‘Hot competition’ in the global pharmaceutical industry

Following Pfizer, AbbVie, at 13 trillion won… Acquired ADC development company Immunogen

Domestic companies are also racing to secure technology

SAMBA establishes dedicated production facility next year… Lotte also plans to expand its production plant in the U.S.

’56 trillion won, 30 trillion won.’

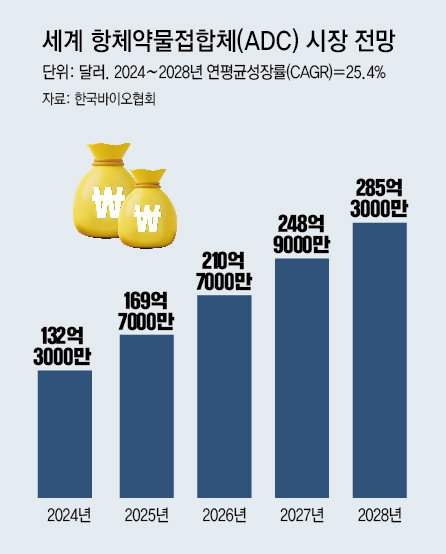

This is the largest merger, acquisition (M&A) and technology transfer in the biopharmaceutical industry this year. Both contracts were related to ‘antibody drug conjugate (ADC)’, which is considered the next-generation anticancer drug technology. ADC is emerging as a black hole in the global pharmaceutical investment market. The ADC market size is expected to be $36 billion (approximately 47 trillion won) in 2029. Major global pharmaceutical companies such as Pfizer, AstraZeneca, AbbVie, and Merck & Co. (MSD) are competitively investing in promising ADC companies around the world. Domestic companies are also responding quickly by conducting joint research with ADC companies or securing ADC production facilities.

According to the industry on the 3rd, global pharmaceutical company AbbVie announced on the 1st that it will acquire Immunogen, a U.S. ADC development company, for $10.1 billion (approximately 13.12 trillion won). It is the third largest M&A in the bio industry this year. The largest was in March when Pfizer purchased Seegene, also an ADC company, for $43 billion (approximately 55.85 trillion won).

ADC technology began to receive serious attention last year when clinical results were announced at the American Society of Clinical Oncology (ASCO) showing that the breast cancer ADC treatment ‘Enhertu’ significantly lowers the risk of death in breast cancer patients who are difficult to treat.

Immunogen, acquired by AbbVie, is the developer of the ovarian cancer ADC treatment ‘Elahere’, which received rapid approval from the U.S. Food and Drug Administration (FDA) last year. According to an analysis by global investment bank Barclays, Elahier is expected to generate sales of about $500 million next year, with sales expected to grow up to $2 billion by the end of the 2020s. AbbVie said the acquisition “will significantly help accelerate AbbVie’s position in the oncology space.”

Some companies have chosen to adopt technology instead of acquisition. Merck & Co. (MSD) introduced three types of ADC treatment candidates from Daiichi Sankyo for up to $22 billion (approximately KRW 28.58 trillion) in October this year. This is the largest technology transfer contract in the bio industry this year.

There is also an analysis in the industry that global pharmaceutical companies are rushing to develop ADCs that can become a new growth engine ahead of the expiration of patents for ‘blockbuster drugs’ (treatments with annual sales of more than 1 trillion won). AbbVie’s patent for autoimmune disease ‘Humira’ expired in the US market this year, and MSD’s European patent for immunotherapy ‘Keytruda’ is scheduled to expire in 2028. As of last year, the two medicines each generated sales of approximately 27 trillion won. An official from a domestic bio investment company said, “With many blockbuster drugs about to expire their patents, global pharmaceutical companies are busy looking for next-generation growth engines that can make up for large sales.”

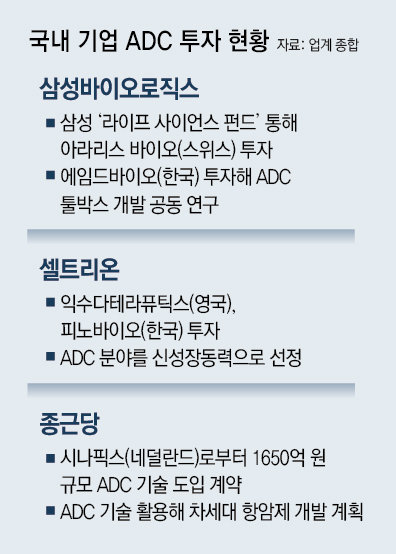

Domestic companies are also speeding up their efforts to secure ADC technology. Through the ‘Life Science Fund’ established with Samsung C&T and Samsung Bioepis, Samsung BioLogics invested in Araris Biotech, a Swiss ADC development company, in April of this year, and in Aimed Bio, an ADC company for the first time among domestic companies, in September. In addition, in preparation for the increase in ADC treatment production, we plan to establish a dedicated ADC production facility within next year. Lotte Biologics also plans to expand its ADC production plant in Syracuse, USA, with the goal of producing ADC treatments in 2025.

Celltrion and Chong Kun Dang are engaged in joint development with ADC companies. Celltrion has announced several times this year its strategy to use ADC as a new growth engine. The company made a large investment in Iksuda Therapeutics, a British ADC company, from 2021 to January of this year and currently has secured a total stake of 47.05%. Chong Kun Dang signed a contract to introduce ADC platform technology worth 165 billion won with Dutch company Sinafix early this year.

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.