As the U.S. central bank, the Federal Reserve (Fed), froze the base interest rate for the third consecutive time and announced the possibility of three interest rate cuts of 0.25 percentage points (p) next year, borrowers who borrow with their souls are expected to decline. The debt burden is also expected to decrease somewhat. For a borrower who currently borrowed 300 million won from a bank, the monthly interest is expected to be reduced by more than 200,000 won even if the interest rate falls by just the amount of the base interest rate cut next year.

As bank bond interest rates continued to fall in the market, reflecting the possibility of a base interest rate cut, products with a minimum interest rate of 3% per annum for fixed (mixed) home mortgage loans from commercial banks that use this as the base interest rate also appeared.

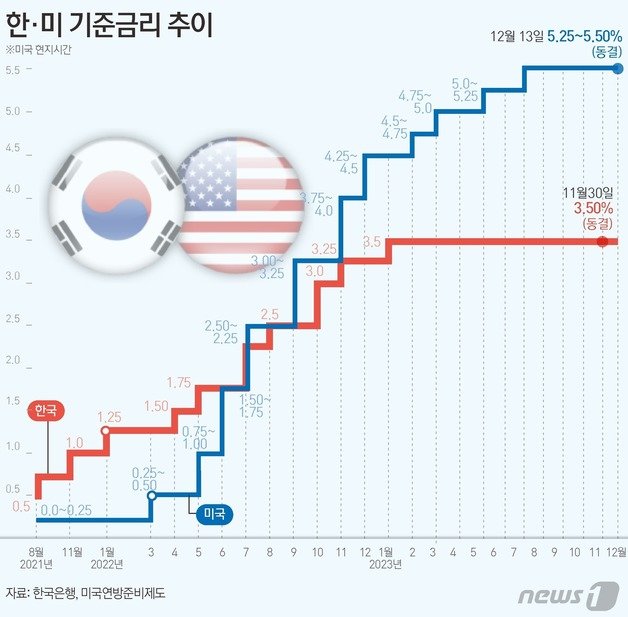

At the Federal Open Market Committee (FOMC) meeting on the 13th (local time), the Federal Reserve froze the benchmark interest rate at the current 5.25-5.50% level and announced that it would cut interest rates three times next year. The base interest rate cut for next year was proposed to be 0.75%p.

Federal Reserve Chairman Jerome Powell said at a press conference, “I believe that the benchmark interest rate has reached or near its peak during this tightening phase,” effectively signaling the end of interest rate hikes. 17 out of 19 FOMC attendees also expected the policy interest rate to be lower than the current level by the end of 2024.

The market began to reflect the possibility of an interest rate cut early on. As the interest rate on 10-year U.S. government bonds falls sharply, interest rates are also falling in the Korean financial market, especially on long-term bonds. The interest rate on 5-year bank bonds (unsecured, AAA), which is the standard for fixed mortgage loans, fell from 4.463% on November 14, a month ago, to 4.046% on the 13th of this month.

Accordingly, the lower end of the fixed interest rate for home loans, which was in the 4% range until a month ago, has recently fallen to the 3% range. The fixed interest rate for home loans of the five major banks, which was 4.03-6.436% per annum on the 13th of last month, was lowered to 3.66-5.962% per annum on the 11th of this month.

The U.S. central bank, the Federal Reserve System (Fed), has effectively declared the end of the historic interest rate hike designed over the past two years. The benchmark interest rate was frozen for three consecutive times and signaled that it would be lowered by 0.75 percentage points (p) three times next year. ⓒ News1

The U.S. central bank, the Federal Reserve System (Fed), has effectively declared the end of the historic interest rate hike designed over the past two years. The benchmark interest rate was frozen for three consecutive times and signaled that it would be lowered by 0.75 percentage points (p) three times next year. ⓒ News1 Loan borrowers who had been suffering from high interest rates can now take a breather from the fear of further interest rate increases. The financial authorities are promoting ‘win-win financing’ to ease the interest burden of vulnerable borrowers, and a refinance loan platform for mortgage loans is also scheduled to be launched, so further interest rate cuts can be expected.

However, considering the government’s household debt management policy and the time lag in interest rate cuts with the United States, it is highly likely that the domestic interest rate cut will proceed gradually rather than radically. Many experts predict that the Bank of Korea will lower its base interest rate in the second half of next year after confirming the interest rate cut in the United States.

Currently, the average interest rate for mortgage loans from commercial banks is around 4% per year. If 300 million won is borrowed at an interest rate of 4.75% per annum (30-year maturity, principal and interest equal conditions), the interest paid to the bank per month amounts to 1.18 million won. Even if the loan interest rate is reduced by only the base interest rate cut (0.75%p) announced by the Federal Reserve next year, the borrower’s monthly interest is expected to be reduced by about 200,000 won to 980,000 won.

An official from the banking industry said, “There is pressure to manage household debt, but considering the situation of base interest rate and market interest rate cuts and the atmosphere of promoting win-win finance, more and more weight is being placed on interest rate cuts rather than interest rate increases.” He added, “Starting next year, borrowers’ debt burden will also gradually decrease. “It is expected,” he said.

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.