is building a production facility for precursors, an intermediate material for cathode materials. Both companies joined hands with China’s CNGR, the world’s No. 1 precursor company. CNGR owns a 40% stake in the nickel refining corporation and an 80% stake in the precursor production corporation. The total investment amount amounts to 1.5 trillion won.

If the current stake remains the same, if battery materials produced by LG Chem and POSCO Group are supplied to North American battery and automobile manufacturers, they will not be able to receive subsidies according to IRA FEOC regulations. Materials produced here must be supplied to markets other than the United States, or additional shares in the joint venture must be secured. Both companies plan to secure additional shares or develop plans to secure them in consultation with their joint venture partners. There is an immediate investment burden of more than hundreds of billions of won.

For companies that are still in the business agreement (MOU) stage, it is inevitable to completely revise their business strategies and financing methods. Currently, LG Energy Solutions is preparing to cooperate with China’s Yahua to mine lithium hydroxide in Morocco. SK On and EcoPro decided to build a precursor factory by investing a total of 1.21 trillion won in China’s Geolinmei and Jeonbuk Semangeum.

The reason Korean companies join hands with Chinese companies at the risk of not receiving IRA subsidies is because China has a tight grip on the battery supply chain. According to a report released by Goldman Sachs in September, 60% of lithium, 65% of nickel, and 68% of cobalt needed for electric vehicle batteries are under China’s influence. In addition, cooperation to enter the Chinese market is inevitable, as it is one of the three largest electric vehicle markets along with Europe and North America.

In fact, in a conference call (telephone conference) held after the performance announcement in April of this year, LG Chem said, “Collaborating with Huayu Cobalt while taking risks has the advantage of securing raw materials,” and added, “If the FEOC regulations completely exclude Chinese companies, the stake He also said, “We are also considering a plan to acquire the entire company.”

For this reason, some industry voices say, ‘We are glad that it is at the level we expected’ regarding the 25% share limit, which is the same level as the Semiconductor Act. A battery industry official said, “It was at the level we expected and we were preparing for it,” and added, “It is positive that the uncertainty has been resolved.”

Washington =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.