[일본 반도체의 역습]

〈China〉 Japan-TSMC’s ‘Honeymoon’

The Japanese international school ‘Kumamoto International’ expanded and relocated to Higashi-ku, Kumamoto City in September. It was scheduled to open in April next year, but was moved forward by more than half a year. This is because expatriate employees and their families had to come to Japan in advance as the completion of Taiwan’s TSMC’s Kumamoto Plant 1 was approaching. When the factory is completed, the number of TSMC expatriates and their families is expected to reach about 750. Of the 20 employees selected by Kumamoto International during its expansion process, four are Taiwanese. It is an international school that uses 70% English and 30% Japanese, but plans to also hold Taiwanese language classes. Nearby Kumamoto University-affiliated elementary, middle, and high schools also decided to establish English classes for families of TSMC expatriates.

Kyushu Financial Group, a Japanese financial company, predicted that TSMC’s effect on the local economy of Kumamoto Prefecture will amount to 6.9 trillion yen (approximately 62.8762 trillion won) over 10 years. He said, “This is a ‘once-in-a-century opportunity’ for the Kyushu economy.” In fact, Japanese subsidiaries (materials, parts, equipment) companies are also making investments or considering them one after another near TSMC. The effect is expected to be further amplified if TSMC confirms the second and third factories following the first foundry (semiconductor consignment production) factory in which it will invest 11.2 trillion won.

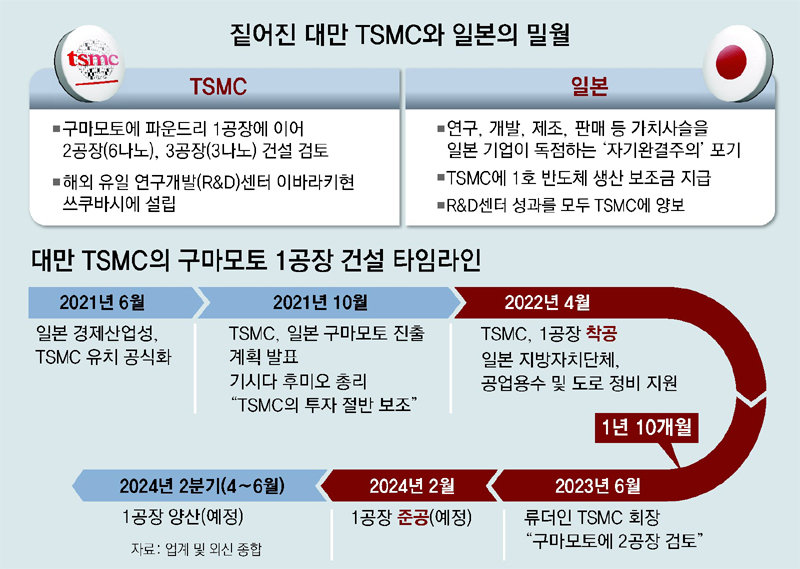

According to the industry on the 26th, Japan, which dreams of ‘semiconductor revival’, and TSMC, which aims to become ‘the world’s No. 1 semiconductor company’, are gradually developing into a strong friendly relationship. Japan is pursuing strengthening its domestic production base (step 1) and securing next-generation design technology (step 2) in accordance with the ‘Semiconductor and Digital Industrial Strategy’ revised in June. Japan, which suffered production disruptions in automobiles and electronic products due to a shortage of semiconductors during the pandemic, chose a strategy to secure its domestic supply chain even by borrowing the power of foreign companies.

Abandon ‘self-completionism’ in research-manufacturing-sales

Accept unfavorable conditions and make concessions to TSMC

Additional review of TSMC 2nd and 3rd factories

“It is significant in that Japan gave up ‘self-completeness’ and changed direction.”

Kim Gyu-pan, a senior research fellow at the Korea Institute for International Economic Policy and an expert on the Japanese economy and industry, said this about cooperation between Japan and Taiwan’s TSMC in a phone call with the Dong-A Ilbo on the 26th. Self-completionism, a management philosophy that permeates the Japanese manufacturing industry, refers to a method in which Japanese companies or affiliates monopolize the entire value chain, including basic research, product development, manufacturing, and sales.

After being overtaken by Korea in the memory industry, Japan, the ‘semiconductor empire’, has adopted a ‘fab-lite’ strategy of relying on overseas foundries (consignment production of semiconductors) rather than its own production. Instead, it took charge of one axis of the global semiconductor supply chain with powerful small and medium-sized companies.

However, the policy direction has changed through the coronavirus pandemic. This is because serious production disruptions occurred at major factories such as Toyota and Sony due to a shortage of semiconductors. Accordingly, stabilizing the domestic semiconductor supply chain has been made a top priority. This is why the Japanese government stipulated ‘operating the factory for more than 10 years’ and ‘supplying priority to Japan in case of semiconductor shortage’ as conditions for subsidy payment.

The Japanese government declared that it would attract overseas foundry factories to the country in June 2021. In October of the same year, when TSMC announced its plan to expand into Kumamoto, Prime Minister Fumio Kishida personally welcomed the company, saying, “We will subsidize half of the investment.” This is the time when Japan and TSMC have emerged as strong collaboration partners.

TSMC, which received full support, responded by opening its first overseas research and development (R&D) center in Tsukuba, Japan’s science city, in June last year. The Japanese government paid 19 billion yen out of the 37 billion yen (about 336.7 billion won) it cost to build the R&D center. As the semiconductor industry is sensitive to technology leaks, the Japanese government is known to have accepted somewhat humiliating conditions, such as giving up all research results to TSMC. TSMC is further strengthening its partnership with Japan by additionally reviewing Kumamoto Plants 2 and 3.

In line with TSMC’s advance, Japanese small and medium-sized companies are also making large-scale investments. Tokyo Electron, Japan’s largest equipment company, will invest 43 billion yen to build a development plant in TSMC Kumamoto with the goal of completion in 2025. TSMC plans to double its current business scale in the Kyushu region. Toppan has expanded its investments in photomask and substrate manufacturing, and Denso plans to invest 500 billion yen in the semiconductor sector by 2030. As the Japanese government had expected, the entire ecosystem is moving forward.

For TSMC, as competition for cutting-edge semiconductors expands to packaging (post-processing), cooperation with Japanese parts, parts, and equipment companies with world-class technology provides an opportunity to gain a competitive edge.

It is clear that Korean semiconductor companies are not happy with this. An official in the semiconductor industry said, “The competitiveness of semiconductors, especially foundries, comes from economies of scale. The longer the honeymoon between Japan and TSMC continues, the greater the burden will be on Korean companies such as Samsung in the short and long term.”

Some predict that the honeymoon between the two will not last long, as the next step for Japan, which has expanded its domestic production base, is next-generation design technology below 2 nanometers. This is because Japan’s ultimate goal is not ‘Made in Japan’ but ‘Made by Japan’ such as Lapidus. TSMC is also acting as Taiwan’s ‘silicon shield’ that receives military help from the United States, so some say there will be limits to boldly bringing cutting-edge processes to Japan. Kim Yang-paeng, a researcher at the Korea Institute for Industrial Economics & Trade, said, “Cutting-edge processes will ultimately be centered around our own country.”

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.